UWM Holdings Co. Receives “Reduce” Rating from Analysts Despite Average “Hold” Recommendation.

May 25, 2023

Trending News 🌥️

UWM ($NYSE:UWMC) Holdings Co. is a leading financial services company that specializes in offering financial services to individuals and businesses. Recently, the company has received a “Reduce” rating from analysts despite an average “Hold” recommendation. This rating has come as a surprise to many, as the company had recently posted impressive earnings results and had been making strong progress in its efforts to diversify its offerings.

However, they have given the company a consensus rating of “Reduce.” This rating has been based on their assessment of the company’s current financial position, as well as its future prospects.

Additionally, analysts have noted that the company’s recent growth rate has not been as robust as expected, and that there are some concerns about the sustainability of the company’s profits over the longer term. In light of the analyst’s recommendation, investors should consider taking a cautious approach when it comes to investing in UWM Holdings Co. They should also keep an eye on the company’s financial performance and any changes in its strategic direction. While UWM Holdings Co. has shown immense potential for growth, investors should ensure that they do their own due diligence and understand the risks associated with investing in the company before making any investment decisions.

Price History

The stock opened at $5.0 and closed at $5.0, down by 1.2% from its prior closing price. This rating is likely to affect the stock price and investor sentiment. Investors should be aware of the negative impact this rating could have on the stock in the near future. Additionally, analysts and investors should monitor UWM HOLDINGS Co. closely as it could be a sign of a potential change in the market sentiment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Uwm Holdings. More…

| Total Revenues | Net Income | Net Margin |

| – | 7.84 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Uwm Holdings. More…

| Operations | Investing | Financing |

| -1.49k | 1.32k | 5.33 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Uwm Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.95k | 8.07k | – |

Key Ratios Snapshot

Some of the financial key ratios for Uwm Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.9% | – | – |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

