Texas Teacher Retirement System Trims Holdings in Envista Holdings Co. by 13.0% in Fourth Quarter

June 8, 2023

🌥️Trending News

TRS is one of the largest and oldest public pension funds in the United States, and its divestment from Envista Holdings ($NYSE:NVST) Co. marked a significant shift in the company’s portfolio. Envista Holdings Co. is a medical device company that develops and manufactures innovative products used for minimally-invasive procedures in orthopedic, spine, and pain management specialties. With a focus on improving patient safety and outcomes, Envista Holdings Co. companies have come to be trusted by professional healthcare providers all over the world.

The company is based in Austin, Texas and is listed on the New York Stock Exchange (NYSE: NVST). Despite the recent divestment by TRS, the company remains a strong and reliable investment option with its innovative products and industry expertise.

Analysis

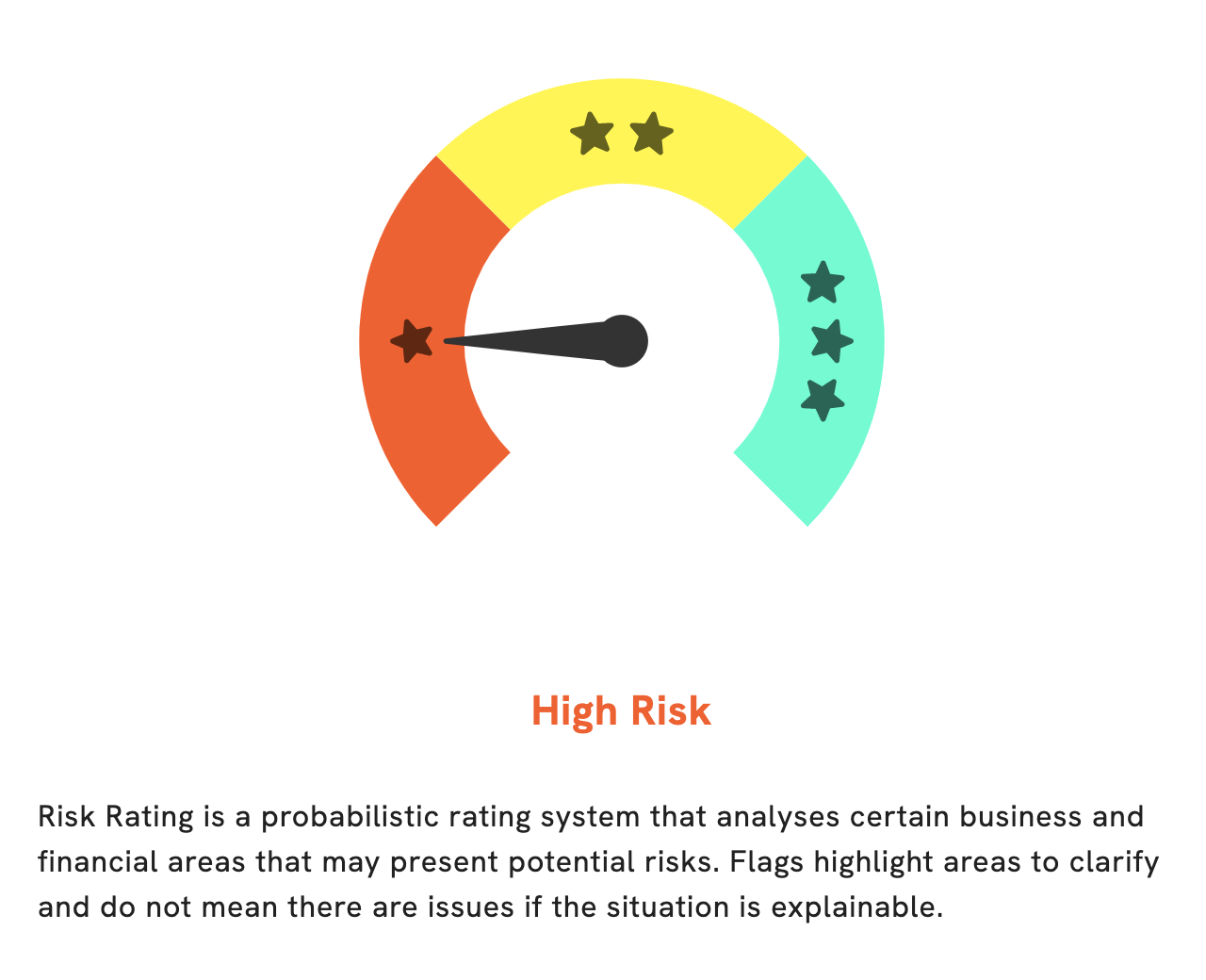

At GoodWhale, we’ve analyzed ENVISTA HOLDINGS‘s financials in detail. Our Risk Rating of ENVISTA HOLDINGS reveals it to be a high risk investment in terms of financial and business aspects. To assess the risk further, we have detected three risk warnings after analyzing the income sheet, balance sheet, and cashflow statement. If you want to know more about this, register with us and we’ll provide the information. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Envista Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.56k | 212 | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Envista Holdings. More…

| Operations | Investing | Financing |

| 182.3 | -684.4 | 5.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Envista Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.58k | 2.3k | 26.14 |

Key Ratios Snapshot

Some of the financial key ratios for Envista Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.9% | 13.0% | 11.8% |

| FCF Margin | ROE | ROA |

| 4.2% | 4.5% | 2.9% |

Peers

Its main competitors are Medikit Co Ltd, Nihon Kohden Corp, and Fukuda Denshi Co Ltd. Envista has a strong market presence in the US, Europe, and Asia Pacific.

– Medikit Co Ltd ($TSE:7749)

As of 2022, Medikit Co Ltd has a market cap of 41.17B and a Return on Equity of 6.14%. The company produces and sells medical equipment and supplies. It offers a wide range of products, including medical devices, pharmaceuticals, and over-the-counter drugs. Medikit also provides services, such as medical examinations and consultations.

– Nihon Kohden Corp ($TSE:6849)

Nihon Kohden is a Japanese manufacturer of medical equipment, with a particular focus on patient monitoring systems. The company has a market cap of 278.79B as of 2022 and a return on equity of 13.19%. Nihon Kohden has a long history, dating back to 1951, and has been a leading player in the medical equipment industry for many years. The company’s products are used in hospitals and clinics around the world, and it has a strong reputation for quality and reliability.

– Fukuda Denshi Co Ltd ($TSE:6960)

Fukuda Denshi Co Ltd is a Japanese company that manufactures and sells medical equipment. The company has a market cap of 138.83B as of 2022 and a Return on Equity of 9.95%. Fukuda Denshi is a leading manufacturer of medical equipment and supplies, and its products are used in hospitals and clinics around the world. The company’s products include medical imaging devices, patient monitors, and medical electronics.

Summary

Envista Holdings Co. is a company that has seen investors take notice recently. This suggests the fund managers believed there were better opportunities elsewhere. Investors should do their own research to determine if Envista is a good investment option for them, taking into account the company’s fundamentals, corporate data, and overall performance in the market. In addition, investors should consider the effects of macroeconomic factors and geopolitical events that may affect the stock price.

Recent Posts