NOW Experiences Significant Shareholder Reduction as Yousif Capital Management LLC Cuts Stake

April 9, 2023

Trending News 🌧️

NOW ($NYSE:DNOW) Inc. has experienced a significant shareholder reduction as Yousif Capital Management LLC cuts its stake in the company. NOW Inc., formerly National Oilwell Varco, Inc., is a leading provider of technology, equipment, and services to the global energy industry. It operates through four main business segments: Wellbore Technologies, Completion & Production Solutions, Rig Technologies, and Engineering & Construction Services. NOW Inc.’s products and services are used in the drilling, completion, production and maintenance of oil and gas wells. Its products include drill bits, downhole tools, pressure control equipment and subsea production systems.

Additionally, it provides engineering services and solutions to customers in the oil and gas industries.

Market Price

The opening price of NOW Inc. stock was $11.2, and it closed the day at $10.9, a decrease of 0.8% from the previous closing price of $11.0. This shareholder reduction could indicate a shift in investor sentiment towards the company, and could have a significant impact on the stock price in the near future. It is important for investors to keep an eye on this situation as it unfolds, as it could have major implications for the company’s long-term success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Now Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.14k | 128 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Now Inc. More…

| Operations | Investing | Financing |

| 0 | -87 | -10 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Now Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.32k | 476 | 7.63 |

Key Ratios Snapshot

Some of the financial key ratios for Now Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.2% | 46.3% | 6.6% |

| FCF Margin | ROE | ROA |

| -0.4% | 10.7% | 6.7% |

Analysis

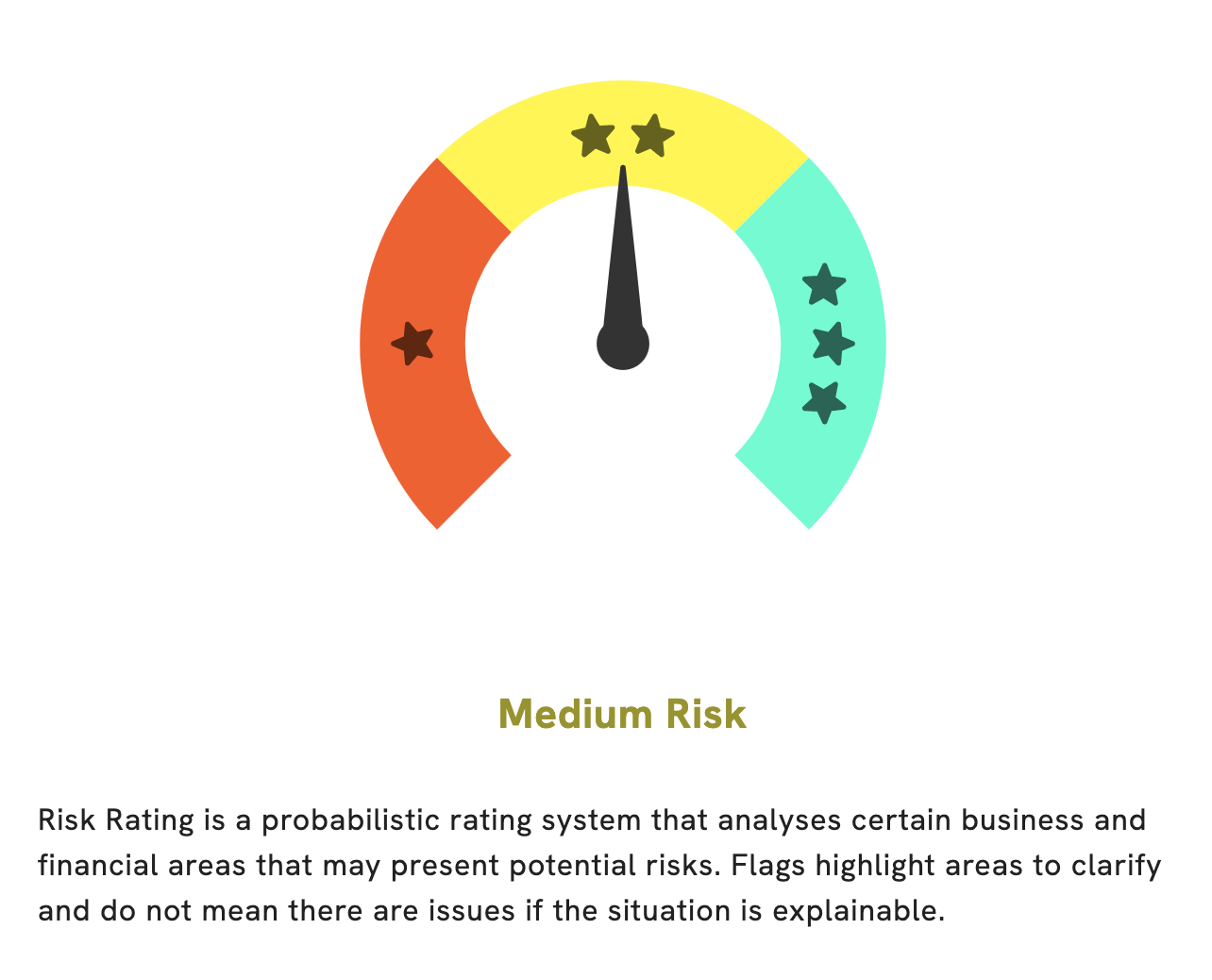

At GoodWhale, we conducted an analysis of NOW INC‘s financials. Our risk rating concluded that investing in NOW INC is a medium risk investment, and we detected 2 risk warnings in the income sheet and balance sheet. If you’d like to dig deeper and understand the particularities of our analysis, become a registered user and access our complete report. More…

Peers

NOW Inc is an American provider of oilfield products and services with operations in the United States, Canada, Latin America, the Middle East, Africa, and Asia Pacific. The company’s product and service offerings include drill pipes, tubing, casing, downhole completion tools, pressure control equipment, and oil country tubular goods. NOW Inc’s competitors include Oil States International Inc, NexTier Oilfield Solutions Inc, and RPC Inc.

– Oil States International Inc ($NYSE:OIS)

The company has a market cap of 460.1M as of 2022 and a Return on Equity of -1.47%. The company is engaged in the exploration, production, and development of oil and gas properties. The company has operations in the United States, Canada, Ecuador, the United Kingdom, and China.

– NexTier Oilfield Solutions Inc ($NYSE:NEX)

NexTier Oilfield Solutions Inc is a leading provider of oilfield services. The company has a market cap of 2.58B and a ROE of 20.02%. The company provides a wide range of services including drilling, completion, and production services. The company has a strong presence in the United States and Canada.

– RPC Inc ($NYSE:RES)

RPC Inc is a publicly traded company with a market capitalization of $2.21 billion as of 2022. The company has a return on equity of 16.65%. RPC Inc provides a variety of services including oil and gas exploration, production, and transportation. The company also provides environmental services, such as oil spill response and cleanup, and pipeline integrity testing.

Summary

NOW Inc. has seen an investor shift with Yousif Capital Management LLC selling 19045 of their shares. Analyzing the sector, NOW Inc. is a provider of oil and gas production equipment and services, and is currently operating in a climate of low oil prices and demand. As a result, the investor sell-off could be a sign that financial performance is not looking promising. Investors should closely monitor the company’s financials, especially in comparison to peer companies in the same sector, to gauge potential risk and future opportunities.

Recent Posts