Liberty Oilfield Services Closes at $16.59, Down 1.43% from Previous Day

January 16, 2023

Trending News ☀️

Liberty Oilfield Services ($NYSE:LBRT) is a leading provider of advanced hydraulic fracturing services, enabling oil and gas producers to unlock the full potential of their wells. The company has a strong portfolio of existing customers, as well as new clients signing up for its services. Yesterday, Liberty Oilfield Services reported its closing stock price at $16.59, down 1.43% from the previous day’s close. Liberty Oilfield Services has experienced a volatile stock market over the last few months, as the company’s share price has been volatile amid uncertainties in the energy industry. The company has recently shifted its focus to more efficient and cost-effective hydraulic fracturing services, which have helped it gain market share. Yesterday’s closing price was a minor setback compared to the company’s overall positive performance on the market. The company’s growth in recent years has been driven by its commitment to providing high-quality services that meet customer needs.

It has adopted modern technologies, such as real-time monitoring of well performance, to maximize efficiency and reduce costs. Liberty Oilfield Services also offers customized solutions for each customer, helping them maximize their production and optimize their operations. In addition to its hydraulic fracturing services, Liberty Oilfield Services also offers a wide range of other services, such as well completion and flowback services, well stimulation services, and well maintenance and repair services. These services help customers maximize their return on investment by improving their operational efficiency and reducing costs. Overall, Liberty Oilfield Services has been performing well on the market despite the current economic uncertainty. Despite this minor setback, investors should keep an eye on Liberty Oilfield Services’ stock performance in the coming weeks.

Share Price

At the time of this news release, the overall sentiment in the market seemed to be mostly positive. LIBERTY opened at $16.9 and closed at $16.6, a difference of 1.4%. LIBERTY is an American based oilfield services company that provides hydraulic fracturing and well stimulation services to oil and gas drilling operations. They offer a variety of services such as pressure pumping, fluid handling, and well stimulation to help clients extract and produce oil and gas more efficiently. LIBERTY has a wide network of locations across the United States which allows them to provide their services to a large number of customers.

LIBERTY has experienced several days of negative growth, but investors remain optimistic about their future prospects. The company has seen an increased demand for their services due to the increased activity in the oil and gas industry, and they have taken steps to expand their operations to meet this demand. Despite the recent dip in stock value, LIBERTY is still well-positioned to continue its growth and provide high quality services to its customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LBRT. More…

| Total Revenues | Net Income | Net Margin |

| 3.61k | 191.14 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LBRT. More…

| Operations | Investing | Financing |

| 347.94 | -401.05 | 42.55 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LBRT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.53k | 1.12k | 7.71 |

Key Ratios Snapshot

Some of the financial key ratios for LBRT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.4% | 14.9% | 5.9% |

