Chevron Rides High on OPEC Production Cuts

April 13, 2023

Trending News 🌧️

As one of the world’s leading integrated energy companies, Chevron ($NYSE:CVX) engages in exploration, production, refining and marketing of oil and natural gas. Recently, Chevron has been riding high on OPEC production cuts, which have largely contributed to its premium valuations. This came as a relief for Chevron, as it was struggling to maintain its premium valuations in the face of dwindling oil prices. Further, Chevron saw a significant jump in its quarterly earnings due to increased production from new offshore projects. This was a result of the company’s investments in deepwater exploration, which have allowed it to tap into new resources and expand its production capabilities.

Additionally, Chevron’s position as a leader in the oil and gas industry has enabled it to benefit greatly from the OPEC cuts. Overall, Chevron has been riding high on OPEC production cuts, which have played a major role in boosting its premium valuations. The company has seen impressive gains in its quarterly earnings and stock price, thanks to its robust investments and strategic positions in the industry. Going forward, Chevron is well-positioned to capitalize on the OPEC cuts and enjoy sustained success in the long run.

Stock Price

On Wednesday, CHEVRON CORPORATION stock opened at $170.4 and closed at $169.8, marking a slight 0.4% increase from the previous closing price of 169.2. The company has seen a steady increase in share value since the start of the OPEC production cuts, and this modest but consistent growth has contributed to investors’ faith in the energy giant. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chevron Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 235.72k | 35.47k | 15.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chevron Corporation. More…

| Operations | Investing | Financing |

| 49.6k | -12.11k | -24.98k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chevron Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 257.71k | 97.47k | 83.17 |

Key Ratios Snapshot

Some of the financial key ratios for Chevron Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.0% | 636.5% | 21.3% |

