Great West Life Assurance Co. Increases Stake in Oceaneering International,

February 4, 2023

Trending News ☀️

Oceaneering International ($NYSE:OII), Inc. is a global provider of engineered services and products, primarily to the offshore oil and gas industry. The company’s core services include subsea engineering and construction; remote intervention tools; deepwater intervention systems; and asset integrity and inspection, maintenance, and repair services. Recently, Great West Life Assurance Co. has increased its stake in Oceaneering International, Inc. This move signals an expansion of Great West Life Assurance Co.’s presence in the company and further strengthens their relationship. The increased presence of Great West Life Assurance Co. allows for greater access to the company’s resources and expertise, which could lead to improved services and products for Oceaneering International, Inc. Furthermore, this move could open up new avenues for exposure for Oceaneering International, Inc. Great West Life Assurance Co.’s increased stake in the company could help to increase its visibility in the marketplace and could potentially attract further investors.

This could lead to an increase in stock value for Oceaneering International, Inc., which could result in significant returns for both companies. Through a stronger relationship built on increased resources and exposure, Oceaneering International, Inc. will have greater opportunities to expand their services and products while potentially increasing their stock value.

Price History

As a result of the announcement, OCEANEERING INTERNATIONAL stock opened at $20.2 on Friday and closed at $20.7, representing a 2.8% increase from its last closing price of $20.1. Great West Life Assurance Co. is one of the largest life insurance companies in Canada and the large financial investment is a key indicator of the trust they have in the company. The increase in stock price is also an indication that investors have confidence in the future of the company. The stock has been steadily increasing over the past few weeks and this latest news has only added to the positive sentiment surrounding the company.

This could potentially lead to increased demand for the stock and further increases in its value. Overall, this is great news for Oceaneering International, Inc. as it demonstrates that there is still significant investor interest in the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Oceaneering International. More…

| Total Revenues | Net Income | Net Margin |

| 2k | -36 | -1.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Oceaneering International. More…

| Operations | Investing | Financing |

| 52.01 | -34.16 | -101.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Oceaneering International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.92k | 1.45k | 4.69 |

Key Ratios Snapshot

Some of the financial key ratios for Oceaneering International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.2% | -74.3% | 2.7% |

