Repligen Corporation Welcomes Martin D. Madaus to its Board of Directors.

February 14, 2023

Trending News ☀️

Repligen Corporation ($NASDAQ:RGEN) is pleased to welcome Martin D. Madaus to its Board of Directors. Mr. Madaus brings with him a wealth of experience and knowledge, making him a valuable addition to the Board of Directors. Repligen Corporation is a bioprocessing company that focuses on growing and purifying proteins and other biologicals for use in medical applications. The company offers a comprehensive suite of products, services, and technologies that are used in the development, manufacture, and supply of biopharmaceuticals. Repligen’s core capabilities include protein production, cell culture media, and other bioprocessing components that are essential to the development and manufacture of biotherapeutic drugs. With a strong focus on innovation and customer service, Repligen has established itself as a leader in the biopharmaceutical industry.

The company holds several patents and continually invests in research and development to produce the most advanced biotherapies. Repligen’s products are used by some of the largest biopharmaceutical companies worldwide. Mr. Madaus’s extensive knowledge of the biopharmaceutical industry and his leadership experience will be invaluable to Repligen’s growth and success. With his depth of expertise and leadership skills, he will be an integral part of Repligen’s continued success.

Market Price

Currently, news coverage of this appointment has been mostly positive. Repligen Corporation focuses on developing and commercializing high-value products used in the biopharmaceutical manufacturing process. On Thursday, REPLIGEN CORPORATION stock opened at $192.4 and closed at $186.1, down by 2.8% from its previous closing price of 191.4. Mr. Madaus, who is currently a managing partner at Life Science Ventures, LLC, is a veteran of the healthcare technology and biotech industries, having held executive positions at Genzyme, Novartis, and Baxter International. He also brings extensive experience in business development and corporate strategy to the table.

The Repligen Corporation Board of Directors believes that Mr. Madaus will be a great asset to the company, and that his expertise will help to maximize shareholder value and accelerate the rate of innovation. Furthermore, his extensive connections in the biopharmaceutical industry should be a great benefit in helping the company expand into new markets. The Board of Directors is excited to welcome Mr. Madaus aboard, and they are confident that his contributions will help to further strengthen Repligen Corporation’s position within the healthcare and biopharmaceutical industries. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Repligen Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 801.29 | 166.34 | 19.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Repligen Corporation. More…

| Operations | Investing | Financing |

| 159.82 | -174.2 | -12.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Repligen Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.46k | 627.42 | 33.05 |

Key Ratios Snapshot

Some of the financial key ratios for Repligen Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 46.9% | 76.0% | 24.8% |

