MPLX LP Reports Record Earnings, Beating Estimates by $0.08 and $110 Million in Revenue

May 4, 2023

Trending News 🌧️

MPLX LP ($NYSE:MPLX) recently reported their earnings for the quarter, and their results had investors and analysts alike in awe. According to Generally Accepted Accounting Principles (GAAP), the company’s Earnings Per Share (EPS) was $0.91, exceeding estimates by a whopping $0.08. Similarly, the company reported total revenue of $2.71B, which was a staggering $110M more than what was projected. MPLX LP is a master limited partnership based in Ohio and it is engaged in the gathering, processing and transportation of crude oil and other petroleum products, as well as storage and marketing of those products.

It owns and operates a network of gathering and transportation pipelines, storage terminals and related assets extending across the U.S. Midwest and Gulf Coast regions. The company also manages crude oil logistics and supplies services to producers, refiners and buyers in the United States, Canada and Mexico.

Earnings

MPLX LP recently reported record earnings for FY2022 Q4, ending December 31 2022. The report showed total revenue of 2501.0M USD and net income of 816.0M USD, beating estimates by $0.08 and $110 million in revenue. This represented a 3.6% decrease in total revenue and a 1.7% decrease in net income compared to the same period last year. However, the company has seen a steady increase in total revenue over the last three years, with the total rising from 2109.0M USD to 2501.0M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mplx Lp. More…

| Total Revenues | Net Income | Net Margin |

| 10.59k | 3.94k | 38.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mplx Lp. More…

| Operations | Investing | Financing |

| 5.12k | -900 | -3.87k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mplx Lp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 35.67k | 22.62k | -0 |

Key Ratios Snapshot

Some of the financial key ratios for Mplx Lp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.2% | 11.1% | 46.9% |

| FCF Margin | ROE | ROA |

| 40.7% | -51781.2% | 8.7% |

Share Price

The stock opened at $35.1 and closed at $34.7, dipping 0.4% from the previous closing price of $34.9. This marks a significant milestone for MPLX LP, as the company continues to show strong performance in the energy sector. Live Quote…

