Jennison Associates LLC Decreases Stake in Dorian LPG Ltd. by 15.1% in Q4.

June 20, 2023

🌥️Trending News

In the fourth quarter, Jennison Associates LLC decreased its stake in Dorian ($NYSE:LPG) LPG Ltd. by 15.1%, as reported by the firm. Dorian LPG Ltd. is a publicly traded international owner and operator of very large gas carriers (VLGCs). The company also provides services for the transportation and storage of liquefied petroleum gas (LPG) and petrochemical gas. The company offers its customers reliable shipping services with flexible options to meet their requirements. Dorian LPG Ltd. operates in markets around the world and has offices in Athens, London, and Singapore. Jennison Associates LLC’s decision to decrease its stake in Dorian LPG Ltd. by 15.1% in the fourth quarter will likely have a negative short-term effect on the company’s stock, as it indicates reduced investor confidence in the company.

However, investors should research the company’s performance and fundamentals before making any decisions about their investments.

Analysis

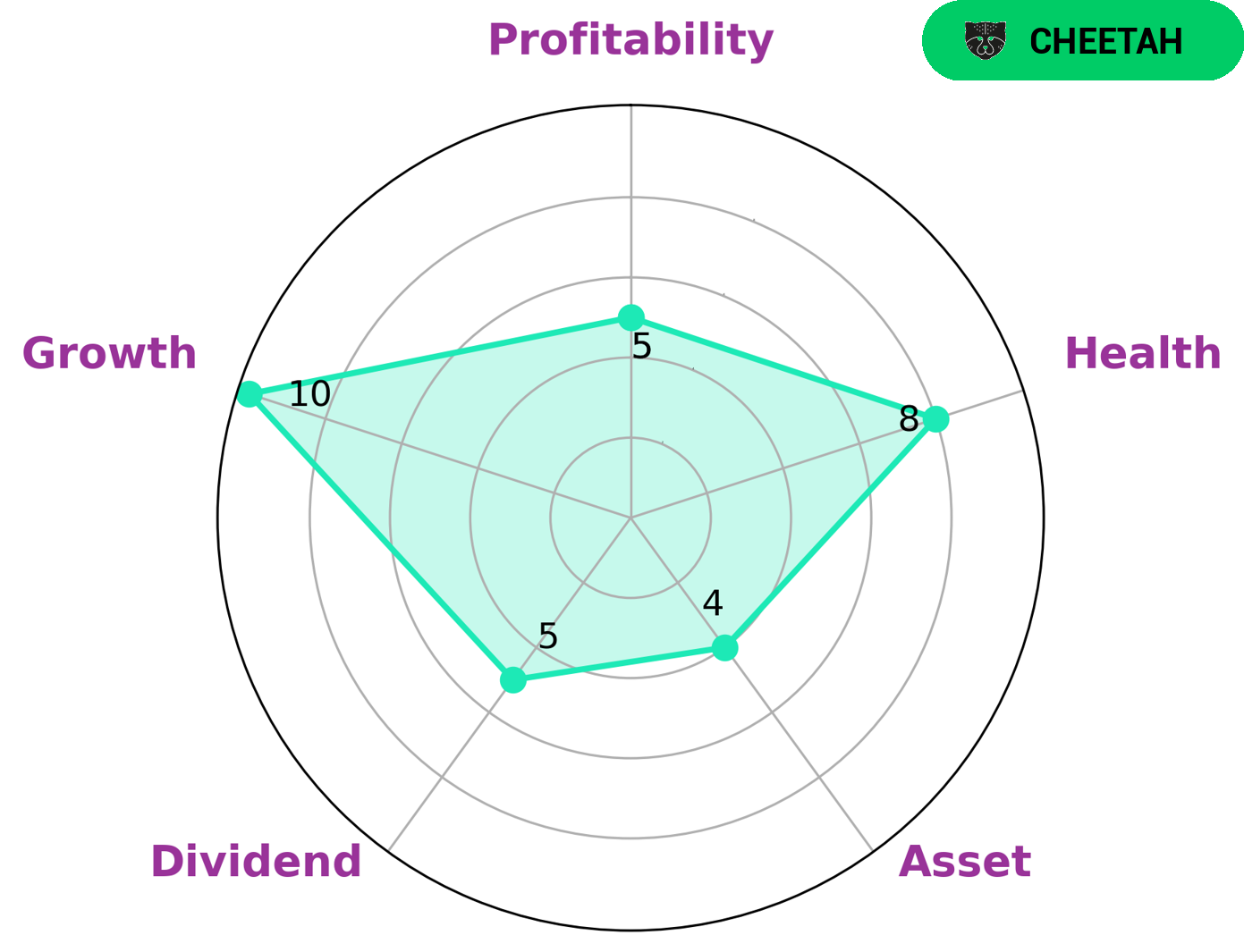

GoodWhale’s analysis of DORIAN LPG‘s wellbeing has revealed strong growth and a medium asset, dividend, and profitability score. The company has been awarded an 8/10 on the health score, indicating its financial stability and ability to pay off its debt and fund future operations. Additionally, DORIAN LPG has been classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Considering the positives and negatives of investing in DORIAN LPG, investors looking for high growth potential may be interested in the company. However, it is important to note that it is not as stable as other companies due to its lower profitability. Therefore, investors need to weigh the risks and rewards of investing in companies like DORIAN LPG before making a decision. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dorian Lpg. More…

| Total Revenues | Net Income | Net Margin |

| 389.75 | 172.44 | 43.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dorian Lpg. More…

| Operations | Investing | Financing |

| 155.97 | 68.77 | -35.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dorian Lpg. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.71k | 835.07 | 20.75 |

Key Ratios Snapshot

Some of the financial key ratios for Dorian Lpg are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.3% | 7.2% | 53.9% |

| FCF Margin | ROE | ROA |

| 37.2% | 15.4% | 7.7% |

Peers

