Antero Resources Corporation Sees High Volume Trading and High Returns Potential with Beta of 3.53.

February 11, 2023

Trending News 🌥️

Antero Resources ($NYSE:AR) Corporation (AR) has been the subject of much speculation due to its high trading volume and potential for high returns. In the most recent trading session, it saw an impressive 6.9 million shares exchanged, signaling that investors and traders are betting on the company’s potential.

Additionally, its beta of 3.53 suggests that there could be a high return potential for those willing to take a risk. Antero Resources Corporation is an independent oil and gas company headquartered in Denver, Colorado, with operations in the Appalachian Basin and Rocky Mountains. The company’s management team has a long history of success in the energy sector, including expertise in engineering and geology. As a result, Antero has consistently generated strong returns for its shareholders, even during periods of declining prices. With its high trading volume, potential for high returns, and experienced management team, Antero Resources Corporation could be a great opportunity for investors who are willing to take a risk. For those looking for long-term investments, Antero could provide a steady stream of returns over time.

Price History

On Thursday, ANTERO RESOURCES stock opened at $26.8 and closed at the same price, up by 0.8% from its prior closing price of 26.6. This has been a positive sign for the company’s investors and shareholders. The high Beta value of 3.53 indicates that the stock of ANTERO RESOURCES is more volatile than the market and its movements are more sensitive to the changes in the overall market. This high Beta value also implies that the stock can have a higher return than the market, which provides investors and shareholders with an opportunity to make higher returns on their investments. The high volume trading also suggests that ANTERO RESOURCES is gaining traction in the market and is being noticed by investors across the globe.

With the stock opening and closing at the same price, this indicates a steady growth which is likely to continue in the coming days. Overall, ANTERO RESOURCES has seen positive results lately and investors are getting interested in the stock. With a high Beta value and potential for high returns, ANTERO RESOURCES seems to be a promising option for investors looking to diversify their portfolios into stocks with higher returns potentials. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Antero Resources. More…

| Total Revenues | Net Income | Net Margin |

| 8.4k | 2.07k | 40.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Antero Resources. More…

| Operations | Investing | Financing |

| 3.05k | -923.69 | -2.13k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Antero Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.41k | 7.94k | 20.49 |

Key Ratios Snapshot

Some of the financial key ratios for Antero Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.3% | 181.9% | 34.6% |

