Insiders Investing Heavily in Comstock Resources: Natural Gas Producer Seeing High Demand

March 31, 2023

Trending News ☀️

Comstock Resources ($NYSE:CRK), a natural gas producer, has been seeing some high demand in recent months. This is due in large part to the enthusiasm of the company’s insiders, who have been investing heavily in the stock. The company’s stock has been steadily increasing and has been a great investment for those insiders. COMSTOCK RESOURCES, Inc., is an independent energy company engaged in the acquisition, exploration, development and production of oil and natural gas in the United States. It primarily operates wells in Texas and Louisiana. COMSTOCK RESOURCES has the potential to develop resources from its core regions that are highly profitable and will support future growth. As a result, it has become an attractive target for investors looking to invest in a stable energy producer.

In addition, it has a strong balance sheet with low debt levels, providing it with financial flexibility. With its strong fundamentals, COMSTOCK RESOURCES is poised to benefit from any increase in energy prices, making it an attractive investment for those looking to benefit from rising energy prices. For those looking to get into the natural gas sector, COMSTOCK RESOURCES is an excellent option. The company’s insiders are investing heavily into the stock, making it an attractive prospect for investors. With its strong balance sheet and potential for future growth, COMSTOCK RESOURCES is positioned well to benefit from any future increases in energy prices.

Stock Price

On Thursday, COMSTOCK RESOURCES opened at $10.7 and closed at $10.4, down by 1.0% from the previous closing price of $10.5. Despite this minor drop, the company appears to be seeing high demand for its stock, as indicated by the presence of major insider investors. This is likely due to the fact that natural gas production is an increasingly lucrative industry and investors are keen to capitalize on this potential. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Comstock Resources. More…

| Total Revenues | Net Income | Net Margin |

| 3.63k | 1.12k | 47.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Comstock Resources. More…

| Operations | Investing | Financing |

| 1.7k | -1.1k | -576.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Comstock Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.69k | 3.42k | 8.21 |

Key Ratios Snapshot

Some of the financial key ratios for Comstock Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 67.7% | 102.5% | 43.4% |

