Warby Parker Beats Earnings and Revenue Expectations Despite GAAP EPS of -$0.09

May 10, 2023

Trending News 🌥️

Warby Parker ($NYSE:WRBY), a leading retail eyewear company, recently announced their second quarter earnings, beating analysts’ expectations. Despite a GAAP earnings per share (EPS) of -$0.09, Warby Parker’s performance was better than expected by $0.01.

Additionally, their revenue of $171.97M exceeded the predicted amount by $5.25M. Warby Parker is a pioneer in the online eyewear retail industry, known for its innovative approach to providing customers with stylish and affordable frames. Through Warby Parker’s Home Try-On program, customers can order five frames to try on at home before committing to a purchase. The company is also committed to social consciousness, donating a pair of glasses for every pair sold.

Earnings

WARBY PARKER‘s earnings report of FY2022 Q4 ending December 31 2022, showed that the company had a total revenue of 146.49M USD and a net income loss of 20.25M USD. Despite the GAAP EPS of -$0.09, WARBY PARKER still managed to beat both earnings and revenue expectations. This indicates solid progress in their financial performance and profitability, despite challenging economic conditions.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Warby Parker. More…

| Total Revenues | Net Income | Net Margin |

| 598.11 | -110.39 | -18.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Warby Parker. More…

| Operations | Investing | Financing |

| 10.37 | -60.18 | 3.29 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Warby Parker. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 568.71 | 282.06 | 2.49 |

Key Ratios Snapshot

Some of the financial key ratios for Warby Parker are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.3% | – | -18.6% |

| FCF Margin | ROE | ROA |

| -8.3% | -24.4% | -12.2% |

Market Price

Shares in the company opened at $12.2 and closed at $12.1, representing a slight increase of 0.3% from its last closing price of $12.1. Despite the loss on paper, investors have responded positively to the result of being able to exceed revenue and earnings expectations. Live Quote…

