Capital Impact Advisors LLC Increases Holdings in LeMaitre Vascular, by $798,000 in 2023.

March 21, 2023

Trending News 🌥️

LEMAITRE ($NASDAQ:LMAT): LeMaitre Vascular, Inc. has seen an increase in investments from Capital Impact Advisors LLC in 2023. The total amount of the investment stands at $798,000, a significant sum for the company. This shows the confidence investors have in the future of LeMaitre Vascular, Inc. and the potential for success it holds. Based out of Burlington, Massachusetts, LeMaitre Vascular, Inc. is a medical device company that specializes in the development, manufacture and marketing of devices for the treatment of peripheral vascular disease. They focus on providing innovative solutions to improve patient outcomes and reduce costs.

With new technologies and products always in the works, LeMaitre Vascular continues to remain at the forefront of the medical device industry. With this new influx of capital, the company will be able to strengthen existing products and introduce new ones, ensuring they remain competitive within the medical device market. With this newly acquired capital, LeMaitre Vascular is poised to reach new heights, as it is well-equipped to further its mission and vision for better patient care.

Price History

On Friday, LeMaitre Vascular, Inc. (NASDAQ: LMAT) saw its stock open at $50.5 and close at $49.7, down by 1.7% from its previous closing price of 50.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lemaitre Vascular. More…

| Total Revenues | Net Income | Net Margin |

| 161.65 | 20.64 | 14.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lemaitre Vascular. More…

| Operations | Investing | Financing |

| 25.38 | -10.37 | -9.23 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lemaitre Vascular. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 310.48 | 42.27 | 12.14 |

Key Ratios Snapshot

Some of the financial key ratios for Lemaitre Vascular are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.3% | 12.2% | 17.0% |