| FCF Margin | ROE | ROA |

| -0.5% | 7.2% | 1.8% |

Analysis

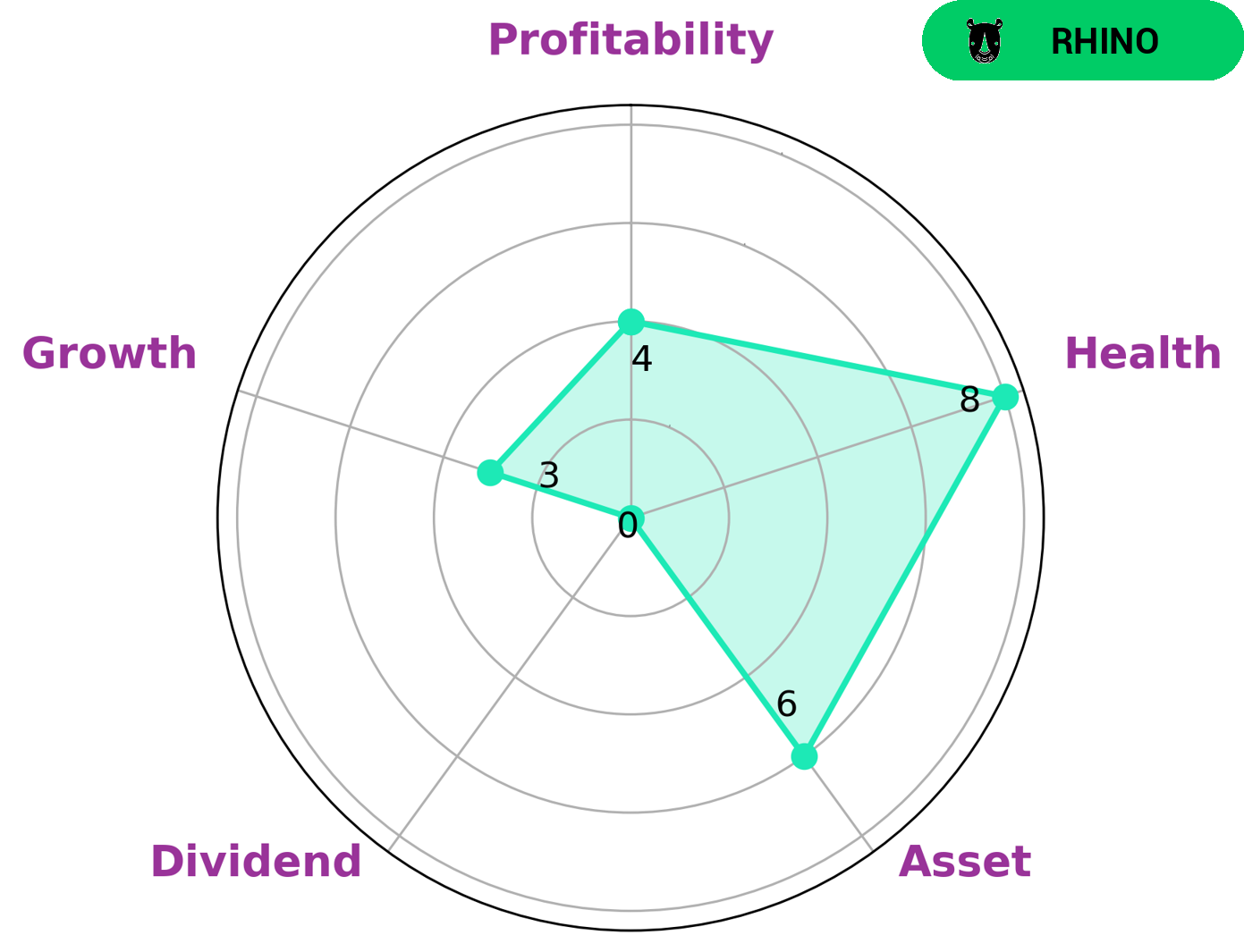

GoodWhale conducted an analysis of OCEANEERING INTERNATIONAL‘s fundamentals and according to Star Chart, the company has a high health score of 8/10. This score suggests that OCEANEERING INTERNATIONAL is in a strong position to sustain future operations even in times of crisis. The company is classified as a ‘rhino’, meaning that it has achieved moderate revenue or earnings growth. Investors who are interested in such a company may be looking for companies with strong cashflows and debt, as well as those that have achieved moderate growth. OCEANEERING INTERNATIONAL scores highly in terms of its cashflows and debt, but is only medium in terms of asset and profitability, and weak in terms of dividend and growth. Overall, OCEANEERING INTERNATIONAL is a strong and stable company with potential for moderate growth. This makes it an attractive option for investors looking for companies with sound fundamentals and moderate growth potential. More…

Peers

Oceaneering International, Inc. is one of the world’s largest providers of engineered services and products to the offshore oil and gas industry, with a focus on deepwater applications. The company has a significant competitive advantage in its unique ability to operate in extremely deepwater environments. Deep Down, Inc. is a leading provider of subsea intervention, installation, and abandonment services to the oil and gas industry. The company has a strong track record of delivering complex projects safely and on time. Dolfines is a leading provider of remotely operated vehicles (ROVs) and related services to the oil and gas industry. The company has a broad range of ROVs and related services that are used in a variety of applications, including deepwater drilling and production. Bumi Armada Bhd is a leading provider of floating production, storage, and offloading (FPSO) vessels and related services to the oil and gas industry. The company has a strong track record of delivering projects on time and on budget.

– Deep Down Inc ($OTCPK:DPDW)

The company’s market capitalization is 7.25 million as of 2022. The company’s return on equity is -2.83%. The company is engaged in the development of oil and gas projects.

– Dolfines ($BER:JPZ0)

Bumi Armada is a Malaysia-based international offshore oilfield services provider. The Company is engaged in the charter, operation and maintenance of floating production, storage and offloading (FPSO) vessels, Floating LNG (FLNG) vessels, Tension Leg Platforms (TLPs), FPSO topsides, FSOs, LNG regasification units, LNG carriers, LNG/CNG carriers, other LNG related floating units, process platforms, mini-refineries, riser platforms and living quarters platforms.

Summary

Investors have seen a positive sentiment for Oceaneering International, Inc. after Great West Life Assurance Co. increased its stake in the company. Analysts believe this move could be an indication of bullishness for the company in the longterm, as Great West Life Assurance Co. is a leading investor in the market. Looking at Oceaneering International, Inc.’s financials, investors may be encouraged by the company’s strong balance sheet and steady growth in revenues over the past few years. With a strong history of innovation and a strong customer base, many investors are optimistic about the company’s potential returns.

Furthermore, Oceaneering International, Inc. is well-positioned to benefit from the current uptick in oil prices, which could provide additional growth opportunities. Longterm investors may find Oceaneering International, Inc. an attractive option due to its strong fundamentals and promising outlook.

Recent Posts