EQUITRANS MIDSTREAM Facing Setback as Court Revokes Key Water Permit for Mountain Valley Pipeline

April 5, 2023

Trending News 🌥️

EQUITRANS MIDSTREAM ($NYSE:ETRN), a leading energy infrastructure company, has been dealt a major setback after a court revoked a key water permit for its Mountain Valley Pipeline project. This decision has put the future of the pipeline in doubt and has caused considerable financial uncertainty for the company. EQUITRANS MIDSTREAM is an energy infrastructure company based in the United States. It provides midstream services such as gathering, processing, and transporting natural gas and natural gas liquids. It also offers natural gas storage, fractionation, and transportation services. The company is engaged in the development, construction, and operation of various midstream projects. The Mountain Valley Pipeline is one of the major projects that has been put in jeopardy by the court’s decision. The court ruling revoking the water permit is likely to have a significant impact on EQUITRANS MIDSTREAM’s operations.

However, without the permit, the future of the project is uncertain. This could lead to substantial financial losses for EQUITRANS MIDSTREAM and its investors.

Share Price

This caused their stock to open at $5.9, and then close at $5.2, representing a drop of 9.7% from its previous closing price of $5.8. This news comes as especially disheartening news to EQUITRANS MIDSTREAM, who had been counting on the pipeline to generate revenue for their business. In the meantime, it appears that EQUITRANS MIDSTREAM has been left with little option, as they look to evaluate the situation and decide what steps to take next. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Equitrans Midstream. More…

| Total Revenues | Net Income | Net Margin |

| 1.36k | -327.85 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Equitrans Midstream. More…

| Operations | Investing | Financing |

| 845.77 | -567.04 | -345.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Equitrans Midstream. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.45k | 8.37k | 3.8 |

Key Ratios Snapshot

Some of the financial key ratios for Equitrans Midstream are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.9% | -11.7% | 10.6% |