| FCF Margin | ROE | ROA |

| 13.7% | 6.5% | 5.5% |

Analysis

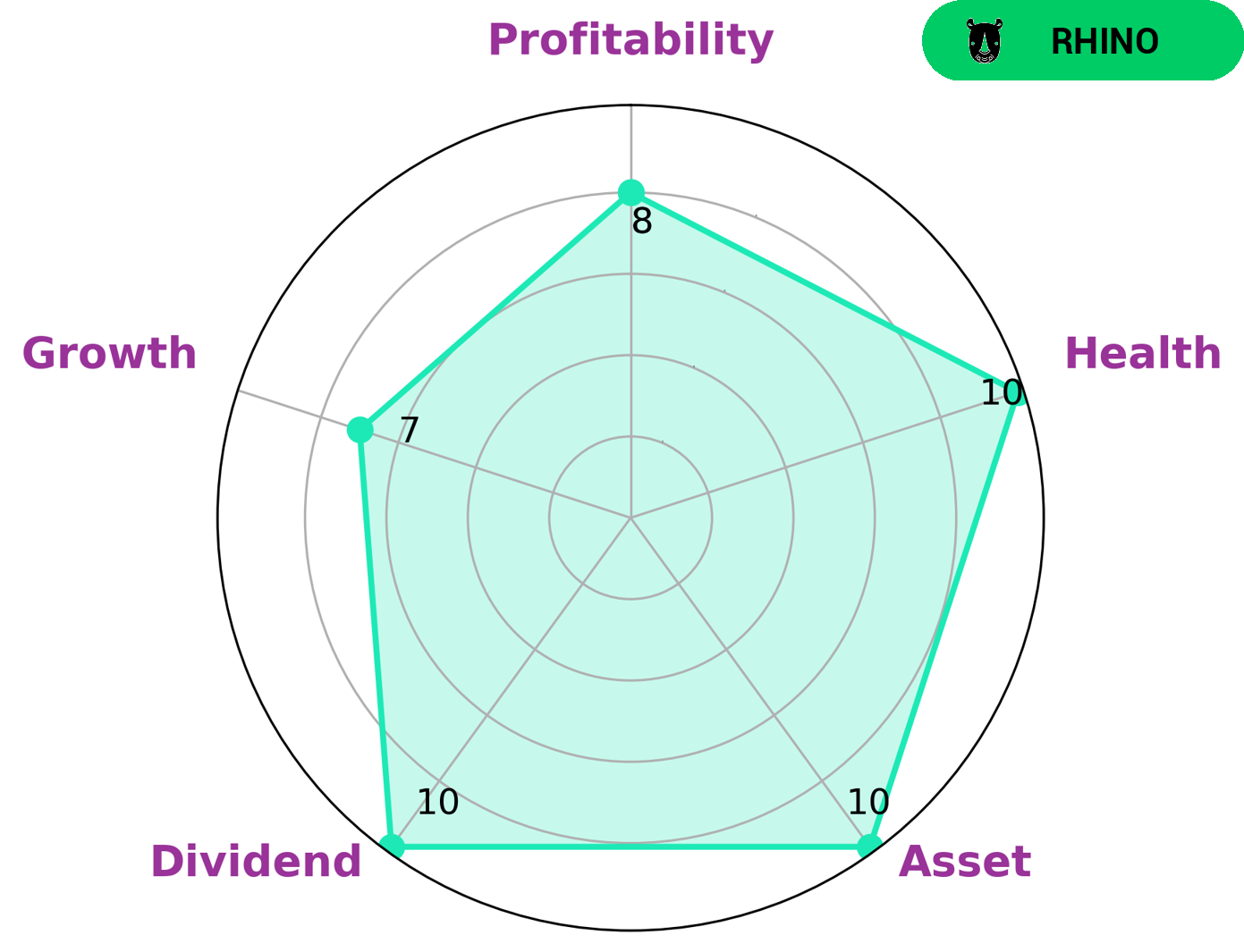

At GoodWhale, we conducted an analysis of the fundamentals of LEMAITRE VASCULAR in order to better understand what kind of investors may be interested in such a company. Our Star Chart showed that LEMAITRE VASCULAR was strong in many areas, including asset, dividend, growth, and profitability. We classified LEMAITRE VASCULAR as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. Furthermore, LEMAITRE VASCULAR has a high health score of 10/10 considering its cashflows and debt, indicating that it is capable of riding out any crisis without the risk of bankruptcy. This could be attractive to investors who are looking for a more secure investment opportunity. In conclusion, we believe that LEMAITRE VASCULAR offers a solid option for investors looking to invest in a stable company with promising growth potential. More…

Peers

It focuses on the development, manufacture and marketing of minimally invasive products for the treatment of peripheral vascular diseases. The company operates through two segments, Direct and OEM. The Direct segment offers proprietary products to hospitals and other medical institutions through direct sales force. The OEM segment provides stents and other products to Original Equipment Manufacturers (OEMs) for sale under their own brands. LeMaitre’s competitors include Atrion Corp, Implanet SA, Vycor Medical Inc.

– Atrion Corp ($NASDAQ:ATRI)

Atrion Corporation is a medical device company that develops, manufactures and markets products primarily for use in cardiac and ophthalmic surgery. The company’s products include Cardiax, a cannula used in cardiac surgery; Ophthalmic products, including the HydroVue and Glaucoma Shunt systems to treat glaucoma; and PerQCat, a catheter used in urology procedures.

– Implanet SA ($OTCPK:IMPZY)

Implanet SA is a French company specializing in the design and manufacture of medical implants for the treatment of orthopedic pathologies. The company’s products are used in the treatment of various conditions, including osteoarthritis, degenerative disc disease, scoliosis, and deformities of the hip, knee, and shoulder. As of 2022, Implanet SA had a market capitalization of 3.88 million euros and a return on equity of -114.56%. The company’s products are sold in over 50 countries worldwide and its customers include some of the world’s leading orthopedic surgeons and hospitals.

– Vycor Medical Inc ($OTCPK:VYCO)

Vycor Medical Inc is a medical device company that specializes in the development and commercialization of minimally invasive products for neurosurgery. The company’s products are designed to provide surgeons with improved access and visualization during surgery, while minimizing tissue damage and surgical time. Vycor Medical’s products are sold in over 30 countries worldwide.

As of 2022, Vycor Medical Inc had a market capitalization of 3.17 million and a return on equity of 6.36%. The company’s products are used in a variety of neurosurgical procedures, including brain surgery, spinal surgery, and skull-base surgery.

Summary

Investment analysts at Capital Impact Advisors LLC have increased their holdings in LeMaitre Vascular, Inc. by $798,000 in 2023. The analysis suggests that the company’s performance is strong and investors have confidence in the continued growth of its stock. The investment firm has predicted that LeMaitre Vascular shares will continue to rise, likely due to the company’s expanding portfolio of medical technologies, such as its vascular grafts and other products.

Additionally, the company’s recent acquisitions and partnerships are expected to bolster their long-term prospects and provide shareholders with greater returns. While further research is advised, the current outlook for LeMaitre Vascular appears to be positive.

Recent Posts