EnLink Midstream: Invest For Growth, Not Just High Yields

May 2, 2023

Trending News ☀️

EnLink Midstream is a great option for those looking to invest for long-term growth, even if it may not offer the highest yields. ENLINK MIDSTREAM ($NYSE:ENLC) is a midstream energy infrastructure company based in Dallas, Texas. It operates in both the midstream and downstream segments of the oil and gas industry, with a primary focus on natural gas, crude oil, and natural gas liquids. The company owns and operates a diverse portfolio of assets including processing plants, storage tanks, pipelines, gathering systems, and gas-to-liquids facilities. The company also provides services such as transportation, storage, and marketing of natural gas and crude oil. ENLINK MIDSTREAM’s primary customers are both large integrated oil and gas companies and independent producers. The company has a well-diversified revenue base which is spread across multiple commodities and regions. This diversification allows the company to mitigate risks related to price fluctuations in any single commodity or region.

In addition, ENLINK MIDSTREAM has a highly-experienced management team with extensive experience in the midstream energy industry. This team is well-positioned to capitalize on opportunities for growth and ensure that the company’s operations remain efficient and cost-effective. All in all, ENLINK MIDSTREAM offers investors the potential for attractive long-term growth, even if it may not offer the highest yields. With its well-diversified revenue base and experienced management team, the company is well-positioned to capitalize on opportunities for growth and deliver value for its shareholders.

Share Price

EnLink Midstream (ENL, NYSE) opened on Monday at $9.7 and closed at the same level, down 1.4% from its previous closing price of $9.8. This presents an interesting opportunity for investors looking to invest for growth, rather than just high yields. ENL’s strong balance sheet, its diversified portfolio, and its focus on organic growth mean that the company’s revenue should continue to grow in the coming quarters. The company’s solid fundamentals, attractive dividend yield, and promising outlook make it a compelling investment opportunity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Enlink Midstream. More…

| Total Revenues | Net Income | Net Margin |

| 9.53k | 361.3 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Enlink Midstream. More…

| Operations | Investing | Financing |

| 1.05k | -773 | -279.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Enlink Midstream. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.65k | 5.74k | 2.79 |

Key Ratios Snapshot

Some of the financial key ratios for Enlink Midstream are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.4% | 17.6% | 6.8% |