Analysis

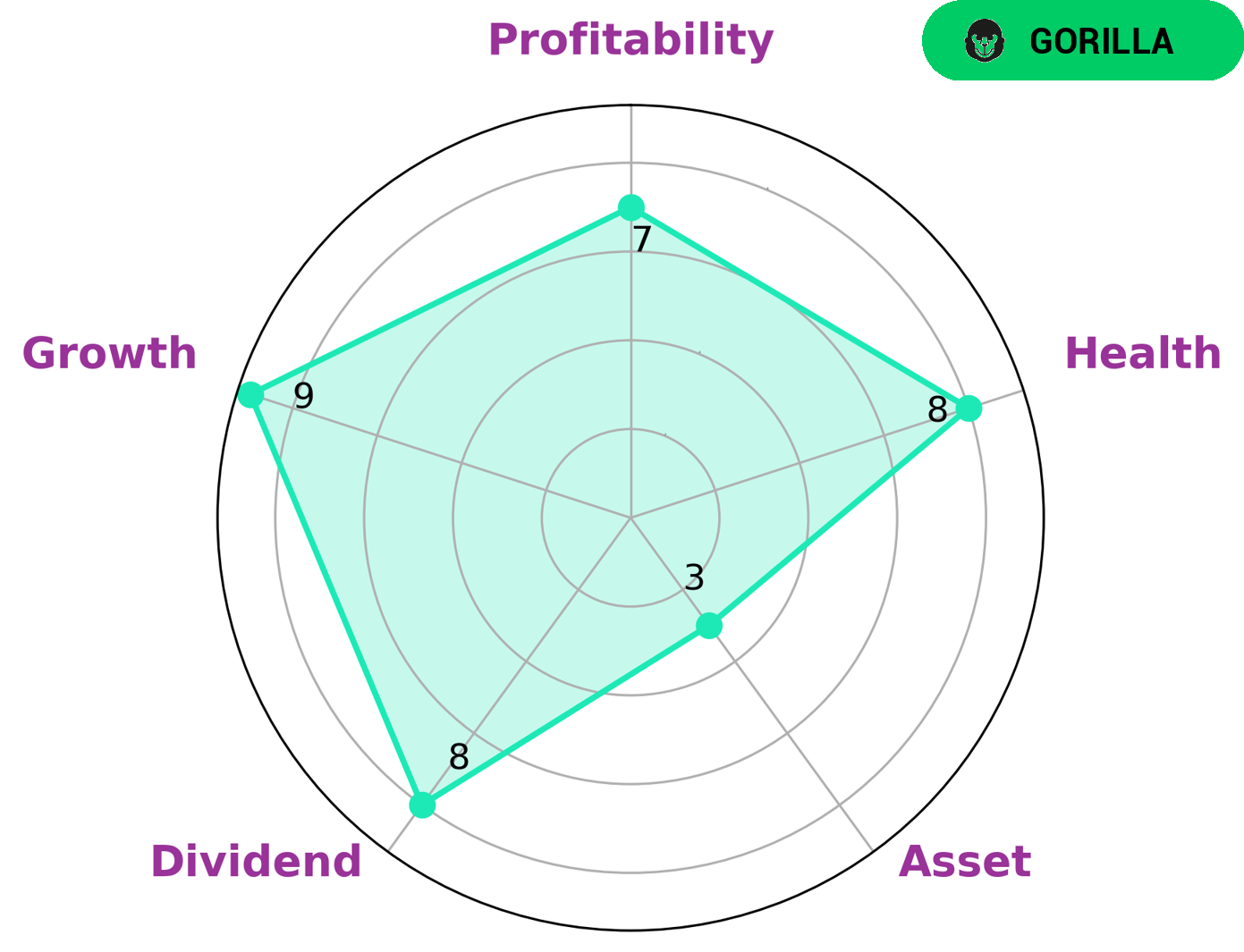

GoodWhale has conducted an analysis of MPLX LP‘s fundamentals and concluded that it is classified as a ‘gorilla’ type of company, which indicates that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. From our analysis, we have deduced that MPLX LP is strong in dividend, growth, profitability, and weak in asset. Additionally, it has a high health score of 8/10 considering its cashflows and debt, showing that it is capable to sustain future operations in times of crisis. Given these results of our analysis, investors who are looking for a company with a strong competitive advantage and are comfortable with the risk associated with owning a stock may be interested in MPLX LP. As it has a high health score, this further indicates its potential for long-term success. More…

Peers

MPLX LP is a publicly traded master limited partnership that owns, operates, develops, and acquires midstream energy infrastructure assets. The company’s asset portfolio includes approximately 11,800 miles of crude oil and light product pipelines, approximately 8,200 miles of natural gas pipelines, approximately 36 natural gas processing plants, and approximately 50 crude oil and light product storage facilities. MPLX LP is headquartered in Findlay, Ohio.

MPLX LP’s primary competitors are Marathon Petroleum Corp, Energy Transfer LP, and Magellan Midstream Partners LP. All three companies are engaged in the business of transporting, storing, and processing petroleum products.

– Marathon Petroleum Corp ($NYSE:MPC)

Marathon Petroleum Corp is an oil refining and marketing company with a market cap of $54.29B as of 2022. The company has a return on equity of 32.4%. Marathon Petroleum Corp is engaged in the refining, marketing, retailing and transportation of petroleum products and crude oil. The company operates through three segments: Refining & Marketing, Retail, and Midstream. Marathon Petroleum Corp was founded in 1887 and is headquartered in Findlay, Ohio.

– Energy Transfer LP ($NYSE:ET)

Energy Transfer LP is a master limited partnership that owns and operates energy infrastructure assets in the United States. The company’s assets include natural gas pipelines, natural gas storage facilities, and crude oil pipelines. Energy Transfer’s natural gas pipelines transport natural gas from production areas to market centers. The company’s crude oil pipelines transport crude oil from production areas to refineries and market centers. Energy Transfer’s natural gas storage facilities provide storage capacity for natural gas. The company also owns and operates natural gas gathering and processing facilities.

Energy Transfer’s market cap as of 2022 is 36.67B. The company has a Return on Equity of 14.71%. Energy Transfer’s business is focused on the transportation, storage, and gathering of natural gas and crude oil. The company’s pipelines transport natural gas and crude oil from production areas to market centers. Energy Transfer’s natural gas storage facilities provide storage capacity for natural gas. The company also owns and operates natural gas gathering and processing facilities.

– Magellan Midstream Partners LP ($NYSE:MMP)

Magellan Midstream Partners LP is a publicly traded partnership that owns, operates, and leases a diversified portfolio of energy infrastructure assets in the United States. The company’s assets include approximately 8,400 miles of pipelines, 80 terminals, and six product storage facilities. Magellan Midstream Partners LP is headquartered in Tulsa, Oklahoma.

Summary

MPLX LP is a publicly traded master limited partnership that invests in midstream energy infrastructure. The GAAP EPS of $0.91 was 8 cents above analyst estimates, and revenue of $2.71B was $110M higher than expected. This exceeded the expectations of analysts, indicating that the company is performing well and has potential to produce strong returns for investors. The stock has been trending upward in response to the positive news, making now a potentially opportune time to invest in MPLX LP.

Recent Posts