| FCF Margin | ROE | ROA |

| -1.5% | 9.8% | 5.3% |

VI Analysis

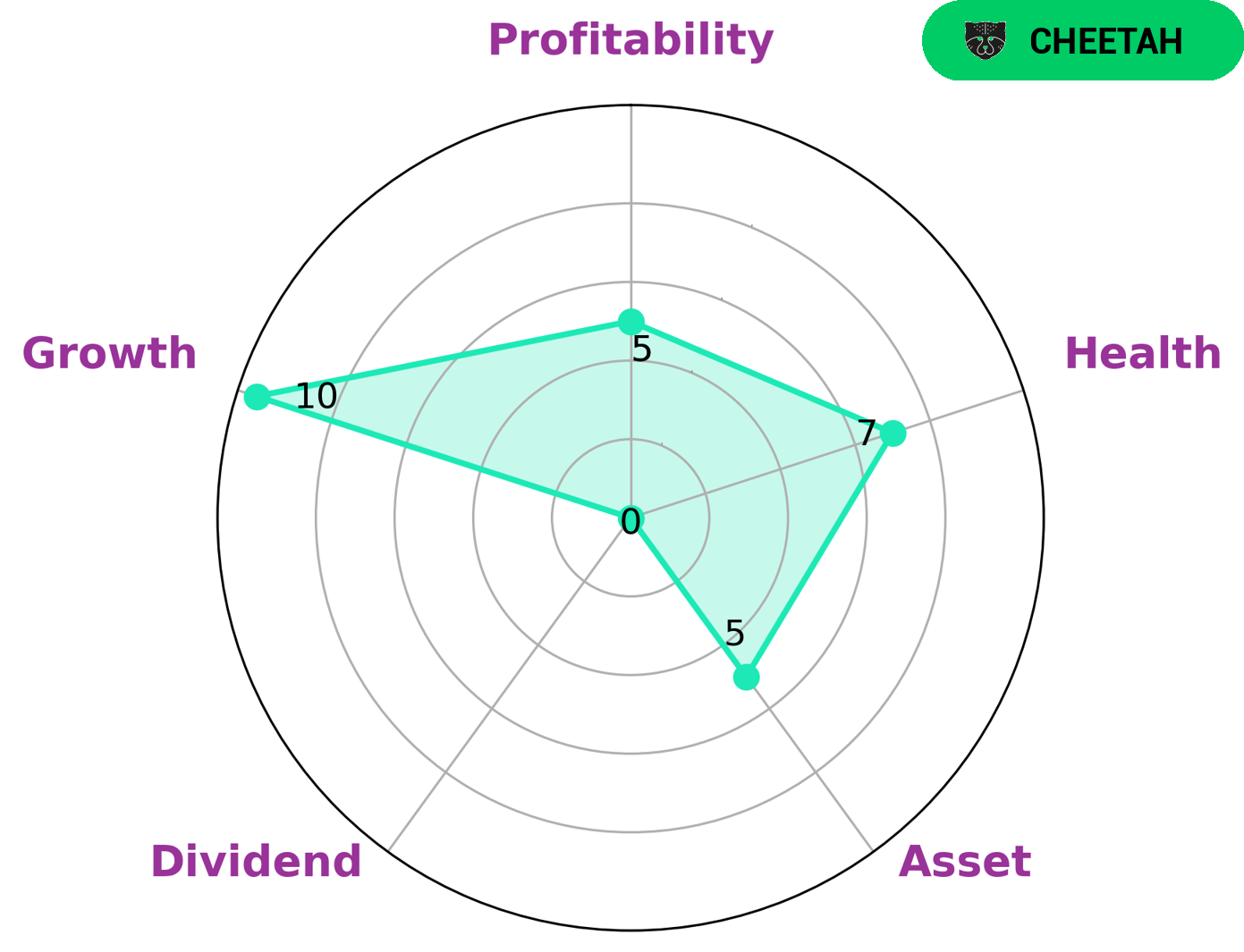

Liberty Oilfield Services has a high health score of 7/10, indicating its strong potential to sustain future operations even in times of crisis. Its fundamentals, as reflected in the VI Star Chart, show that the company is strong in growth and medium in asset, profitability and dividend. Based on this analysis, Liberty Oilfield Services is classified as a ‘cheetah’ – a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors looking for growth opportunities with a higher risk appetite may be interested in such a company. Despite the lower stability, Liberty Oilfield Services has a high health score of 7/10 indicating its ability to survive in tough market conditions. Furthermore, its strong growth in revenue or earnings can offer investors the potential for significant returns should their investments pay off. Overall, Liberty Oilfield Services offers a unique opportunity for investors looking to diversify their portfolio with a company that has high growth potential but may come with higher risks. By taking into account the health score and overall fundamentals reflected in the VI Star Chart, investors can make an informed decision on whether or not such a company is right for their portfolio. More…

VI Peers

The oil and gas industry is a highly competitive market. There are many large and small companies competing for market share. Liberty Energy Inc is a small company that is up against some big names in the industry. Sixty Six Oilfield Services Inc, Serica Energy PLC, and Helix Energy Solutions Group Inc are all large, well-established companies. Liberty Energy Inc is a relative newcomer to the industry, but it has been quickly gaining market share. The company has been aggressive in its pricing and marketing, and it has been able to capture a significant portion of the market.

– Sixty Six Oilfield Services Inc ($OTCPK:SSOF)

Sixty Six Oilfield Services Inc is a publicly traded company with a market cap of 1.63M as of 2022. The company has a strong ROE of 35.81% and is engaged in providing oilfield services to the upstream oil and gas industry. Some of the services offered by the company include drilling, completion, and production services. The company has a strong presence in the Bakken region of North America and is well-positioned to capitalize on the growing demand for oil and gas services in this region.

– Serica Energy PLC ($LSE:SQZ)

Serica Energy PLC is an oil and gas exploration and production company with a market cap of 871.59M as of 2022. The company has a Return on Equity of 64.14%. Serica Energy PLC is engaged in the exploration, development, production and sale of crude oil, natural gas and natural gas liquids. The company has a portfolio of assets in the UK, Indonesia, Vietnam and Trinidad & Tobago.

– Helix Energy Solutions Group Inc ($NYSE:HLX)

Helix Energy Solutions Group Inc is an international offshore energy services company that provides decommissioning and decommissioning services to the oil and gas industry. The company has a market cap of 673.68M as of 2022 and a Return on Equity of -3.94%. Helix Energy Solutions Group Inc is headquartered in Houston, Texas.

Summary

Liberty Oilfield Services is a company that provides oilfield services, making it a viable investment opportunity. The stock recently closed at $16.59, down 1.43% from the previous day. Despite this, the overall sentiment of news and analysis surrounding the company is mostly positive.

Analysts suggest that Liberty Oilfield Services is likely to provide a solid return on investment due to its strong position in the industry. Although there are risks associated with investing in any company, Liberty Oilfield Services has a history of delivering strong results and is expected to remain a reliable investment in the future.

Recent Posts