NVST Leverages Comprehensive Product Portfolio and Global Reach to Tap Into $27 Billion Global Dental Industry Market.

February 1, 2023

Trending News ☀️

Envista Holdings ($NYSE:NVST) is a leading global medical technology company that is focused on the dental industry. The company is committed to delivering innovative and clinically effective products and services to global dental care providers. Their comprehensive product portfolio includes imaging systems, consumables, general and specialty equipment, instrumentation, and software. Envista leverages its extensive product offering and global reach to tap into the $27 billion global dental industry market. The company’s products are designed to enhance the efficiency and accuracy of dental procedures, while also improving patient safety and comfort. Furthermore, they are continuously developing new products and services that strengthen their competitive position in the market. Envista has a strong presence in the U.S., Europe, Asia, Latin America, and the Middle East, allowing them to meet the demands of dental care providers around the world. Envista is well-positioned to benefit from the growth of the global dental industry. The industry is projected to grow at a mid-single digit CAGR over the next five years, driven by factors such as increasing demand for cosmetic dentistry, aging populations, and technological advancements in dental care. For these reasons, I recommend going long on Envista Holdings. The company has a wide range of products and a strong presence in the global market, allowing them to meet the demands of dental care providers around the world.

Additionally, their products are designed to enhance the efficiency and accuracy of dental procedures, while also improving patient safety and comfort. These strengths position Envista to take advantage of the growth potential of the global dental industry and capitalize on the estimated $27 billion market opportunity.

Stock Price

So far, news sentiment for the company has been mostly positive. On Tuesday, ENVISTA HOLDINGS stock opened at $38.2 and closed at $39.0, up by 2.7% from the prior closing price of 38.0. The company is committed to providing innovative solutions for dental professionals and their patients. ENVISTA HOLDINGS’ portfolio includes a wide range of products, such as digital imaging systems and software, dental drills and handpieces, dental implants and prosthetics, and laboratory and laboratory equipment. With its comprehensive portfolio, the company is well-positioned to meet the needs of a variety of customers in the dental industry.

This gives ENVISTA HOLDINGS the ability to offer customers innovative products and services on a global scale. Furthermore, the company has established relationships with major dental associations and insurance providers around the world, which will help to increase its customer base. The positive news sentiment surrounding the company and its stock performance on Tuesday further demonstrate the potential of ENVISTA HOLDINGS to capitalize on the market opportunity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Envista Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.56k | 255.4 | 8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Envista Holdings. More…

| Operations | Investing | Financing |

| 208.4 | -367.6 | 82.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Envista Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.41k | 2.45k | 24.28 |

Key Ratios Snapshot

Some of the financial key ratios for Envista Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.8% | 1.3% | 10.9% |

