Federal Circuit Upholds Validation of Teleflex Incorporated Guide Catheter Patents in Medtronic Appeal

June 12, 2023

🌥️Trending News

Teleflex Incorporated ($NYSE:TFX) is a global provider of medical technology products and services with a focus on providing innovative solutions that improve the health and quality of life of patients. The company is dedicated to enhancing patient care through the development, manufacture, and marketing of a wide variety of medical products and services. Recently, the Federal Circuit upheld Teleflex Innovations’ patents for guide catheters, medical devices used in cardiology, after Medtronic’s appeal. The claims across all six patents were confirmed as valid. This was a major victory for Teleflex, as the validity of their patents was upheld and Medtronic’s appeal was denied. The six patents in question cover inventions related to methods of manufacturing guide catheters, as well as a guide catheter design.

This decision serves as an important reminder of Teleflex’s commitment to protecting their valuable intellectual property rights. The ruling is also a testament to Teleflex’s dedication to innovation and advances in patient care. As a leading provider of medical technology, Teleflex is committed to developing products and technologies that enhance patient care and improve the quality of life for those suffering from chronic conditions. The company’s guide catheter technology helps make minimally invasive surgery easier and more accurate, allowing for quicker patient recovery times. With this favorable ruling, Teleflex continues to be a leader in the medical device industry.

Share Price

On Tuesday, TELEFLEX INCORPORATED stock opened at $240.6 and closed at $236.0, down by 1.9% from the last closing price of 240.7. The ruling was a major win for TELEFLEX INCORPORATED, as it gives them a significant advantage in the medical device market and ensures their patent protection. This decision also stops Medtronic from infringing on TELEFLEX INCORPORATED’s patent rights and will likely have a positive impact on TELEFLEX INCORPORATED’s stock in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Teleflex Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 2.86k | 362.75 | 13.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Teleflex Incorporated. More…

| Operations | Investing | Financing |

| 364.22 | -267.02 | -290.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Teleflex Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.92k | 2.81k | 87.52 |

Key Ratios Snapshot

Some of the financial key ratios for Teleflex Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.1% | 0.8% | 17.9% |