| FCF Margin | ROE | ROA |

| 17.4% | 48.3% | 17.3% |

Analysis

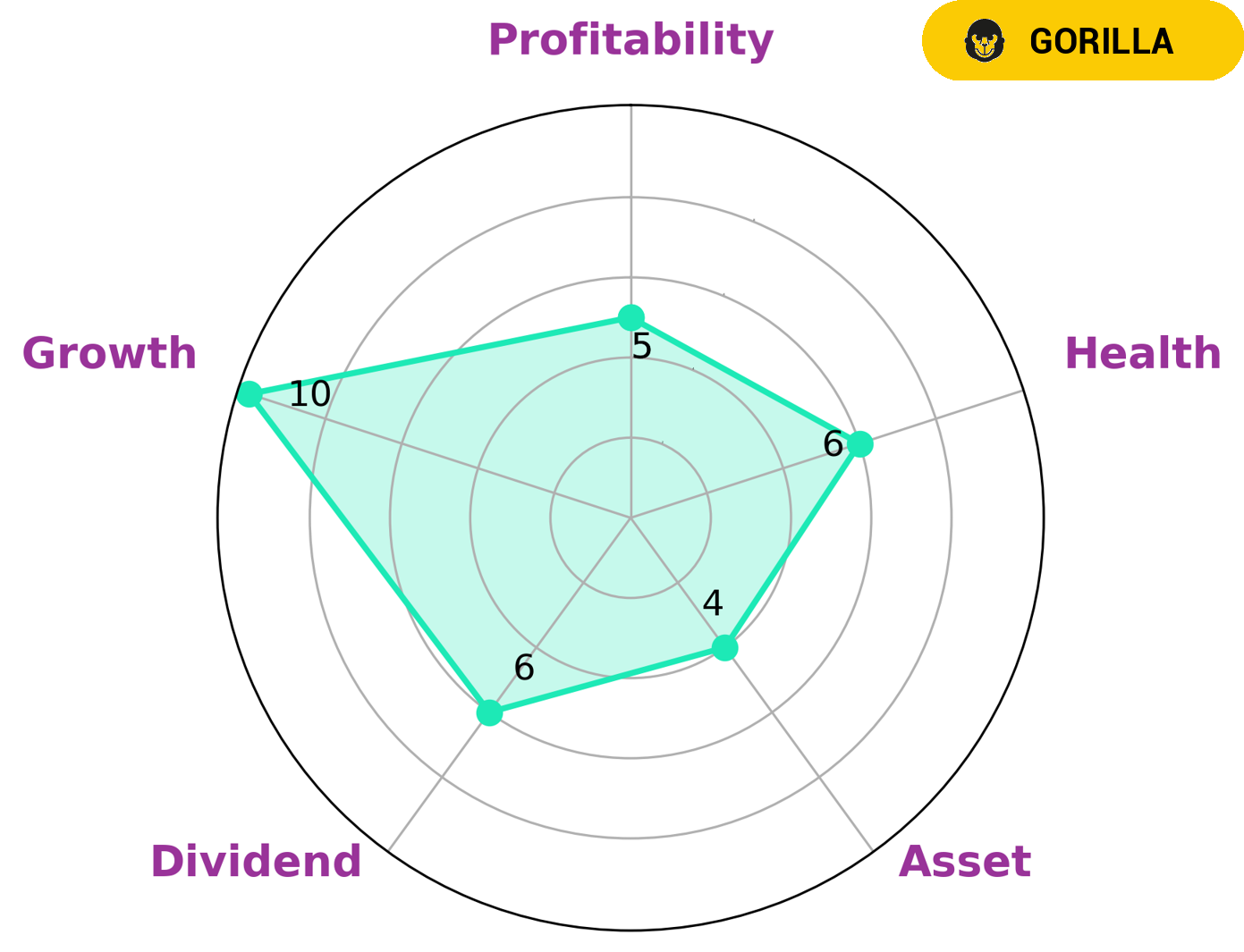

GoodWhale conducted an analysis of COMSTOCK RESOURCES and found that the company has an intermediate health score of 6/10 according to our Star Chart. This suggests that COMSTOCK RESOURCES might be able to pay off debt and fund future operations. After further analysis, we classified COMSTOCK RESOURCES as a ‘gorilla’, which indicates a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are interested in making long-term investments may be especially interested in COMSTOCK RESOURCES because the company is strong in terms of growth, and medium in terms of asset, dividend, and profitability. Investing in a company with a strong competitive advantage can often lead to steady returns over time. More…

Peers

Comstock Resources Inc. is an American oil and gas company engaged in the exploration, development, production and acquisition of properties in the United States. The company’s core areas of operation are in the states of Texas and Louisiana. The company’s main competitors are Antero Resources Corp, EQT Corp, and CNX Resources Corp. Comstock Resources Inc. has a market capitalization of $2.6 billion as of February 2018, while its competitors have market capitalizations of $13.4 billion (Antero Resources Corp), $11.5 billion (EQT Corp), and $3.4 billion (CNX Resources Corp), respectively.

– Antero Resources Corp ($NYSE:AR)

Antero Resources is a natural gas and oil company that operates in the Appalachian Basin. The company has a market capitalization of $10.83 billion as of 2022 and a return on equity of 15.98%. Antero Resources is engaged in the exploration, development, and production of natural gas and oil properties in the United States. The company was founded in 2002 and is headquartered in Denver, Colorado.

– EQT Corp ($NYSE:EQT)

EQT Corporation is a publicly traded natural gas and oil exploration and production company with operations in the United States and Canada. The company has a market cap of $14.63 billion as of 2022 and a return on equity of -5.33%. EQT Corporation is one of the largest producers of natural gas in the United States and is headquartered in Pittsburgh, Pennsylvania.

– CNX Resources Corp ($NYSE:CNX)

CNX Resources Corp is a publicly traded natural gas and oil exploration and production company with a market cap of $3.46 billion as of March 2022. The company’s primary operations are in the Appalachian Basin, which includes the Marcellus Shale and Utica Shale plays. CNX Resources was founded in 1987 and is headquartered in Canonsburg, Pennsylvania.

Summary

Comstock Resources is a natural gas producer and publicly traded oil and gas exploration and production company. Investing Analysis of Comstock Resources has identified that there has been an abundance of insider buying over the past several months, indicating a strong faith among insiders in the future of the company. Analysts have noted that Comstock is well-positioned and have demonstrated a strong return on equity over the past three years, with the potential for further upside.

Comstock also has substantial reserves located in prime drilling areas with favorable terms, making it a good choice for investors looking for value. Despite the presence of potential risks, such as commodity price volatility, the company is well-positioned to take advantage of market opportunities, making it an attractive option for investors.

Recent Posts