NOW’s Debt-Free Future: Stock Price at $9.49 Amidst Zero Debt-to-Equity Ratio

May 10, 2023

Trending News 🌥️

NOW ($NYSE:DNOW) Inc. is a leading oilfield products and services provider. The company’s stock price has been holding steady around $9.49, due in part to its impressive 0.00 Debt-to-Equity Ratio. This ratio is calculated by dividing a company’s total liabilities by its total shareholder’s equity, and a ratio of 0.00 implies that NOW Inc. has no liabilities, or no debt. This is an incredibly positive sign for the company, as it implies an incredibly bright future for NOW Inc. An analysis of NOW Inc.’s stock price of $9.49 in light of its zero debt-to-equity ratio reveals a strong outlook for the company. The lack of debt eliminates the risk of defaulting on payments and any other debt-related issues that could have a negative impact on stock prices in the future. Furthermore, the absence of liabilities also means that NOW Inc. has more financial flexibility to invest in new projects and increase their future earnings potential.

In addition, the company’s current stock price of $9.49 may provide investors with an attractive opportunity for return on investment. A debt-free future suggests that the company is well-positioned financially and can focus on growth, which could make NOW Inc. an attractive option for investors who are seeking long-term investments. This ratio coupled with the company’s current stock price of $9.49 could be a significant factor in determining whether NOW Inc. is a good investment opportunity for investors in the future.

Market Price

Monday was a good day for NOW Inc., as the company opened its stock at $9.49 and closed the day with its stock at the same price of $9.49. This was in spite of the 0.1% dip from its prior closing price of $9.5. This stability can be attributed to the fact that NOW Inc. has a zero debt-to-equity ratio, meaning that it is debt-free. This makes it an attractive investment in the market and is likely why the stock price held steady.

The key takeaway from this information is that investors are attracted to companies like NOW Inc., which have no debt and offer a stable stock price despite market volatility. This suggests that NOW Inc. is in a prime position to capitalize on any potential opportunities in the future and has the financial flexibility to do so. With its current debt-free status, NOW Inc. is well-positioned to enjoy a prosperous and successful future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Now Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.25k | 129 | 6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Now Inc. More…

| Operations | Investing | Financing |

| 16 | -94 | -43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Now Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.33k | 485 | 7.85 |

Key Ratios Snapshot

Some of the financial key ratios for Now Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.7% | 157.1% | 6.8% |

