Whales Betting Big Against Chevron in 2023: Options History Reveals Bearish Stance

March 25, 2023

Trending News 🌥️

The options activity of a large investor, commonly referred to as a ‘whale’, has revealed a bearish stance on Chevron Corporation ($NYSE:CVX) for 2023. This investor, who has substantial capital, appears to be betting against the energy giant in the near future. Their actions suggest that they are expecting Chevron’s stock to decline in the next few months. This investor’s actions could have a significant impact on the company’s stock performance. If their predictions prove to be correct, it could mean a significant drop in Chevron’s stock price.

On the other hand, if the investor is wrong and the stock does not decline, it could be an opportunity for investors to capitalize on the potential gains by buying into Chevron. Given this whale’s activity, it is clear that they are taking a pessimistic outlook towards Chevron’s prospects in the future. Investors should carefully consider all factors before making any decisions and should always seek professional advice before investing.

Stock Price

In recent weeks, news sentiment has been mostly positive for CHEVRON CORPORATION, with the stock opening at $152.1 and closing at $156.1 on Friday, representing a 1.0% increase from the prior closing price of $154.5. However, options data reveals a bearish stance on the company’s stock in the future. This suggests that the majority of large investors, or “whales” are betting against Chevron in 2023. This could indicate that any short-term gains in the stock may be short-lived as investors may be looking for more reliable long-term investments elsewhere. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chevron Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 235.72k | 35.47k | 15.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chevron Corporation. More…

| Operations | Investing | Financing |

| 49.6k | -12.11k | -24.98k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chevron Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 257.71k | 97.47k | 83.17 |

Key Ratios Snapshot

Some of the financial key ratios for Chevron Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.0% | 636.5% | 21.3% |