| FCF Margin | ROE | ROA |

| 16.0% | 19.7% | 12.2% |

Analysis

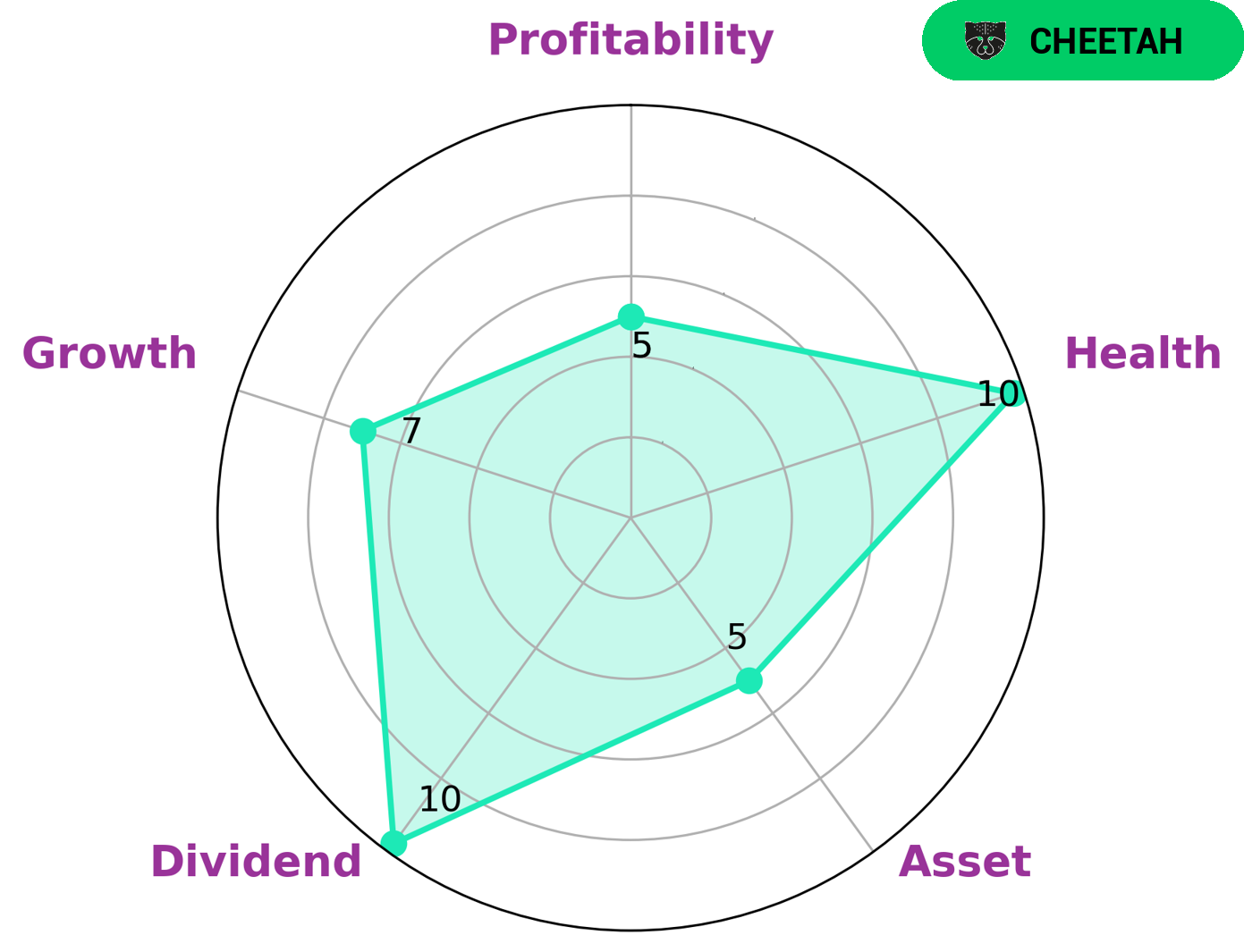

At GoodWhale, we analyzed the fundamentals of CHEVRON CORPORATION and found it to have a high health score of 10/10 with regard to its cashflows and debt. This shows that CHEVRON CORPORATION is capable to sustain future operations in times of crisis. We also classified it as a ‘cheetah’, a type of company we conclude that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Our star chart analysis revealed that CHEVRON CORPORATION is strong in dividend, growth, and medium in asset, profitability, which indicates that it may be attractive to investors who are looking for income and capital appreciation. Investors interested in long-term investments and stability should take into consideration that the company’s lower profitability and lower stability may entail some risks. More…

Peers

The Chevron Corp competes with Exxon Mobil Corp, Occidental Petroleum Corp, and ConocoPhillips. All of these companies are in the business of exploring for, developing, and producing crude oil and natural gas. Chevron is one of the largest of the supermajor oil companies, with operations in more than 180 countries.

– Exxon Mobil Corp ($NYSE:XOM)

Exxon Mobil Corporation is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller’s Standard Oil Company, and was formed on November 30, 1999 by the merger of Exxon (formerly the Standard Oil Company of New Jersey) and Mobil (formerly the Standard Oil Company of New York). The world’s seventh largest company by revenue, ExxonMobil is also the seventh largest publicly traded company by market capitalization. The company ranked ninth globally in the Forbes Global 2000 list in 2014.

– Occidental Petroleum Corp ($NYSE:OXY)

Occidental Petroleum Corp is a large American oil and gas company with operations in the United States, the Middle East, and Latin America. The company has a market cap of 63.77B as of 2022 and a return on equity of 29.73%. Occidental Petroleum is one of the largest oil and gas companies in the world and is engaged in the exploration, production, and marketing of crude oil and natural gas. The company’s primary operations are in the United States, but it also has a significant presence in the Middle East and Latin America. Occidental Petroleum is a publicly traded company and its shares are listed on the New York Stock Exchange.

– ConocoPhillips ($NYSE:COP)

ConocoPhillips is an American multinational energy corporation with its headquarters in Houston, Texas. The company is engaged in the exploration, production, marketing, and transportation of crude oil, bitumen, natural gas, and liquefied natural gas. As of December 31, 2019, the company had estimated proved reserves of 8.4 billion barrels of oil equivalent.

ConocoPhillips has a market capitalization of $150.08 billion as of January 2021. The company’s return on equity was 30.9% for the year ended December 31, 2020.

ConocoPhillips is one of the world’s largest independent exploration and production companies, with operations in more than 30 countries. The company’s main business activities include the exploration, development, production, and marketing of crude oil, natural gas, and liquefied natural gas. ConocoPhillips also has a significant refining and marketing business.

Summary

Chevron Corporation has seen a sharp increase in stock price this year due to the OPEC cuts, resulting in premium valuations. Despite the increase in price, Chevron is still a sound investment for those willing to take a long-term approach. The company has a strong balance sheet, and its reserves are subject to a low cost of capital.

In addition, Chevron’s production growth has been positive over the last several years and its future outlook for production growth looks promising. Furthermore, the company’s portfolio is diversified across both oil and gas, providing investors with a more secure means of investing. With these factors in mind, Chevron Corporation is an ideal investment for those looking to gain exposure to the energy industry.

Recent Posts