| FCF Margin | ROE | ROA |

| 9.7% | 7.9% | 4.6% |

Analysis

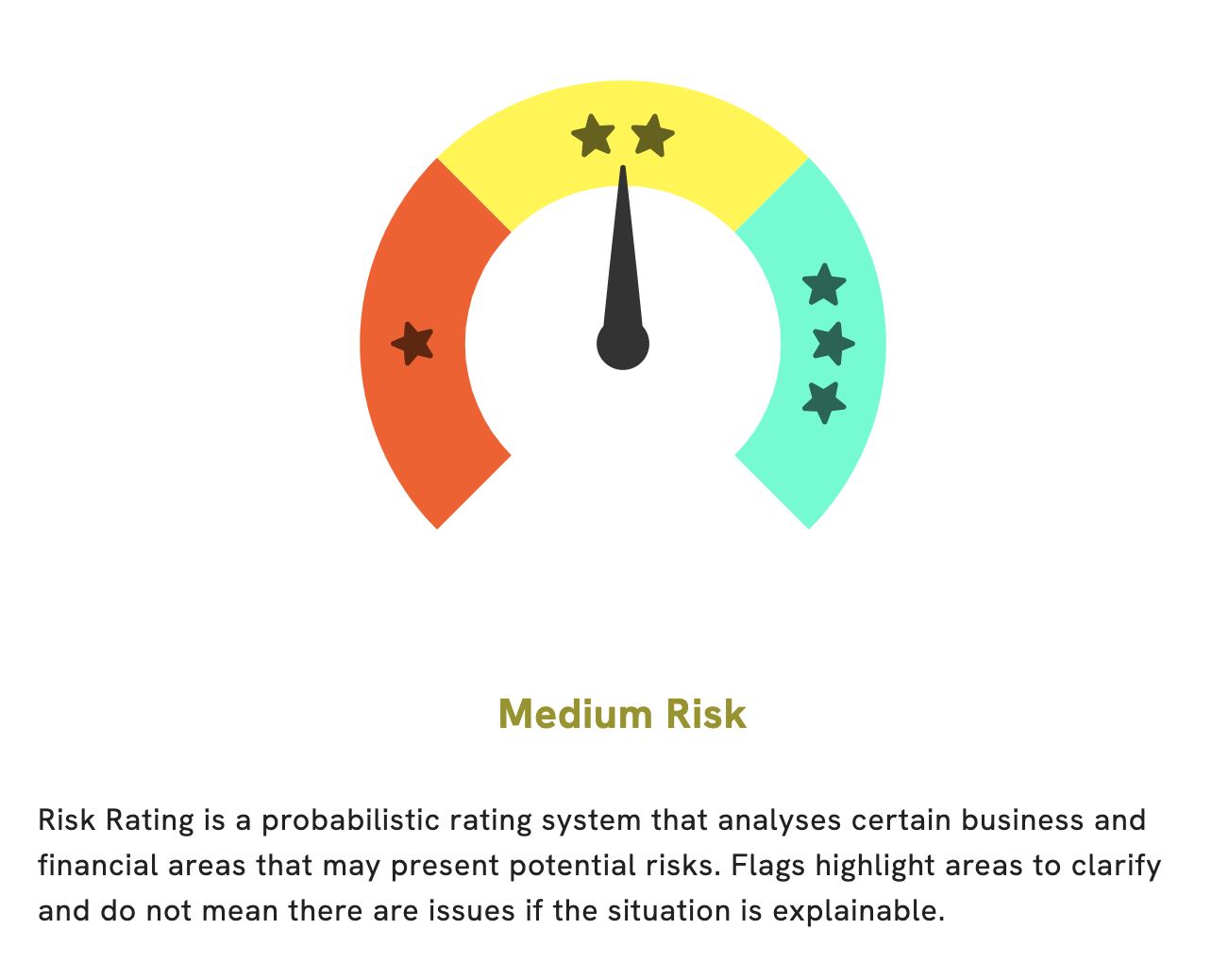

We at GoodWhale have conducted an in-depth analysis into the wellbeing of TELEFLEX INCORPORATED. Our Risk Rating system has determined that TELEFLEX INCORPORATED is a medium risk investment, considering both financial and business aspects. Upon further review of the company’s income sheet and balance sheet, we have found two risk warnings that registered users can access. These risk warnings are a valuable tool when making decisions about investments, so we encourage our registered users to take advantage of them. By staying up to date with risk warnings, our users can make informed decisions that lead to successful investments. More…

Peers

Teleflex Inc., a leading global provider of medical technologies, offers a broad range of products and services for use in critical care and surgery. The company’s products are used by hospitals and other healthcare facilities worldwide. Teleflex’s competitors include Delta Asia International Corp, Meihua International Medical Technologies Co Ltd, and Shanghai Sanyou Medical Co Ltd.

– Delta Asia International Corp ($TPEX:6762)

Daiwa-Asia International Corp is a leading provider of financial services in Asia. The company offers a wide range of products and services, including banking, insurance, asset management, and securities brokerage. Daiwa-Asia has a strong presence in the region, with operations in Hong Kong, Singapore, Taiwan, China, and Japan. The company is listed on the Tokyo Stock Exchange and has a market capitalization of 5.54 billion as of 2022. Daiwa-Asia reported a return on equity of 11.54% for the year ended March 31, 2022.

– Meihua International Medical Technologies Co Ltd ($NASDAQ:MHUA)

Meihua International Medical Technologies Co Ltd is a Chinese medical technology company. It has a market cap of 191.52M as of 2022 and a Return on Equity of 16.31%. The company develops, manufactures, and sells medical devices and equipment. Its products include stents, catheters, and other cardiovascular products.

– Shanghai Sanyou Medical Co Ltd ($SHSE:688085)

Shanghai Sanyou Medical Co Ltd is a medical company with a market cap of 7.06B as of 2022 and a Return on Equity of 8.19%. The company specializes in the manufacture and sale of medical equipment and supplies. It is headquartered in Shanghai, China.

Summary

Teleflex Incorporated is an attractive investment opportunity for those looking to diversify and add a healthcare component to their portfolio. The company has shown solid growth in its quarterly revenue and earnings, and its products have become more popular in recent years due to their use in cardiology procedures. Additionally, the company’s recent success in the Federal Circuit defending six of its patents covering guide catheters will provide a competitive edge against its rivals. Overall, the company holds strong fundamentals and boasts a solid dividend yield, making it a viable choice for investors.

Recent Posts