| FCF Margin | ROE | ROA |

| 34.6% | 5.5% | 0.9% |

Analysis

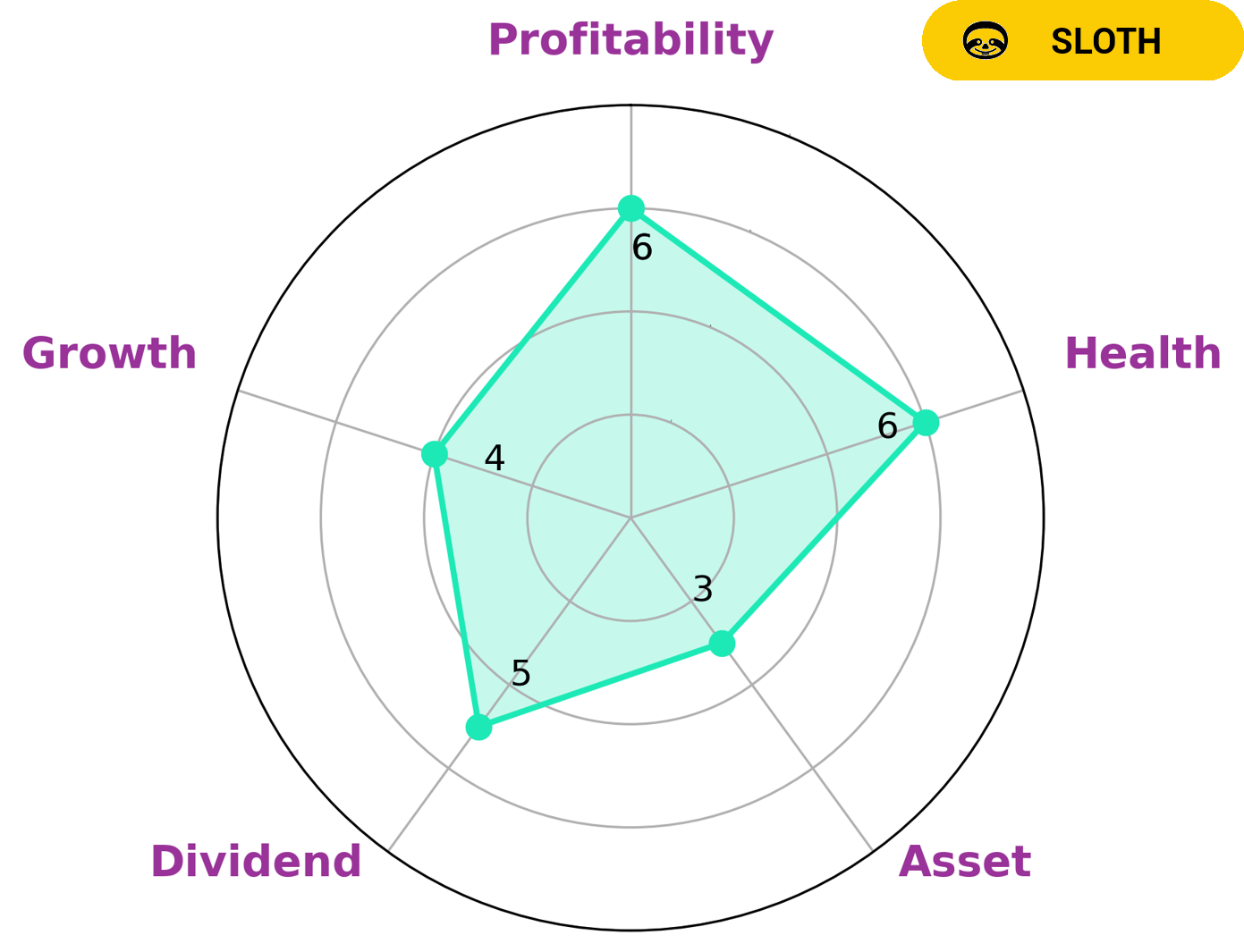

GoodWhale conducted an analysis of the fundamentals of EQUITRANS MIDSTREAM and classified it as a ‘sloth’ on our Star Chart. This type of company has achieved revenue or earnings growth slower than the overall economy. We believe that value investors who are seeking defensive investments, as well as income-seeking investors who are looking for mid-term returns may be interested in EQUITRANS MIDSTREAM. The company has an intermediate health score of 6/10, considering its cashflows and debt. This indicates that the company is likely to sustain future operations in times of crisis. Looking at the different metrics, it is strong in dividend, medium in growth, profitability and weak in asset. All these details make EQUITRANS MIDSTREAM an attractive option for certain types of investors. More…

Peers

The competition between Equitrans Midstream Corp and its competitors is fierce. Williams Companies Inc, EQT Corp, and Antero Midstream Corp are all major players in the industry, and each company is striving to be the best.

– Williams Companies Inc ($NYSE:WMB)

The Williams Companies, Inc. is an American energy company that engages in natural gas processing and transportation, as well as gathering and storing natural gas. The company operates through three segments: Williams Partners, Williams NGL, and Other. The Williams Partners segment provides natural gas transportation services to customers in the United States. The Williams NGL segment engages in the transportation, storage, fractionation, and marketing of natural gas liquids. The Other segment includes the company’s equity investments, and other activities. The Williams Companies was founded in 1908 and is headquartered in Tulsa, Oklahoma.

– EQT Corp ($NYSE:EQT)

EQT Corporation is a publicly traded natural gas company with a market capitalization of $13.99 billion as of 2022. The company has a return on equity of -5.33%. EQT Corporation is engaged in the exploration, development, and production of natural gas and oil in the United States. The company was founded in 1888 and is headquartered in Pittsburgh, Pennsylvania.

– Antero Midstream Corp ($NYSE:AM)

Antero Midstream Corporation is a publicly traded company with a market capitalization of $4.93 billion as of March 2022. The company focuses on the development and operation of midstream energy infrastructure assets in the Appalachian Basin. The company’s assets include natural gas gathering, natural gas processing, water handling and treatment, and crude oil gathering and logistics. Antero Midstream’s return on equity was 17.29% as of March 2022.

Summary

Investors in Equitrans Midstream Corporation have been presented with a bit of a setback following a court’s decision to vacate a key water permit for the Mountain Valley Pipeline. The stock price of the company dropped significantly on the same day as the court decision, leaving many investors concerned. It is yet to be seen how the company will survive this major stumbling block and how it will affect the company’s future financial performance. For now, investors should stay informed on the latest developments concerning this matter, as any more news could have a significant impact on the stock price.

Recent Posts