APA Corporation Strikes Oil in Suriname Waters!

February 12, 2023

Trending News 🌧️

APA ($NASDAQ:APA) Corporation has made a major breakthrough with their oil discovery in the waters off the coast of Suriname. The company is a publicly traded oil and gas company that has been working within the energy sector for many years. It has a large network of exploration, production, and refining sites throughout the United States and the world. The oil discovery was made possible through a deepwater drilling operation conducted by the company. They have been searching for oil in the region for some time and have now finally been successful in their endeavor. The find is also a major boon for the citizens of Suriname, who have seen their economy suffer in recent years due to the decline in oil prices.

The new deposits not only provide an economic boost for the country but also create jobs for local residents and increase revenue for the government. This major discovery will also help APA Corporation to further expand its operations—not only in Suriname but also around the world. The company has already established itself as one of the most successful energy companies and this new find will no doubt add to its impressive list of accomplishments. Overall, this is great news for both APA Corporation and the people of Suriname. This discovery could not have come at a better time and it will no doubt provide a much-needed financial boost to both parties.

Price History

On Thursday, APA Corporation made headlines when news broke that the company had struck oil in the waters off the coast of Suriname. The news was mostly negative for the company, as their stock opened at $42.2 and closed at $41.0, down by 2.5% from its prior closing price of 42.1. The announcement came as a surprise to many investors, as the company had been facing stagnant growth in the past few months. This new development has certainly caused a stir in the financial markets, as many investors are unsure of what it may mean for the future of APA Corporation. The news could mean a major shift in the company’s fortunes, as they stand to gain a significant benefit from their oil exploration efforts. The company’s stock price could potentially rise significantly if the news proves to be true, providing a much-needed boost for the company’s finances.

Analysts are divided on the news, with some believing that the company will be able to capitalize on the newfound source of oil, while others are more cautious in their outlook. Regardless of which side is correct, it is clear that APA Corporation’s future is about to enter a new chapter. It is too early to tell what this news may mean for APA Corporation, but it is clear that it holds the potential to provide them with a much needed shot in the arm. Whether or not this move will prove to be a positive one for the company remains to be seen, but one thing is certain: APA Corporation’s fortunes could be transformed in an instant. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apa Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 10.9k | 3.61k | 28.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apa Corporation. More…

| Operations | Investing | Financing |

| 4.62k | -1.19k | -3.54k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apa Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.63k | 12.08k | 1.85 |

Key Ratios Snapshot

Some of the financial key ratios for Apa Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.5% | 78.8% | 54.2% |