Analysis

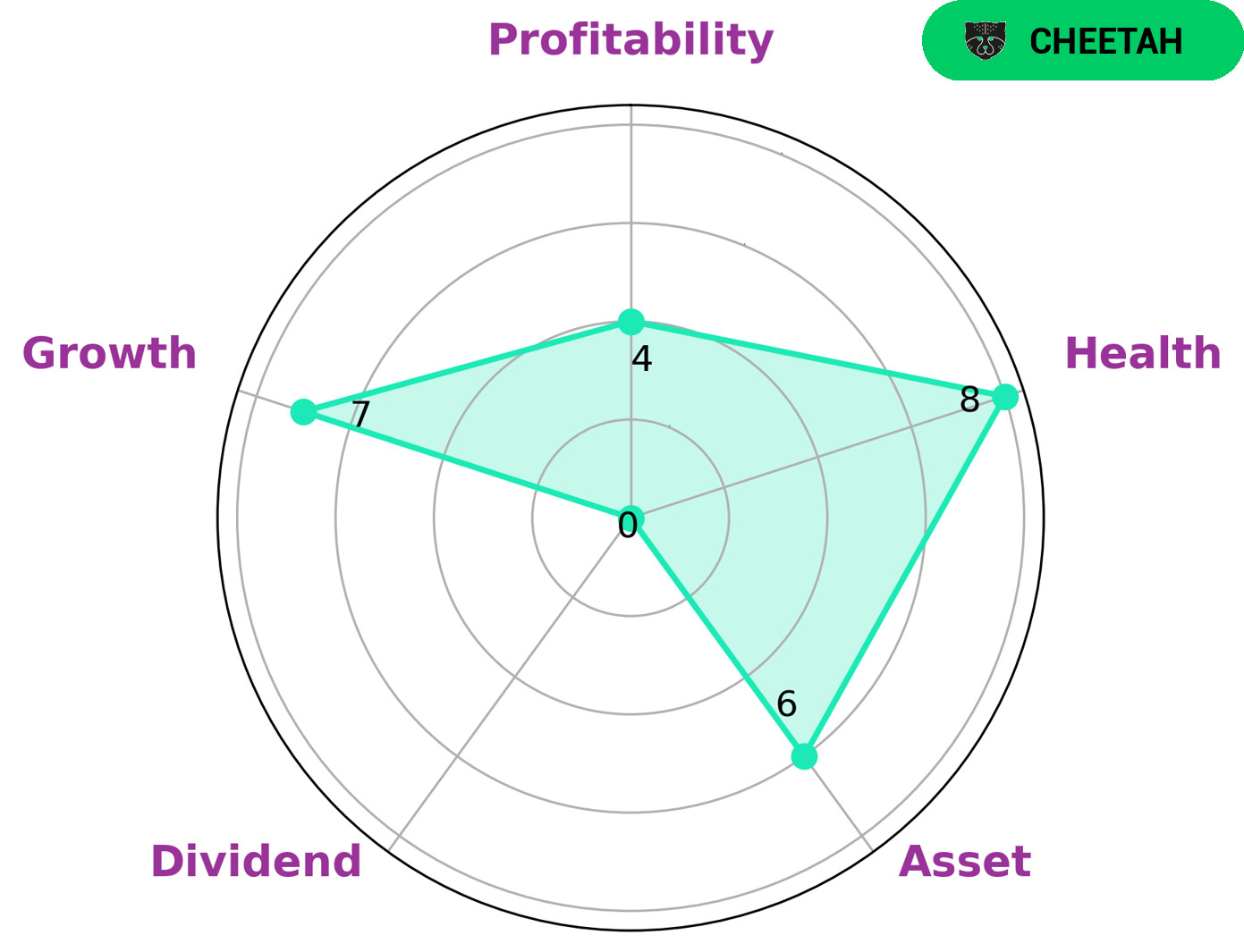

As part of our analysis of WARBY PARKER’s financials, we at GoodWhale recently completed a Star Chart review and found that the company scored an 8/10 in terms of its overall health. We were impressed by the company’s ability to pay off debt and fund future operations. Based on the Star Chart, we classified WARBY PARKER as a “cheetah” type of company. A cheetah company is one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this classification, potential investors in WARBY PARKER should be aware of the associated risks. While it is strong in terms of growth, it is only medium-level in terms of assets, profitability and dividend. More…

Peers

In the world of ophthalmology, there are many companies that compete for market share. Warby Parker Inc is one such company. Founded in 2010, Warby Parker is an online retailer that sells prescription eyeglasses and sunglasses. The company has been successful in taking market share from its competitors, due in part to its focus on providing high-quality products at a lower price point than its competitors. Xvivo Perfusion AB, Kangji Medical Holdings Ltd, and Formosa Optical Technology Co Ltd are all companies that compete with Warby Parker in the ophthalmology space. Each company has its own strengths and weaknesses, and each is vying for a share of the market. Warby Parker has been successful in taking market share from its competitors, and it looks poised to continue to do so in the future.

– Xvivo Perfusion AB ($LTS:0RKL)

Xvivo Perfusion AB is a Sweden-based company engaged in the development and commercialization of perfusion systems for use in organ transplants. The Company’s products include the Xvivo Perfusion System, a portable, self-contained perfusion system that provides oxygenated and nutrients to organs during transport; the Xvivo Perfusion System XPS, a compact, disposable pump designed for single use; and the Xvivo Perfusion System XPS2, a compact, disposable pump with two channels for dual use. In addition, the Company offers the Xvivo Perfusion System XPS3, a compact, disposable pump with three channels for triple use.

– Kangji Medical Holdings Ltd ($SEHK:09997)

Kangji Medical Holdings Ltd is a medical device company that develops, manufactures, and markets minimally invasive products used in various surgical procedures. The company has a market cap of 7.94B as of 2022 and a return on equity of 9.42%. Kangji’s products are used in a variety of surgical procedures, including laparoscopic, thoracic, and urological surgery. The company’s products are sold in over 30 countries worldwide.

– Formosa Optical Technology Co Ltd ($TPEX:5312)

Formosa Optical Technology Co Ltd is a leading manufacturer of optical fiber and fiber-optic cable products. The company has a market cap of 3.46B as of 2022 and a return on equity of 7.45%. Formosa Optical Technology Co Ltd is a publicly traded company listed on the Taiwan Stock Exchange.

Summary

WARBY PARKER has released its quarterly report and the results have been favorable. The company’s GAAP EPS of -$0.09 beat expectations by $0.01 and revenue of $171.97M beat by $5.25M. Analysts have suggested that this indicates a positive trend for the company, with improving financials and strong performance in the marketplace.

It is believed that WARBY PARKER is well-positioned for continued growth, with the potential for further increases in revenue and profitability in the near future. Investors should therefore pay close attention to the company’s progress and take advantage of potential opportunities as they arise.

Recent Posts