| FCF Margin | ROE | ROA |

| 5.5% | 4.4% | 2.7% |

VI Analysis

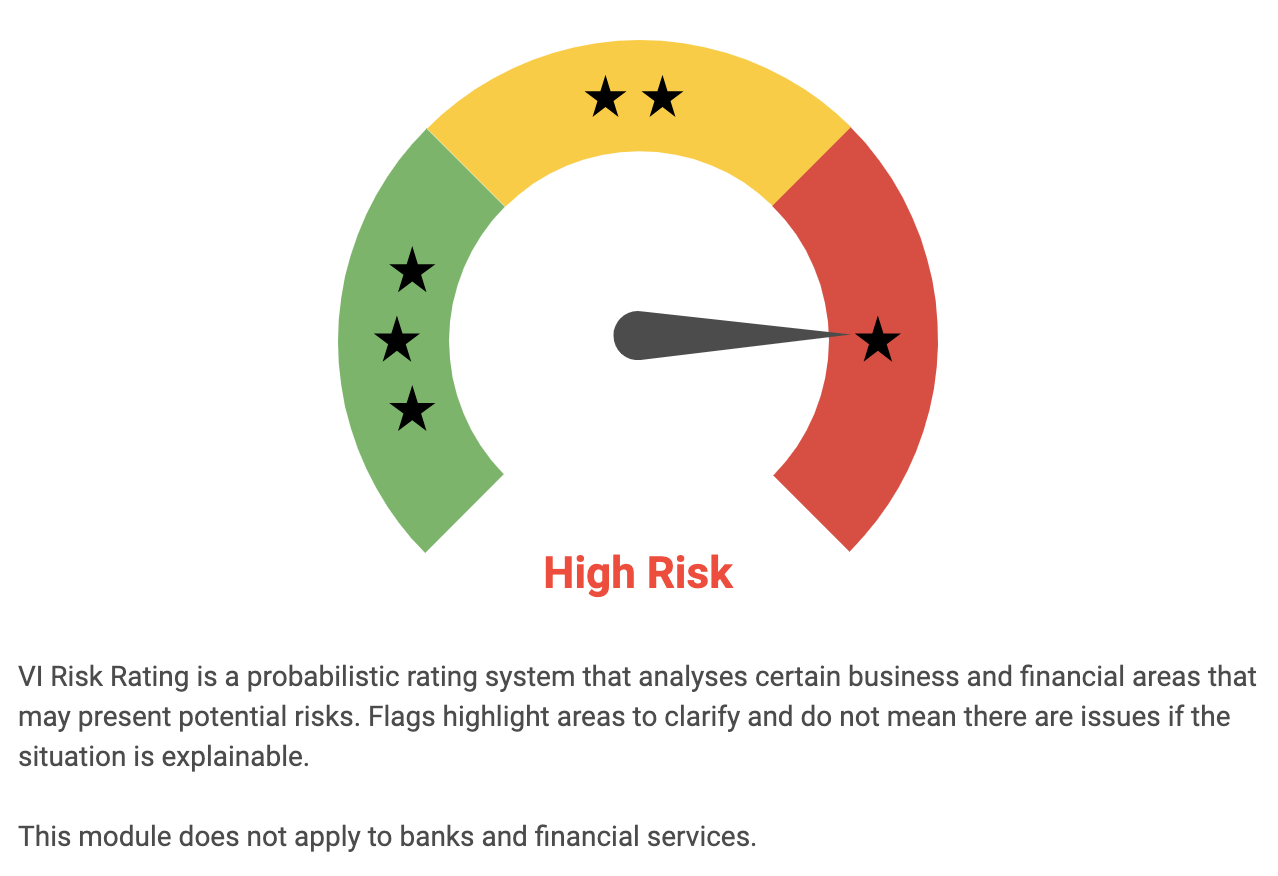

The VI app is a valuable tool for analyzing the fundamentals of ENVISTA HOLDINGS, which can help investors understand the long-term potential of the company. According to VI Risk Rating, ENVISTA HOLDINGS is rated as a high risk investment, with its financial and business aspects both being rated as high risk. The app has detected two risk warnings in the balance sheet and cashflow statement. These warnings may provide potential investors with important insights into the company’s financial performance and stability. By becoming a registered user on the app, users can access detailed information on the company’s financials and risks associated with it. The app also provides users with access to a variety of other features, such as a comprehensive view of the company’s stock performance and news updates.

Furthermore, users can access detailed analyses of the company’s past financial performance and compare it to other companies in the same industry. This provides investors with an in-depth understanding of ENVISTA HOLDINGS’ financial situation, allowing them to make informed investment decisions. In conclusion, the VI app is an essential tool for those considering investing in ENVISTA HOLDINGS. It provides users with an in-depth look at the company’s fundamentals, enabling them to make informed decisions about their investments.

Peers

Its main competitors are Medikit Co Ltd, Nihon Kohden Corp, and Fukuda Denshi Co Ltd. Envista has a strong market presence in the US, Europe, and Asia Pacific.

– Medikit Co Ltd ($TSE:7749)

As of 2022, Medikit Co Ltd has a market cap of 41.17B and a Return on Equity of 6.14%. The company produces and sells medical equipment and supplies. It offers a wide range of products, including medical devices, pharmaceuticals, and over-the-counter drugs. Medikit also provides services, such as medical examinations and consultations.

– Nihon Kohden Corp ($TSE:6849)

Nihon Kohden is a Japanese manufacturer of medical equipment, with a particular focus on patient monitoring systems. The company has a market cap of 278.79B as of 2022 and a return on equity of 13.19%. Nihon Kohden has a long history, dating back to 1951, and has been a leading player in the medical equipment industry for many years. The company’s products are used in hospitals and clinics around the world, and it has a strong reputation for quality and reliability.

– Fukuda Denshi Co Ltd ($TSE:6960)

Fukuda Denshi Co Ltd is a Japanese company that manufactures and sells medical equipment. The company has a market cap of 138.83B as of 2022 and a Return on Equity of 9.95%. Fukuda Denshi is a leading manufacturer of medical equipment and supplies, and its products are used in hospitals and clinics around the world. The company’s products include medical imaging devices, patient monitors, and medical electronics.

Summary

Envista Holdings Corporation is a global leader in dental and oral health solutions, providing products, services, and technologies to dentists, hygienists, and other dental professionals. Through its comprehensive product portfolio and global reach, the company has positioned itself to capitalize on the $27 billion global dental industry market. Investors are optimistic about the company’s growth potential, as evidenced by its strong financial performance and share price appreciation. Envista has a robust balance sheet, and has used its financial resources to invest in strategic acquisitions and partnerships.

In addition, the company has emphasized development of innovative products and services to increase its competitive advantage. With a diversified business model and strong market position, Envista is well-positioned for continued growth in the years ahead.

Recent Posts