Golar LNG: An Unrivaled Opportunity for Low-Risk, Low-Cost FLNG Investment

April 25, 2023

Trending News ☀️

Golar ($NASDAQ:GLNG) LNG (Golar) is a company that specializes in liquefied natural gas (LNG) technologies and production. Golar has positioned itself as an industry leader in floating liquefied natural gas (FLNG) technology and is one of the few companies in the world to have invested in the development of this technology. Golar has been able to develop and commercialize their FLNG technology faster than anyone else, with multiple projects already in operation. Golar LNG‘s FLNG technology is considered unrivaled in the industry due to its low-risk and low-cost approach to investments. Golar’s FLNG technology is designed to be quickly deployed and offers an affordable solution for customers. This allows Golar to capture a large portion of the market and create long-term value for shareholders.

The company offers a broad range of services, from project development to engineering, procurement, construction, commissioning, operations, and maintenance. Golar LNG’s stock has been growing steadily over the past few years as investors recognize the potential of their FLNG technology. The company has been able to capitalize on their unique position as the only provider of this innovative technology, with contracts spanning across the globe and multiple projects already in operation. Golar’s strong fundamentals, low risk, and low-cost approach make it an unrivaled opportunity for investors looking for long-term returns.

Price History

Golar LNG is offering an unrivaled opportunity for low-risk, low-cost FLNG investment. On Monday, GOLAR LNG stock opened at $21.3 and closed at $21.5, up by 1.1% from prior closing price of 21.3. This is indicative of the success of Golar LNG’s low-risk and low-cost investment strategy. Golar LNG’s FLNG vessels are attractive for investors for their ability to generate returns quickly and with minimal capital outlay.

These vessels also present a unique opportunity for investors to diversify their portfolios, thanks to their diversified revenue streams. With its commitment to safety and operational excellence, Golar LNG is a leader in the FLNG space and is the ideal partner for investors looking to make low-risk, low-cost investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Golar Lng. More…

| Total Revenues | Net Income | Net Margin |

| 267.74 | 787.77 | 115.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Golar Lng. More…

| Operations | Investing | Financing |

| 298.88 | 1.07k | -691.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Golar Lng. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.28k | 1.38k | 23.32 |

Key Ratios Snapshot

Some of the financial key ratios for Golar Lng are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -15.8% | -14.9% | 379.5% |