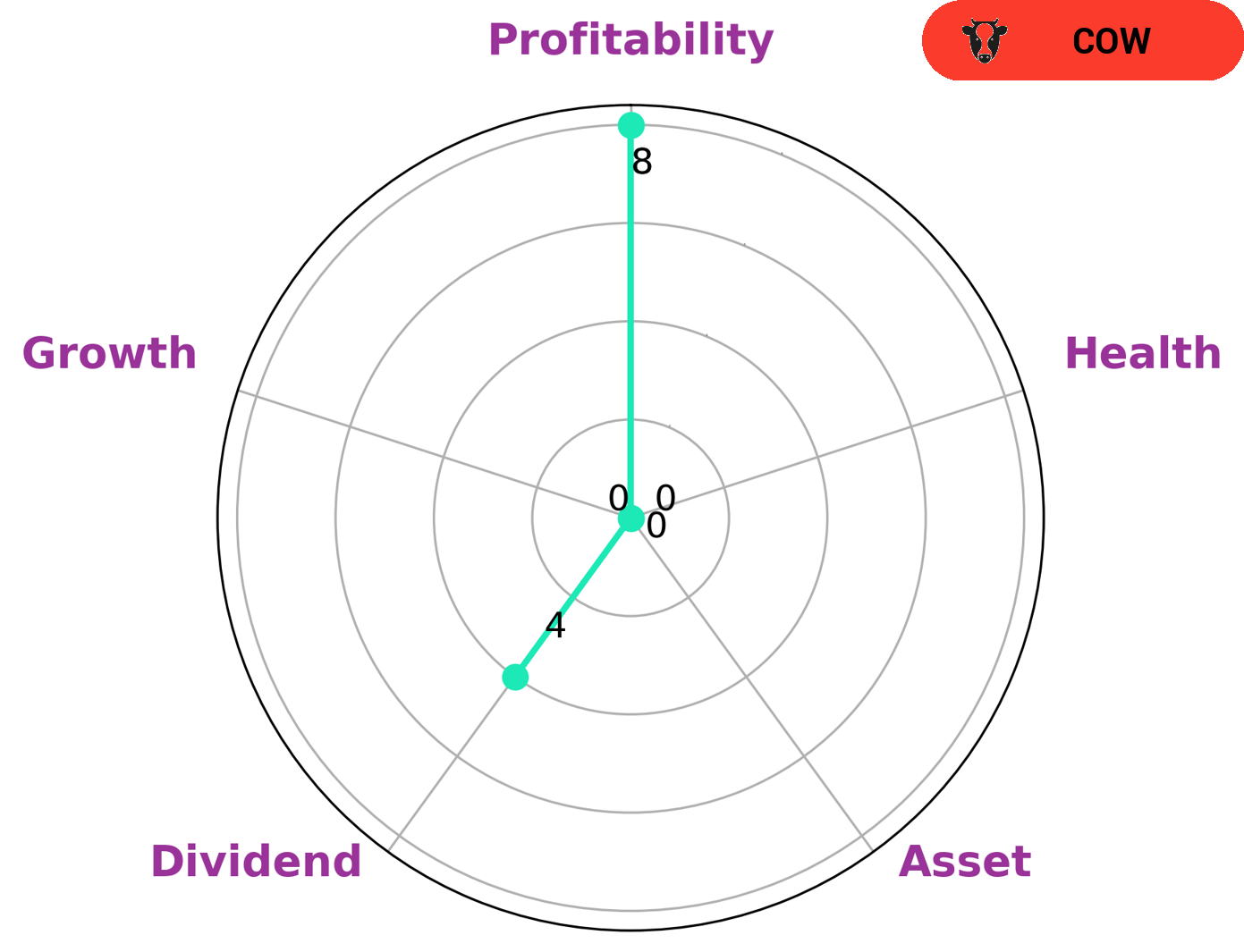

GoodWhale has conducted an analysis of UWM HOLDINGS‘s fundamentals and we have found that it has a low health score of 0/10 with regard to its cashflows and debt. This suggests that it may be less likely to sustain future operations in times of crisis. UWM HOLDINGS is strong in terms of profitability but medium in terms of dividend and weak in growth and asset. Based on this information, we classify UWM HOLDINGS as a ‘cow’, which refers to a company with a track record of paying out consistent and sustainable dividends. This type of company may be of particular interest to investors looking for steady passive income and lower risk investments. More…

Peers

Home Point Capital Inc, Franklin Credit Management Corp, and Ocwen Financial Corp are all competitors of UWM Holdings Corp.

– Home Point Capital Inc ($NASDAQ:HMPT)

Home Point Capital Inc. is a holding company, which engages in the provision of mortgage banking and servicing solutions. It operates through the following segments: Servicing, Lending, and Investment Management. The Servicing segment offers loan servicing solutions. The Lending segment provides correspondent lending, loan origination, and servicing advances. The Investment Management segment offers investment advisory and asset management services. The company was founded on April 2, 2018 and is headquartered in Ann Arbor, MI.

– Franklin Credit Management Corp ($OTCPK:FCRM)

Franklin Credit Management Corporation is a debt collection agency that was founded in 2002. The company is headquartered in New York City, and has offices in Florida, Georgia, and Illinois. Franklin Credit Management Corporation is publicly traded on the NASDAQ under the ticker symbol FCMC. As of 2022, the company has a market capitalization of 1M.

Franklin Credit Management Corporation specializes in collecting delinquent debt for credit card issuers, banks, and other creditors. The company employs a team of skilled collection agents who use a variety of methods to collect on delinquent accounts. In addition to traditional collection methods, Franklin Credit Management Corporation also uses skip tracing and litigation to collect on delinquent accounts.

– Ocwen Financial Corp ($NYSE:OCN)

Ocwen Financial Corporation is a financial services holding company which, through its subsidiaries, engages in the servicing and origination of mortgage loans. As of December 31, 2020, the Company had $573.8 billion of servicing assets, $24.4 billion of subservicing assets, and $17.1 billion of mortgage servicing rights owned. It offers its services to homeowners and mortgage investors through a national servicing platform servicing approximately 2.7 million loans with an aggregate unpaid principal balance of $474 billion. The Company operates through four segments: Servicing, Lending, Real Estate Owned Operations, and Investment Portfolio.

Summary

UWM Holdings Co. has recently been the subject of investing analysis by ten brokerages, who have given the stock an average recommendation of “Hold”. This consensus rating is a downgrade from their previous consensus of “Reduce”. Investors should consider the current market conditions and UWM Holdings Co.’s past performance when making a decision to invest in the company. UWM Holdings Co.’s stock price may be more volatile and investors should be aware of the risks associated with investing in the company.

Recent Posts