Going Forward

April 14, 2023

Trending News ☀️

Antero Resources ($NYSE:AR) is a leading independent oil and gas company that is well-positioned for long-term growth. The company has a strong focus on developing, acquiring and exploiting natural gas, natural gas liquids and oil resources located in the Appalachian Basin. Antero Resources has a long history of operations in the region, and its management team has an extensive track record of success, making it an attractive investment opportunity. Antero Resources is committed to improving the Appalachian Basin through its investments in exploration, development and production. The company has adopted a science based approach to its operations and leverages cutting edge technology to optimize efficiency. Antero Resources is dedicated to creating value for its shareholders through continued investment in its core operations and other growth initiatives.

Antero Resources is positioned for growth in the coming years. Its management team has developed a comprehensive strategy to capitalize on growth opportunities, which includes expanding its operations in the Appalachian Basin and expanding into new areas. Furthermore, Antero Resources’ assets are well-positioned for growth due to the company’s strategic investments. As such, investors should consider Antero Resources as a valuable long-term investment opportunity as the company continues to position itself for growth going forward.

Market Price

Antero Resources faces a tough road ahead, as its stock opened on Wednesday at $24.4 before closing at $23.9—down by 1.8% from the previous closing price of $24.3. Despite this setback, the long-term growth potential for Antero Resources is undeniable. The company has invested heavily in oil and gas exploration, development and production, and has made several strategic acquisitions that have proven to be great investments in the long run.

Additionally, Antero Resources has also focused on expanding its pipeline infrastructure and storage capabilities, which will further improve its production operations. With these factors combined, Antero Resources is positioned to take full advantage of the current market conditions and capitalize on future growth opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Antero Resources. More…

| Total Revenues | Net Income | Net Margin |

| 8.29k | 1.9k | 41.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Antero Resources. More…

| Operations | Investing | Financing |

| 3.05k | -943.61 | -2.11k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Antero Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.12k | 7.1k | 22.72 |

Key Ratios Snapshot

Some of the financial key ratios for Antero Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.5% | 50.4% | 31.3% |