| FCF Margin | ROE | ROA |

| 16.0% | 19.7% | 12.2% |

Analysis

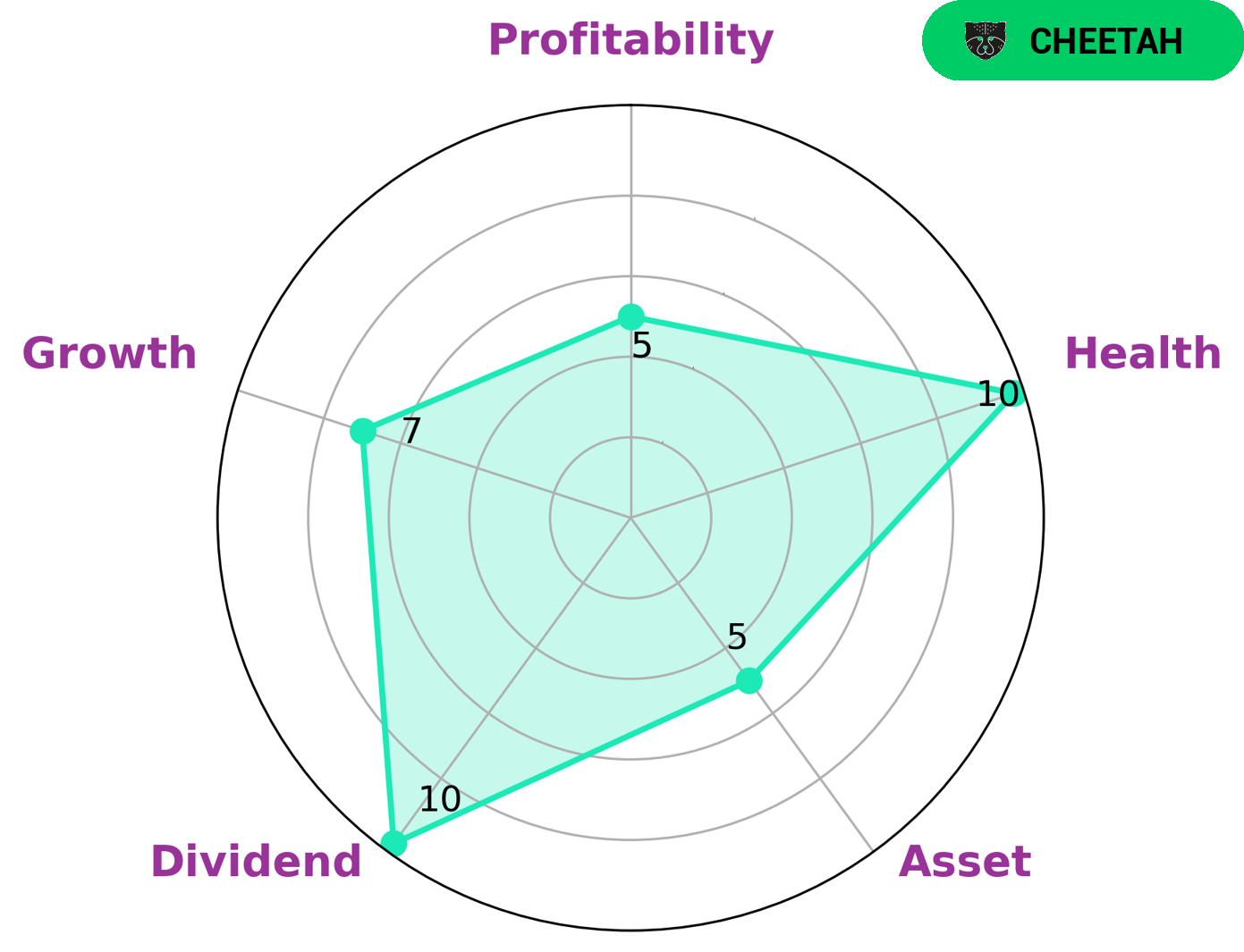

At GoodWhale, we have conducted an analysis of CHEVRON CORPORATION‘s wellbeing. Through our Star Chart, we found that CHEVRON CORPORATION is strong in dividend and growth, and medium in asset and profitability. In terms of health, CHEVRON CORPORATION scored highly with 10/10 due to its strong cashflows and debt levels, which suggests that the company is capable of sustaining future operations in times of crisis. Additionally, we classified CHEVRON CORPORATION as a ‘cheetah’ company, which is defined as a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Thus, investors who are interested in high-growth companies with a bit of risk may find CHEVRON CORPORATION attractive. More…

Peers

The Chevron Corp competes with Exxon Mobil Corp, Occidental Petroleum Corp, and ConocoPhillips. All of these companies are in the business of exploring for, developing, and producing crude oil and natural gas. Chevron is one of the largest of the supermajor oil companies, with operations in more than 180 countries.

– Exxon Mobil Corp ($NYSE:XOM)

Exxon Mobil Corporation is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller’s Standard Oil Company, and was formed on November 30, 1999 by the merger of Exxon (formerly the Standard Oil Company of New Jersey) and Mobil (formerly the Standard Oil Company of New York). The world’s seventh largest company by revenue, ExxonMobil is also the seventh largest publicly traded company by market capitalization. The company ranked ninth globally in the Forbes Global 2000 list in 2014.

– Occidental Petroleum Corp ($NYSE:OXY)

Occidental Petroleum Corp is a large American oil and gas company with operations in the United States, the Middle East, and Latin America. The company has a market cap of 63.77B as of 2022 and a return on equity of 29.73%. Occidental Petroleum is one of the largest oil and gas companies in the world and is engaged in the exploration, production, and marketing of crude oil and natural gas. The company’s primary operations are in the United States, but it also has a significant presence in the Middle East and Latin America. Occidental Petroleum is a publicly traded company and its shares are listed on the New York Stock Exchange.

– ConocoPhillips ($NYSE:COP)

ConocoPhillips is an American multinational energy corporation with its headquarters in Houston, Texas. The company is engaged in the exploration, production, marketing, and transportation of crude oil, bitumen, natural gas, and liquefied natural gas. As of December 31, 2019, the company had estimated proved reserves of 8.4 billion barrels of oil equivalent.

ConocoPhillips has a market capitalization of $150.08 billion as of January 2021. The company’s return on equity was 30.9% for the year ended December 31, 2020.

ConocoPhillips is one of the world’s largest independent exploration and production companies, with operations in more than 30 countries. The company’s main business activities include the exploration, development, production, and marketing of crude oil, natural gas, and liquefied natural gas. ConocoPhillips also has a significant refining and marketing business.

Summary

Chevron Corporation is one of the largest integrated energy companies in the world, with operations spanning across six continents. Investors have been keeping an eye on Chevron’s performance, with many placing their bets on the company in 2023. Recent options history reveals a bearish stance, suggesting that investors are placing more bets against the company than for it. Analysts are predicting that Chevron will continue to perform well in the years to come, citing its impressive portfolio and strong financials as two primary drivers of growth.

Despite the bullish sentiment, investors should take caution when investing in Chevron due to the potential volatility in the energy market. With a sound strategy in place, investors may be able to capitalize on the company’s potential for long-term gains.

Recent Posts