| FCF Margin | ROE | ROA |

| 34.1% | 29.7% | 12.6% |

Analysis

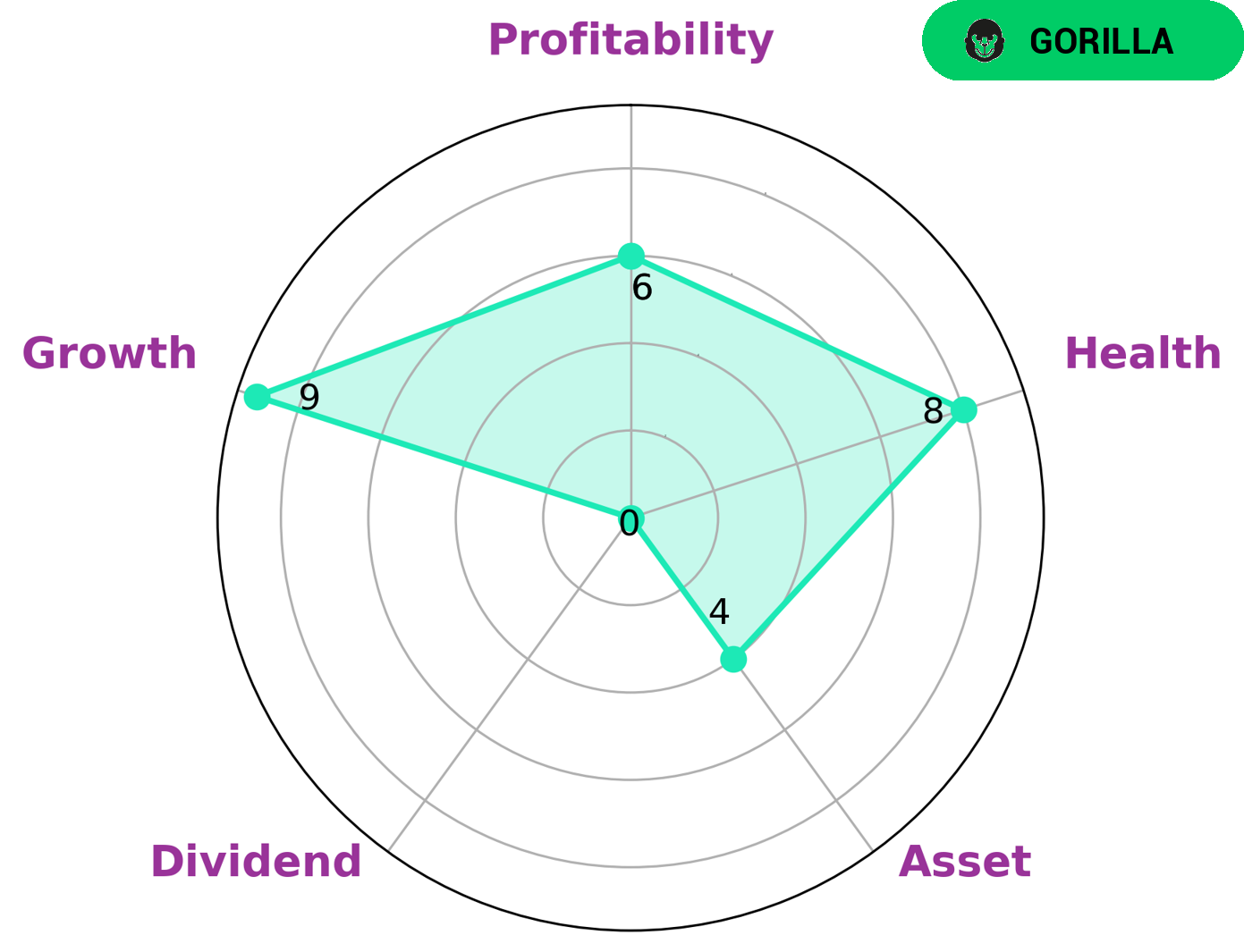

GoodWhale has conducted an analysis of ANTERO RESOURCES‘s financials, finding that based on the Star Chart it is strong in growth, medium in asset, profitability and weak in dividend. This is further evidenced by its high health score of 8/10, indicating that it is well-positioned to sustain future operations in times of crisis. ANTERO RESOURCES has also been classified as a ‘gorilla’, referring to a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes ANTERO RESOURCES an attractive asset for a range of investors including value investors, growth investors, dividend investors and those looking for a combination of the above. Value investors may be interested in the strong financials and ability to sustain operations during difficult times, while growth investors may appreciate the potential for high returns due to the impressive growth rate. Meanwhile, dividend investors may appreciate the potential for returns from the distribution of profits into dividends. Finally, those looking for a combination of the above may find ANTERO RESOURCES to be an attractive asset. Overall, ANTERO RESOURCES’s impressive financials and competitive advantage make it attractive for all types of investors. Its strong growth rate and ability to sustain operations in times of crisis are particularly appealing to those who are looking for a long-term investment. More…

Peers

The company explores, develops, and produces natural gas and oil properties in the Appalachian Basin. As of December 31, 2015, Antero Resources had 2,009.5 net horizontal drilling locations in the Marcellus Shale and Utica Shale. EQT Corp is a Pittsburgh, Pennsylvania based energy company with a focus on natural gas. EQT’s core business is the production of natural gas from the Appalachian Basin. As of December 31, 2015, EQT Corporation had approximately 2.0 million net acres under lease in the Appalachian Basin. Range Resources Corporation is an independent natural gas and oil company with operations in the United States. The company is headquartered in Fort Worth, Texas. As of December 31, 2015, Range Resources had 7.4 trillion cubic feet of estimated proved natural gas reserves. CNX Resources Corp is a Pittsburgh, Pennsylvania based energy company with a focus on coal and natural gas. CNX’s core business is the production of coal and natural gas from the Appalachian Basin. As of December 31, 2015, CNX Resources had approximately 1.8 million net acres under lease in the Appalachian Basin.

– EQT Corp ($NYSE:EQT)

EQT Corp is a publicly traded company with a market capitalization of $14.96 billion as of 2022. The company has a return on equity of 18.8%. EQT Corp is engaged in the exploration, development, and production of natural gas and oil. The company has operations in the United States, Canada, and Australia.

– Range Resources Corp ($NYSE:RRC)

Range Resources Corp is an American oil and gas company with a market cap of 6.82B as of 2022. The company has a Return on Equity of 45.59%. Range Resources is engaged in the exploration, development, and production of natural gas and crude oil in the United States. The company was founded in 1987 and is headquartered in Fort Worth, Texas.

– CNX Resources Corp ($NYSE:CNX)

CNX Resources Corp is a publicly traded company with a market capitalization of over $3 billion as of early 2021. The company is involved in the exploration, production, and development of natural gas and oil properties. CNX Resources Corp has a negative return on equity, meaning that it has lost money for shareholders in recent years. Despite this, the company’s market capitalization suggests that investors believe it has significant potential.

Summary

Antero Resources Corporation is an attractive investment opportunity for those seeking high returns. Antero has seen high volume trading in recent months as investors have become increasingly interested in its stock. Analysts have noted that Antero’s financials appear to be solid and its balance sheet is strong.

Additionally, the company has a large portfolio of natural gas and oil assets and access to some of the most productive areas of the Marcellus and Utica Shale plays. Antero has been aggressive with its hedging strategy, which has mitigated some of the risks associated with investing in the energy sector. All these factors make Antero an attractive investment option.

Recent Posts