Oceaneering International Stocks Revolutionizing the Market

January 8, 2023

Trending News 🌥️

Oceaneering International ($NYSE:OII) Inc. is an American company that provides engineered services and products to the offshore oil and gas industry. The company specializes in providing subsea engineering services, such as subsea production systems, remotely operated vehicles (ROVs), and diving services. It is also involved in providing technical support services, such as subsea fabrication, maintenance, and inspection services. One of the most important aspects of the company’s operations is its stocks, which have been revolutionizing the market at the time of writing. Oceaneering International Inc. is one of the top-performing stocks in the oil and gas sector. Its stocks have consistently outperformed the broader market, making it an attractive option for investors. The company’s stock performance has been driven by strong demand for its services and products, as well as its efficient use of capital. The performance of Oceaneering International Inc. stocks has been further improved by a strong management team and its ability to identify and capitalize on opportunities in the sector.

The company’s management team has consistently been focused on growth and expansion, which has resulted in a number of strategic acquisitions and partnerships. This growth strategy has enabled the company to expand its presence in the sector and cement its position as a leader in the industry. In addition to its impressive stock performance, Oceaneering International Inc. has also been able to capitalize on its strong reputation in the industry. The company is respected for its quality services and products, as well as its commitment to safety and environmental stewardship. This has enabled the company to build strong relationships with clients and partners, which has contributed to its stock performance. With its strong stock performance, efficient capital use, and commitment to safety and environmental stewardship, the company is well-positioned to continue delivering strong returns for its shareholders.

Price History

By the end of the day, their price closed at $16.9, down by a mere 0.2% from the previous closing price of 16.9. This small drop in the stock price is an indication of the strong and reliable nature of Oceaneering International Inc. stocks. The company specializes in providing engineering and technical services to the offshore energy industry, which means their products and services are in high demand all over the world. This makes their stocks a great investment for anyone looking for a reliable and profitable company to invest in. The company’s financials have been consistently strong, with their profits increasing steadily in the past few years. This has made their stocks even more attractive to investors, as they can be assured of a good return on their investment.

Oceaneering International Inc. stocks are also known for their safety, with no major drops in the past few years. Furthermore, Oceaneering International Inc. stocks are highly liquid, meaning investors can quickly and easily buy and sell them whenever they want. This is an attractive feature for those who want to make quick profits and reduce their risks. Their consistent financials, safety, and liquidity make them a great choice for anyone looking to invest in a stable and profitable stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Oceaneering International. More…

| Total Revenues | Net Income | Net Margin |

| 2k | -36 | -1.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Oceaneering International. More…

| Operations | Investing | Financing |

| 52.01 | -34.16 | -101.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Oceaneering International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.92k | 1.45k | 4.69 |

Key Ratios Snapshot

Some of the financial key ratios for Oceaneering International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.2% | -74.3% | 2.7% |