| FCF Margin | ROE | ROA |

| 23.3% | 624.4% | 27.1% |

Analysis

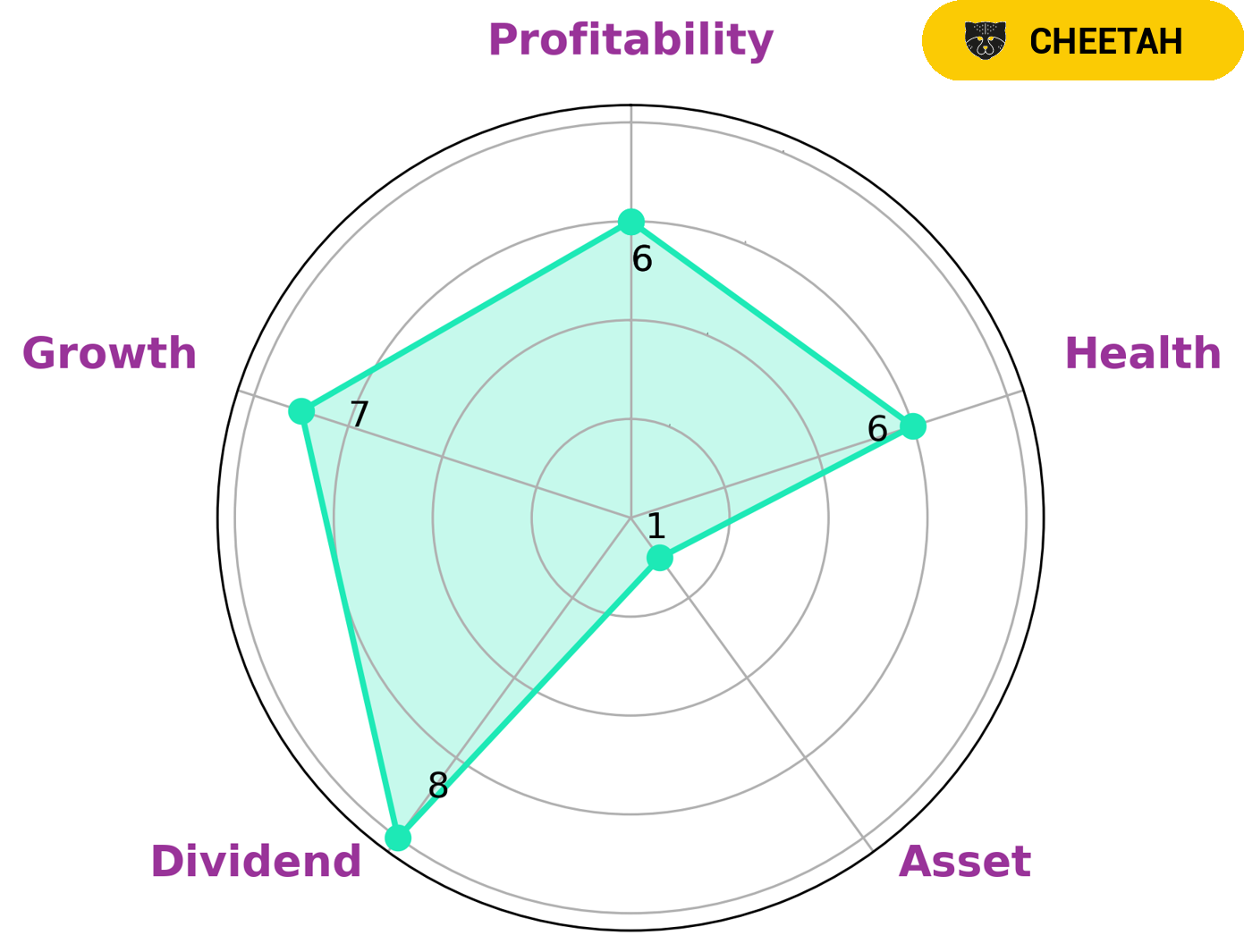

GoodWhale has conducted an analysis of APA CORPORATION‘s financials and Star Chart classifies it as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors that may be interested in such a company could include those who are willing to take on higher risks in exchange for higher rewards, such as venture capitalists. Additionally, value investors seeking to purchase a company at a low price with the potential to generate long-term returns may also be interested. In terms of its financial strength, APA CORPORATION is strong in dividend and growth, medium in profitability and weak in asset. With an intermediate health score of 6/10 with regard to its cashflows and debt, the company may be able to pay off debt and fund future operations. The company’s financial stability and potential for future growth make it attractive to investors who are willing to take a risk on a potentially volatile stock. The financial analysis of APA CORPORATION makes it a potentially interesting investment for certain types of investors. Those with an appetite for risk may seek to capitalize on the company’s potential for future growth, while value investors might seek to purchase the company at a lower price point and benefit from its sustainable future. Ultimately, investors will need to assess the company’s risk profile and evaluate whether it meets their individual needs. More…

Peers

The company has operations in the United States, Canada, and Australia. Pioneer Natural Resources Co, Continental Resources Inc, Hess Corp are some of APA Corp’s main competitors in the oil and gas industry.

– Pioneer Natural Resources Co ($NYSE:PXD)

Pioneer Natural Resources Co is an American oil and gas exploration and production company with operations in the United States, Canada, and Trinidad and Tobago. The company has a market capitalization of $59.39 billion and a return on equity of 24.61%. Pioneer Natural Resources is engaged in the exploration, development, and production of oil and gas properties. The company was founded in 1997 and is headquartered in Irving, Texas.

– Continental Resources Inc ($NYSE:CLR)

Continental Resources Inc is an American petroleum and natural gas exploration and production company with operations in the Bakken formation of North Dakota, Montana, and southern Saskatchewan. The company has a market cap of 26.94B as of 2022 and a Return on Equity of 32.98%. Continental Resources is one of the largest crude oil producers in the United States and is one of the leading operators in the Bakken formation.

– Hess Corp ($NYSE:HES)

Hess Corporation is an American multinational oil and gas company with operations in the United States, Canada, the North Sea, South America, and Africa. The company is headquartered in New York City and has been in operation since 1933. Hess is one of the largest independent oil and gas companies in the world with a market capitalization of $44.39 billion as of 2022. The company’s return on equity is 31.73%.

Hess Corporation is engaged in the exploration, production, purchase, transportation, and sale of crude oil and natural gas. The company also refines, markets, and supplies petroleum products. Hess operates through two segments: Upstream and Downstream. The Upstream segment explores for, develops, produces, transports, and sells crude oil and natural gas. The Downstream segment refines crude oil into finished petroleum products; markets and supplies refined products; and engages in trading operations.

Summary

APA Corporation has recently announced a major success in its exploration efforts in Suriname waters. Reports suggest that the company has struck oil, which could represent a significant source of income going forward. For investors, this news is a positive indication that management has a sensible strategy in place and that the company is well positioned to benefit from future market opportunities. However, the long-term impact of this news on the company’s profitability and stock price is yet to be seen, and investors should conduct their own research before making any decisions.

Recent Posts