| FCF Margin | ROE | ROA |

| 1.8% | 7.1% | 5.2% |

Analysis

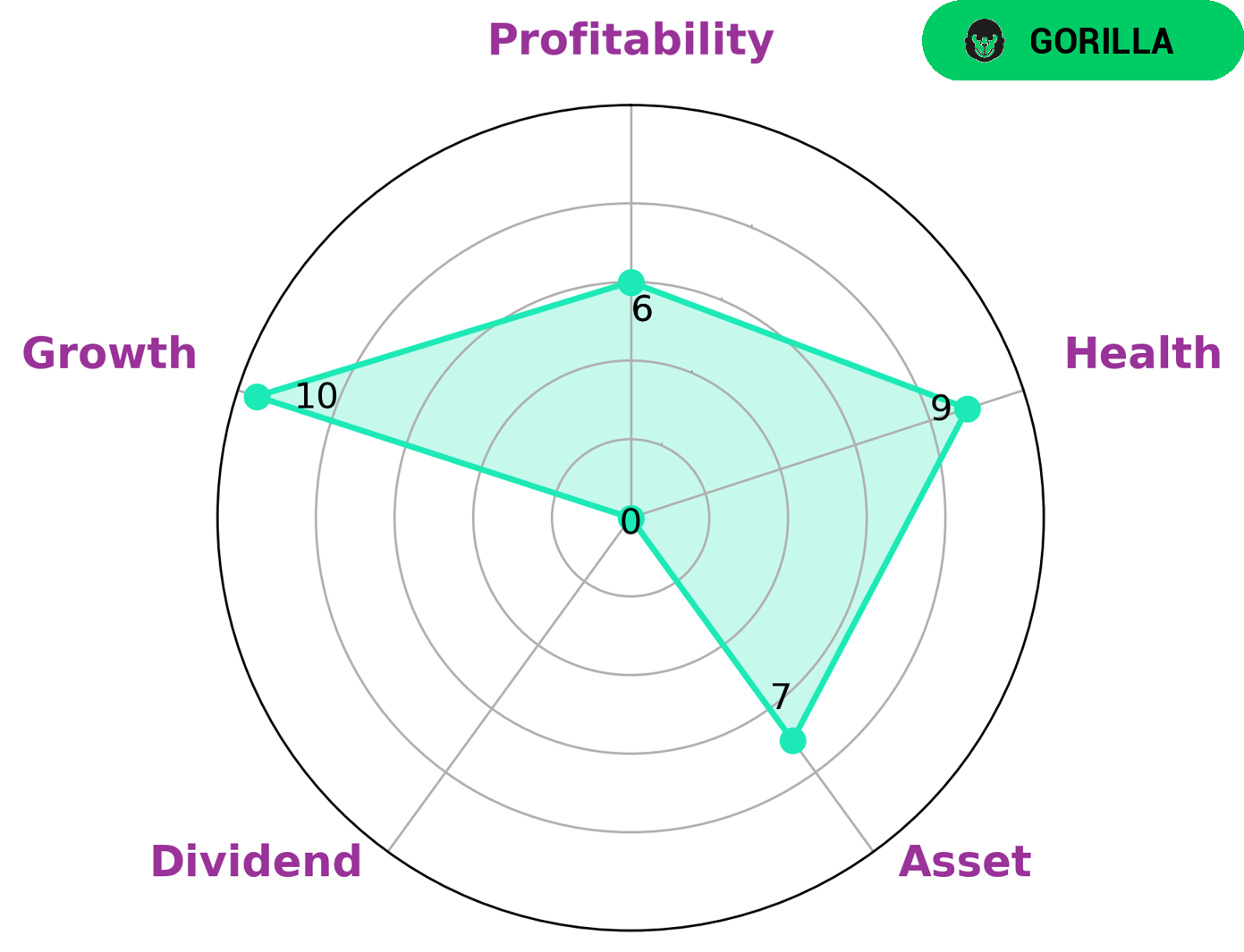

REPLIGEN CORPORATION is a company that has been assessed by GoodWhale for its financials. The Star Chart shows that REPLIGEN CORPORATION is strong in asset and growth, medium in profitability and weak in dividend. The company has a high health score of 9/10 as it is capable to safely ride out any crisis without the risk of bankruptcy. It is classified as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors may be interested in such companies as they often provide long-term returns. These companies show resilience during market downturns and offer diversification benefits. The companies are well-positioned to benefit from positive industry trends, and have the potential to become larger and more profitable. Furthermore, these companies are more likely to have sustainable business models, generating stable cashflows over the long-term. Investors looking for potential investments should also consider other factors such as the management team, product or service quality, customer base and market positioning. Thorough research should be done to ensure that the company can survive any economic downturns and competition. Only then should the investor decide if investing in such companies are suitable for their portfolio. More…

Peers

The company’s products include proteins and antibodies for the treatment of cancer, central nervous system disorders, and infectious diseases. ReGen Biologics Inc, Tecan Group AG, Stevanato Group SPA are all competitors in the market for developing and commercializing therapeutics.

– ReGen Biologics Inc ($OTCPK:RGBOQ)

Regen Biologics, Inc. is a biotechnology company, which focuses on the development, commercialization, and marketing of products in the orthopedic regenerative medicine field. The company’s products include collagen-based scaffolds for use in orthopedic and sports medicine indications. It operates in the United States, Europe, and Asia. The company was founded by David A. Jay and Stephen J. Sacks in 1997 and is headquartered in Laguna Niguel, CA.

– Tecan Group AG ($OTCPK:TCHBF)

Tecan Group AG is a Swiss-based manufacturer of laboratory instruments and solutions for the life sciences sector. The company has a market cap of 4.54B as of December 2020 and a Return on Equity of 6.13%. Tecan Group AG’s products are used in academic and commercial research laboratories, as well as in clinical diagnostic laboratories. The company’s instruments are used for a variety of applications, including drug discovery and development, biopharmaceutical production, food safety testing, and environmental monitoring.

– Stevanato Group SPA ($NYSE:STVN)

Stevanato Group is a leading provider of integrated solutions for the pharmaceutical and biotech industry. The Group offers a complete range of services, from design and development to manufacturing and packaging of finished products. The Group’s products are used in a wide range of therapeutic areas, including cancer, immunology, infectious diseases and neurology.

Summary

Repligen Corporation is an innovative biopharmaceutical company that has recently welcomed Martin D. Madaus to its Board of Directors. Investors are showing positive sentiment towards the company, believing that Madaus’ significant experience in the industry will bring long-term value to Repligen. The company is currently producing a range of products, from antibodies to proteins, peptides, and other drugs.

Investors are encouraged by the company’s strong financial performance and its promising pipeline of products. Repligen’s current financial position and outlook for the future suggest significant potential for growth, making it an attractive investment opportunity.

Recent Posts