| FCF Margin | ROE | ROA |

| 0.1% | 11.4% | 7.2% |

Analysis

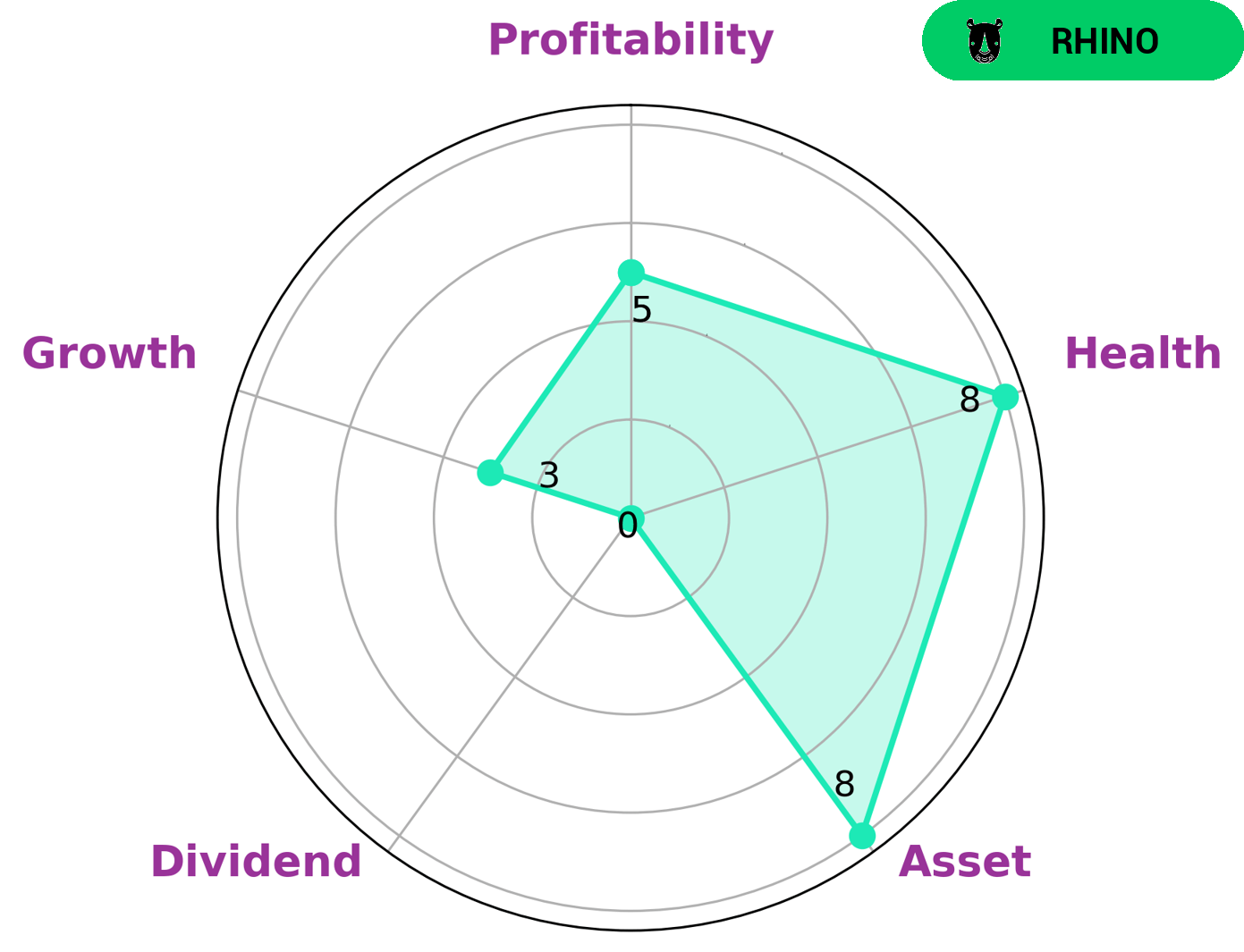

GoodWhale conducted an analysis of NOW INC‘s financials and classified them as ‘rhino’. This type of company typically has achieved moderate revenue or earnings growth. We believe that investors who are looking for a stable and mature company may be interested in NOW INC. Our analysis also shows that NOW INC has a high health score of 8/10, indicating its strong cashflows and debt that can effectively ride out any crisis without the risk of bankruptcy. Furthermore, NOW INC is strong in asset, medium in profitability and weak in dividend, growth. More…

Peers

NOW Inc is an American provider of oilfield products and services with operations in the United States, Canada, Latin America, the Middle East, Africa, and Asia Pacific. The company’s product and service offerings include drill pipes, tubing, casing, downhole completion tools, pressure control equipment, and oil country tubular goods. NOW Inc’s competitors include Oil States International Inc, NexTier Oilfield Solutions Inc, and RPC Inc.

– Oil States International Inc ($NYSE:OIS)

The company has a market cap of 460.1M as of 2022 and a Return on Equity of -1.47%. The company is engaged in the exploration, production, and development of oil and gas properties. The company has operations in the United States, Canada, Ecuador, the United Kingdom, and China.

– NexTier Oilfield Solutions Inc ($NYSE:NEX)

NexTier Oilfield Solutions Inc is a leading provider of oilfield services. The company has a market cap of 2.58B and a ROE of 20.02%. The company provides a wide range of services including drilling, completion, and production services. The company has a strong presence in the United States and Canada.

– RPC Inc ($NYSE:RES)

RPC Inc is a publicly traded company with a market capitalization of $2.21 billion as of 2022. The company has a return on equity of 16.65%. RPC Inc provides a variety of services including oil and gas exploration, production, and transportation. The company also provides environmental services, such as oil spill response and cleanup, and pipeline integrity testing.

Summary

NOW Inc. is currently trading at $9.49 and has a debt-to-equity ratio of 0.00. This is a positive sign for investors as it indicates that the company is not taking on large amounts of debt, but instead relies on equity to finance their operations. It may also suggest that NOW Inc. is in a strong financial position and can generate enough cash to cover its obligations without having to raise additional capital. This could be a benefit for investors who are looking for a steady and reliable company with minimal risk.

Recent Posts