| FCF Margin | ROE | ROA |

| 7.5% | 31.4% | 4.7% |

Analysis

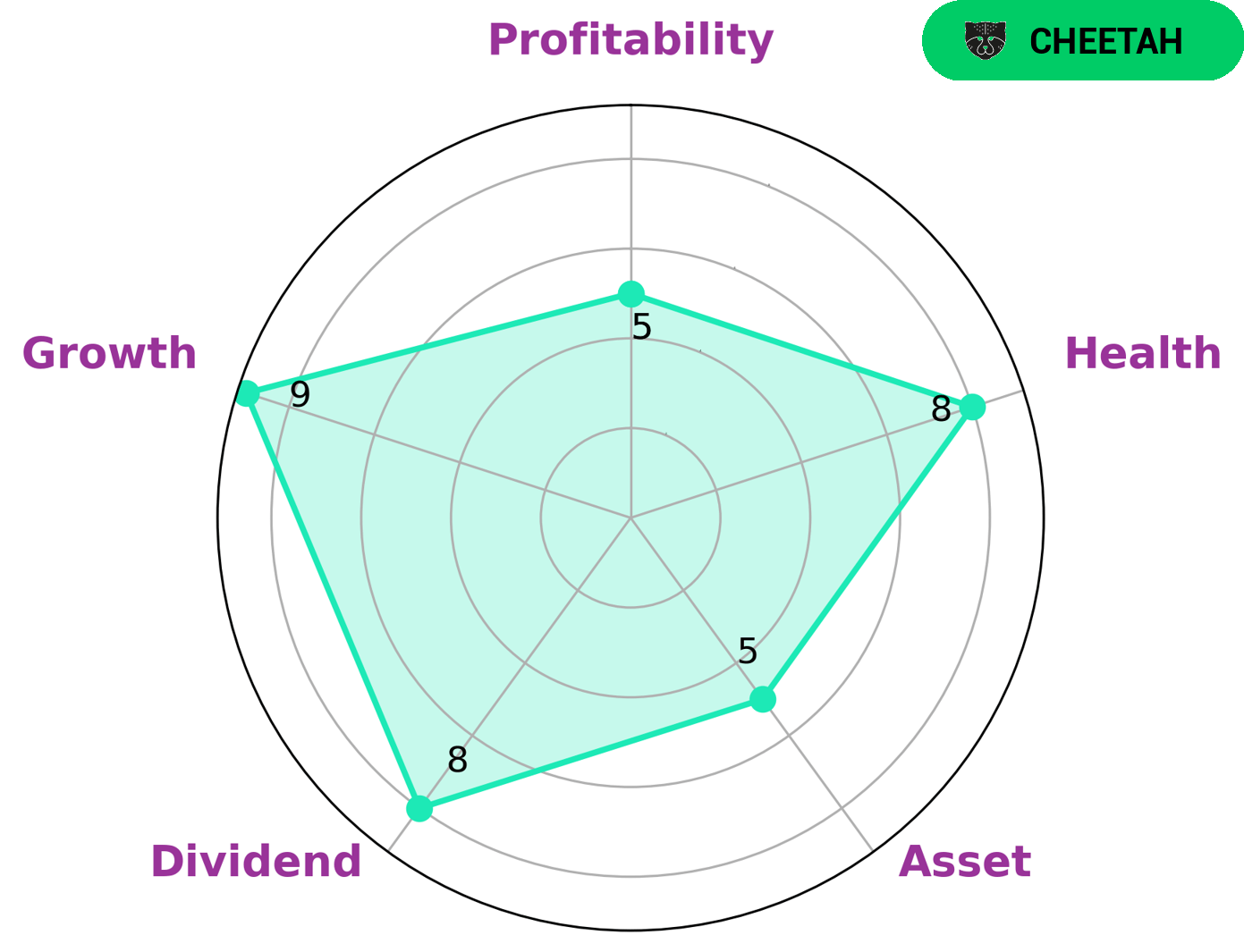

At GoodWhale, we have conducted an analysis of ENLINK MIDSTREAM‘s fundamentals, and the results are impressive. Our Star Chart shows that ENLINK MIDSTREAM is strong in dividend and growth and medium in asset and profitability. ENLINK MIDSTREAM also has a high health score of 8/10 considering its cashflows and debt. This score is an indication that the company is capable to sustain future operations in times of crisis. We have classified ENLINK MIDSTREAM as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for high growth with a bit more risk may find this company attractive. More…

Peers

The company has a large network of pipelines and facilities that span across the United States. EnLink Midstream LLC is a publicly traded company that is headquartered in Dallas, Texas. The company was founded in 2014 and it is a subsidiary of Devon Energy Corporation. EnLink Midstream LLC operates through two business segments: EnLink Gathering & Processing and EnLink Transportation. The company has a workforce of over 2,000 employees. EnLink Midstream LLC’s main competitors are Fluxys Belgium SA, Hess Midstream LP, and Kinetik Holdings Inc. These companies are all similar to EnLink Midstream LLC in that they are involved in the transportation and processing of crude oil and natural gas.

– Fluxys Belgium SA ($LTS:0Q7U)

Fluxys Belgium SA is a leading provider of gas transportation and storage services in Belgium. The company has a market capitalization of 2.23 billion and a return on equity of 14.4%. Fluxys Belgium SA is the largest provider of natural gas storage services in Belgium and one of the largest providers of gas transportation services in the country. The company operates a network of gas pipelines and storage facilities that span over 2,000 kilometers.

– Hess Midstream LP ($NYSE:HESM)

Hess Midstream LP is a midstream energy company that owns, operates, develops and acquires pipelines and other midstream assets. The company has a market cap of 1.2B as of 2022 and a Return on Equity of 208.88%. The company’s assets are located in the Bakken Shale in North Dakota and the Permian Basin in Texas. Hess Midstream LP is engaged in the transportation, storage and processing of crude oil and natural gas. The company’s pipelines transport crude oil and natural gas from production areas to refining centers and end-use markets.

Summary

EnLink Midstream is an attractive investment opportunity for those looking for long-term growth. Despite its current low yield, the company has substantial potential for capital appreciation due to its strong financial position and its strategic investments in midstream infrastructure. EnLink has a strong balance sheet, with a manageable debt-to-equity ratio and lower leverage than many of its peers.

Additionally, it operates a diverse portfolio of assets in several key energy producing regions, providing it with a broad geographic reach. As demand for midstream services increases, EnLink is well-positioned to benefit from the industry’s continued growth. Additionally, its dividend payments are likely to increase over time, providing investors with consistent returns in addition to capital appreciation.

Recent Posts