| FCF Margin | ROE | ROA |

| 11.8% | 25.8% | 14.8% |

Analysis

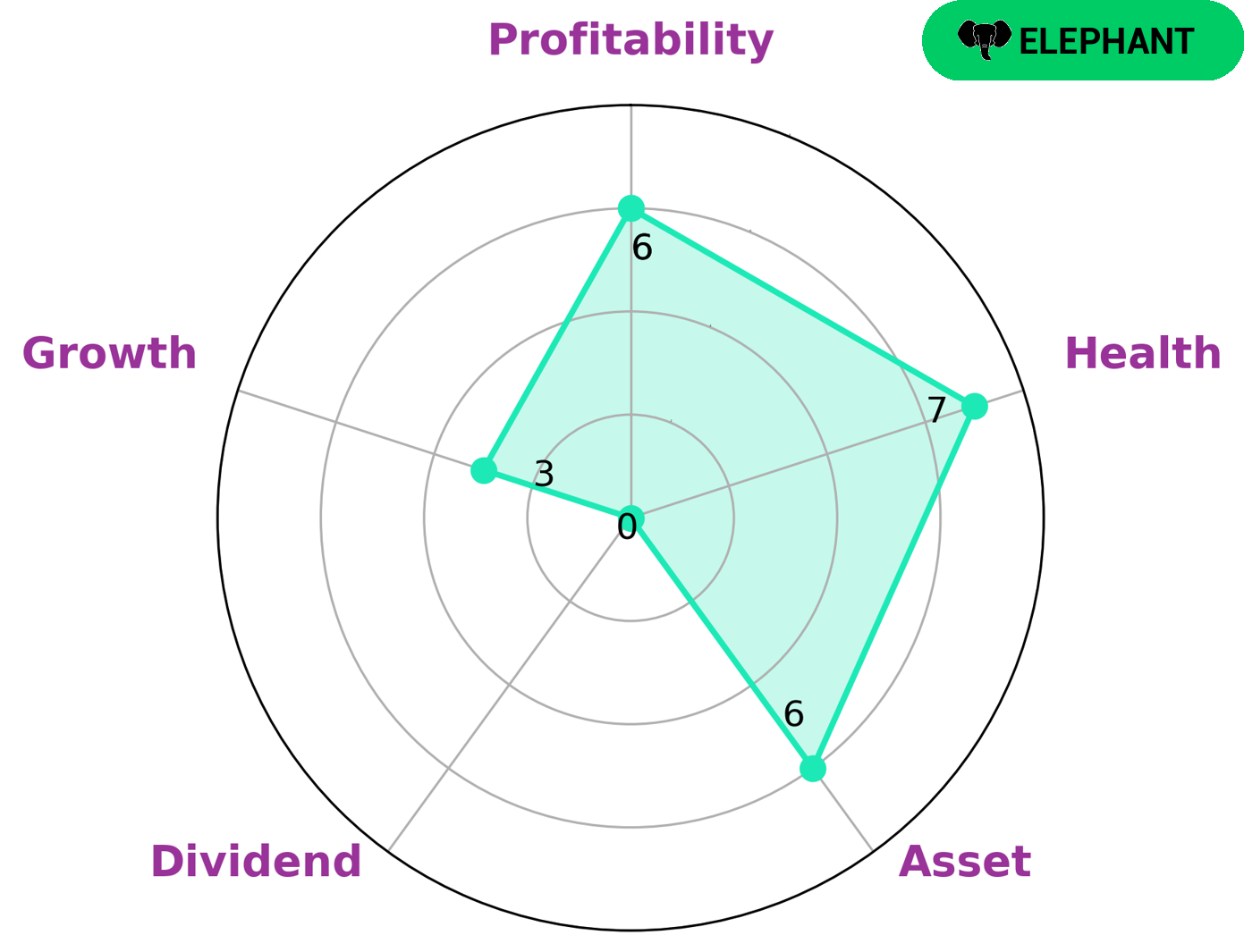

As a responsible investor, GoodWhale strives to analyze the fundamentals of companies before making an investment. So, our team conducted an in-depth analysis of GOLAR LNG and found that it is classified as an ‘elephant’ according to the Star Chart. This rating implies that the company is rich in assets after accounting for its liabilities. Given its strong financials, GOLAR LNG may be attractive to various types of investors. The company has a high health score of 7/10 considering its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. Additionally, it is strong in asset and profitability, but relatively weak in dividend and growth. Thus, investors seeking a company with a good balance sheet and a safe long-term future may benefit from investing in GOLAR LNG. More…

Peers

The competition between Golar LNG Ltd and its competitors is fierce. Each company is vying for a share of the market and customers. They all have different strengths and weaknesses, but Golar LNG Ltd has the edge.

– Fluxys Belgium SA ($LTS:0Q7U)

Fluxys Belgium SA is a leading gas infrastructure company in Belgium. The company has a market capitalization of 2.23 billion as of 2022 and a return on equity of 14.4%. Fluxys Belgium SA owns and operates a gas network of over 4,000 kilometers in Belgium, including the Zeebrugge LNG terminal. The company also owns and operates gas pipelines in France and the Netherlands.

– Genesis Energy LP ($NYSE:GEL)

Genesis Energy LP is a publicly traded limited partnership that engages in the midstream energy business in the United States. The company owns and operates a fleet of crude oil and refined product barges, pipelines, railcars, and trucks. It also owns and operates terminal facilities and a refinery. The company was founded in 1985 and is headquartered in Houston, Texas.

– EnLink Midstream LLC ($NYSE:ENLC)

EnLink Midstream LLC is a company that owns, operates, and develops midstream energy infrastructure in the United States. The company has a market cap of $5.72 billion as of 2022 and a return on equity of 26.4%. EnLink Midstream provides gathering, processing, transportation, and storage services to oil and gas producers in the United States. The company was founded in 2014 and is headquartered in Dallas, Texas.

Summary

Golar LNG is an attractive option for investors due to its low market price and limited competition in the floating liquefied natural gas (FLNG) space. Despite potential risks, Golar LNG’s stock may be an attractive choice for investors looking for long-term growth. Its expertise in the design and construction of FLNG solutions gives it an edge over the competition, and its strong customer base and energy industry connections make it well-positioned for long-term success. The company’s back-catalog of FLNG projects and collaborations with major energy players demonstrate its strong presence in the market.

Additionally, Golar LNG’s strong financials and reliable cash flow make it an appealing investment option.

Recent Posts