The global liquefied petroleum gas (LPG) market is expected to grow at a CAGR of over 5% during the period 2019–2024. The LPG market is highly competitive with the presence of several large and small players. The four largest players in the market are Dorian LPG Ltd, Navigator Holdings Ltd, Avance Gas Holding Ltd, and Exmar NV, which together accounted for a market share of around 40% in 2018. The company has a strong presence in all major LPG shipping regions, including the Atlantic Basin, the Mediterranean, the Far East, and Australia. Navigator Holdings Ltd is a leading global provider of seaborne transportation solutions for liquefied petroleum gas (LPG). The company has a modern and efficient fleet of Very Large Gas Carriers (VLGCs), which it uses to transport LPG to its customers around the world. Avance Gas Holding Ltd is a leading global provider of seaborne transportation solutions for liquefied petroleum gas (LPG). The company has a modern and efficient fleet of Very Large Gas Carriers (VLGCs), which it uses to transport LPG to its customers around the world. Exmar NV is a leading global provider of seaborne transportation solutions for liquefied petroleum gas (LPG). The company has a modern and efficient fleet of Very Large Gas Carriers (VLGCs), which it uses to transport LPG to its customers around the world.

– Navigator Holdings Ltd ($NYSE:NVGS)

Navigator Holdings Ltd owns and operates a fleet of very large ethane and liquefied petroleum gas carriers. As of March 31, 2021, the company’s operated fleet consisted of 44 vessels. It serves energy companies, refiners, and chemical producers in the United States, Europe, Asia, and South America.

– Avance Gas Holding Ltd ($OTCPK:AVACF)

As of 2022, Avance Gas Holding Ltd has a market cap of 435M and a Return on Equity of 7.85%. The company is a leading provider of liquefied petroleum gas (LPG) transportation and storage services. It operates a fleet of LPG carriers and has a global customer base. The company is headquartered in Singapore.

– Exmar NV ($LTS:0EEV)

Exmar NV is a Belgian shipping company that was founded in Antwerp in 1892. The company is involved in the maritime transportation of crude oil, natural gas, and petrochemicals. As of 2022, Exmar NV had a market capitalization of 561.39 million euros and a return on equity of 0.89%. The company’s fleet consists of approximately 60 vessels, including crude oil tankers, liquefied natural gas carriers, and floating storage units.

Summary

This was likely due to a reassessment of the company’s financial outlook or a shift in market sentiment. Investors should take this into account when assessing Dorian LPG Ltd. as an investment opportunity. Analyzing Dorian LPG Ltd.’s performance, prospects, and competitive environment is the key to making an informed decision on whether to invest. Investors should evaluate the company’s financial statements, management, and strategic plans before making any decisions.

Additionally, investors should consider any macroeconomic and industry-specific factors that may have an impact on Dorian LPG Ltd.’s future success.

Recent Posts