| FCF Margin | ROE | ROA |

| 34.8% | 25.1% | 11.5% |

Analysis

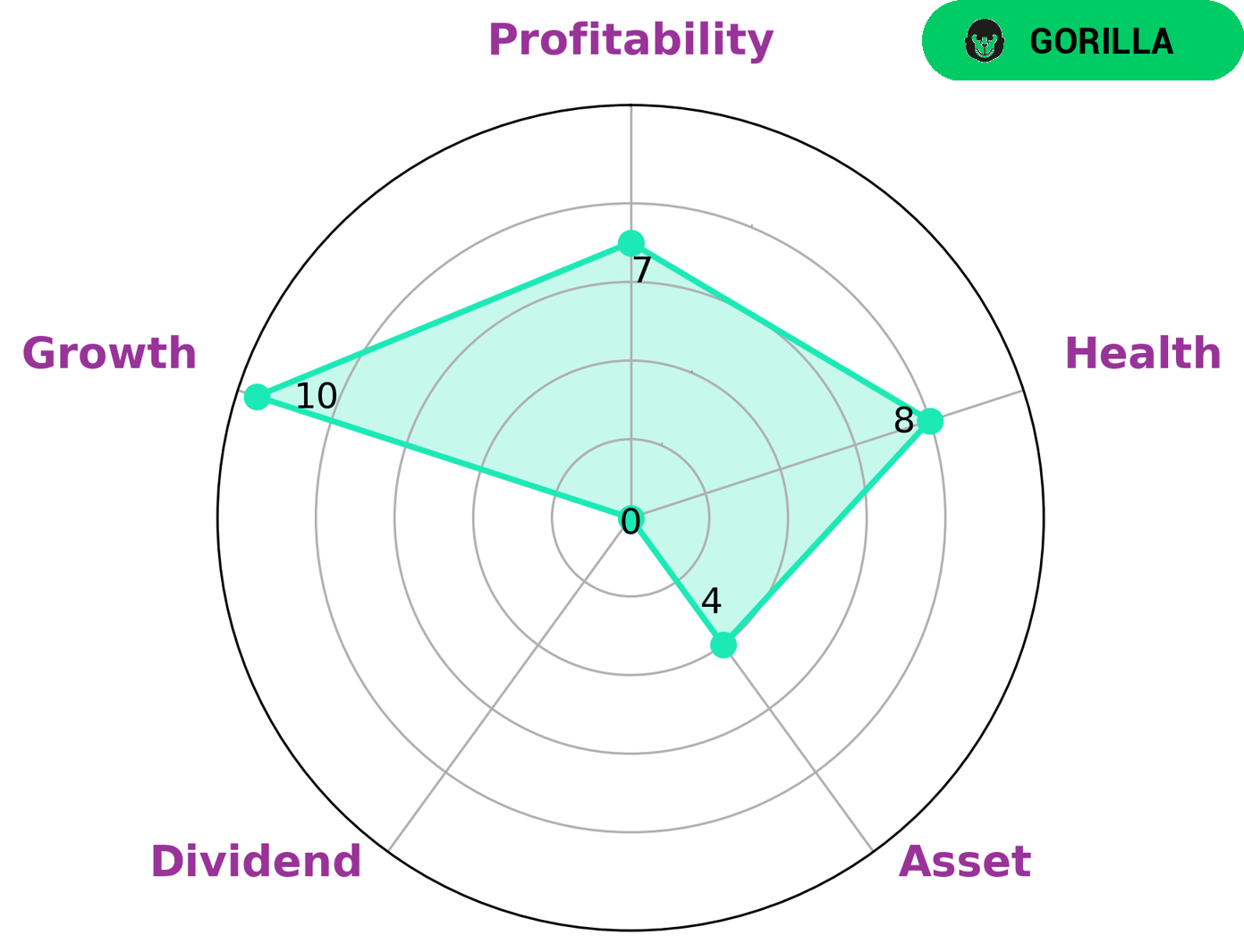

As part of our analysis to assess ANTERO RESOURCES‘s wellbeing, we plotted the company on our Star Chart. The Star Chart shows that ANTERO RESOURCES is strong in growth, profitability, and medium in asset, while being weak in dividend. This places the company in the ‘gorilla’ category, which we use to denote companies with a strong competitive advantage that have achieved stable and high revenue or earning growth. Investors looking for high-growth companies with a competitive advantage may find ANTERO RESOURCES an interesting option. In addition, with a health score of 8/10 considering its cashflows and debt, ANTERO RESOURCES is in a good financial position and is capable of sustaining future operations even in times of crisis. More…

Peers

The company explores, develops, and produces natural gas and oil properties in the Appalachian Basin. As of December 31, 2015, Antero Resources had 2,009.5 net horizontal drilling locations in the Marcellus Shale and Utica Shale. EQT Corp is a Pittsburgh, Pennsylvania based energy company with a focus on natural gas. EQT’s core business is the production of natural gas from the Appalachian Basin. As of December 31, 2015, EQT Corporation had approximately 2.0 million net acres under lease in the Appalachian Basin. Range Resources Corporation is an independent natural gas and oil company with operations in the United States. The company is headquartered in Fort Worth, Texas. As of December 31, 2015, Range Resources had 7.4 trillion cubic feet of estimated proved natural gas reserves. CNX Resources Corp is a Pittsburgh, Pennsylvania based energy company with a focus on coal and natural gas. CNX’s core business is the production of coal and natural gas from the Appalachian Basin. As of December 31, 2015, CNX Resources had approximately 1.8 million net acres under lease in the Appalachian Basin.

– EQT Corp ($NYSE:EQT)

EQT Corp is a publicly traded company with a market capitalization of $14.96 billion as of 2022. The company has a return on equity of 18.8%. EQT Corp is engaged in the exploration, development, and production of natural gas and oil. The company has operations in the United States, Canada, and Australia.

– Range Resources Corp ($NYSE:RRC)

Range Resources Corp is an American oil and gas company with a market cap of 6.82B as of 2022. The company has a Return on Equity of 45.59%. Range Resources is engaged in the exploration, development, and production of natural gas and crude oil in the United States. The company was founded in 1987 and is headquartered in Fort Worth, Texas.

– CNX Resources Corp ($NYSE:CNX)

CNX Resources Corp is a publicly traded company with a market capitalization of over $3 billion as of early 2021. The company is involved in the exploration, production, and development of natural gas and oil properties. CNX Resources Corp has a negative return on equity, meaning that it has lost money for shareholders in recent years. Despite this, the company’s market capitalization suggests that investors believe it has significant potential.

Summary

Antero Resources is an independent natural gas and oil company that operates in the Appalachian Basin. Investors are optimistic about the company’s upside potential due to its strong balance sheet and market position, with large holdings in liquids-rich natural gas and oil assets.

In addition, the company is well-positioned to benefit from the increasing demand for natural gas and low-cost production from the Appalachian Basin. Antero has a large resource base and a low cost of production, making it an attractive investment for those seeking growth potential. The company’s strong internal controls, cost-efficient operations, and a focus on capital discipline have also contributed to its success.

Recent Posts