| FCF Margin | ROE | ROA |

| -0.5% | 7.2% | 1.8% |

VI Analysis

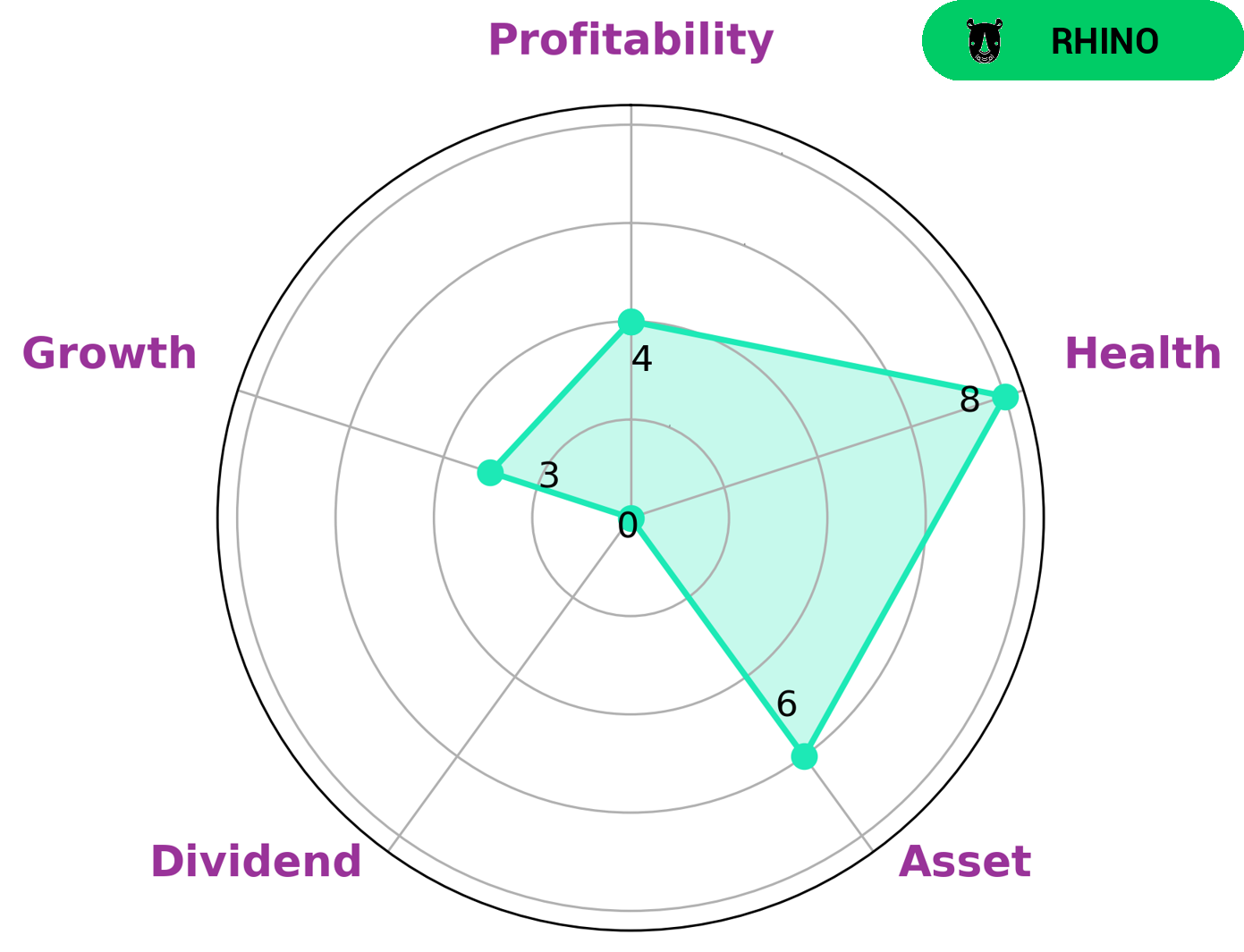

Investors looking for stable opportunities may be interested in Oceaneering International, which has been rated 8/10 in health score by VI Star Chart. This company is strong in liquidity and medium in asset, profitability and weak in dividend, growth. Oceaneering International is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. The company’s fundamentals reflect its long term potential and investors can be assured that it is capable of safely riding out any crisis without the risk of bankruptcy. The company’s strong liquidity indicates that it has sufficient cash to cover its short-term liabilities and that it is able to remain in operations even during times of financial distress. Moreover, its medium ratings in asset, profitability and weak ratings in dividend and growth show that it is able to generate profits and pay dividends, but not at a rate that would make it a high-growth investment. Overall, Oceaneering International seems to be a relatively safe investment for those looking for stability rather than extreme growth. Its solid fundamentals and moderate revenue/earnings growth mean that it may be a good choice for conservative investors who are looking for low-risk investments with steady returns. More…

VI Peers

Oceaneering International, Inc. is one of the world’s largest providers of engineered services and products to the offshore oil and gas industry, with a focus on deepwater applications. The company has a significant competitive advantage in its unique ability to operate in extremely deepwater environments. Deep Down, Inc. is a leading provider of subsea intervention, installation, and abandonment services to the oil and gas industry. The company has a strong track record of delivering complex projects safely and on time. Dolfines is a leading provider of remotely operated vehicles (ROVs) and related services to the oil and gas industry. The company has a broad range of ROVs and related services that are used in a variety of applications, including deepwater drilling and production. Bumi Armada Bhd is a leading provider of floating production, storage, and offloading (FPSO) vessels and related services to the oil and gas industry. The company has a strong track record of delivering projects on time and on budget.

– Deep Down Inc ($OTCPK:DPDW)

The company’s market capitalization is 7.25 million as of 2022. The company’s return on equity is -2.83%. The company is engaged in the development of oil and gas projects.

– Dolfines ($BER:JPZ0)

Bumi Armada is a Malaysia-based international offshore oilfield services provider. The Company is engaged in the charter, operation and maintenance of floating production, storage and offloading (FPSO) vessels, Floating LNG (FLNG) vessels, Tension Leg Platforms (TLPs), FPSO topsides, FSOs, LNG regasification units, LNG carriers, LNG/CNG carriers, other LNG related floating units, process platforms, mini-refineries, riser platforms and living quarters platforms.

Summary

Oceaneering International Inc. is a leading provider of engineered services and products, primarily to the offshore oil and gas industry. The company has seen tremendous growth over the past few years and its stock price has risen significantly. Analysts attribute this growth to the company’s strong balance sheet and its ability to effectively manage its operations. Oceaneering’s business model has also been credited with helping it to weather the economic downturns in the past.

The company has a solid financial position and is well-positioned to take advantage of future opportunities in the oil and gas industry. The company’s stock is considered to be a good long-term investment by many investors, given its robust fundamentals and potential for further growth.

Recent Posts