AtriCure Beats Earnings and Revenue Estimates by Wide Margins

May 3, 2023

Trending News 🌥️

ATRICURE ($NASDAQ:ATRC): AtriCure Inc., a medical device manufacturer and marketer of innovative products designed to treat complex cardiac diseases and cardiac defects, has exceeded expectations for its earnings and revenue for the fourth quarter. The company reported non-GAAP earnings per share of -$0.23, which was $0.12 higher than expected.

In addition, AtriCure reported revenue of $93.5 million, which beat the forecast by $5.97M. These strong financial results are indicative of a commitment to excellence and innovation. From its launch of the first commercially available transcatheter electrical atrial fibrillation ablation system to its 3D mapping and navigation systems, AtriCure has consistently been at the forefront of medical device technology. AtriCure’s success is also due to its ability to adapt to the changing landscape of medical technology. The company is staying ahead of trends in the industry, such as virtual care, data analytics and artificial intelligence, in order to provide its customers with solutions that meet their needs. The company’s strong financial performance is a testament to its commitment to innovation and excellence, and it is likely that AtriCure will continue to exceed expectations going forward.

Earnings

ATRICURE recently released their earning report for the fourth quarter of FY2022, ending December 31 2022. The report revealed that ATRICURE had earned 88.03M USD in total revenue and had a net income loss of 4.17M USD. This marks a 20.2% increase in total revenue from the previous year, and a 57.72M USD to 88.03M USD increase in total revenue over the past three years. This report also shows that ATRICURE has beaten their earnings and revenue estimates by wide margins.

This impressive report is a testament to ATRICURE’s successful strategies and their commitment to continued growth and development. With their impressive performance across the board, only time will tell if ATRICURE will be able to maintain their current momentum and continue to exceed expectations.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Atricure. More…

| Total Revenues | Net Income | Net Margin |

| 330.38 | -46.47 | -14.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Atricure. More…

| Operations | Investing | Financing |

| -22.14 | 44.01 | -7.06 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Atricure. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 585.45 | 128.69 | 9.81 |

Key Ratios Snapshot

Some of the financial key ratios for Atricure are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.7% | – | -12.5% |

| FCF Margin | ROE | ROA |

| -11.8% | -5.7% | -4.4% |

Price History

AtriCure Inc., a medical device company dedicated to creating innovative solutions for the treatment of atrial fibrillation and related conditions, reported that its earnings and revenue beat expectations by wide margins on Tuesday. The company’s stock opened at $44.7 and closed at $43.9, a decline of 2.6% from its previous closing price of $45.1. These strong results show that AtriCure is continuing to perform well and its long-term outlook remains positive. Live Quote…

Analysis

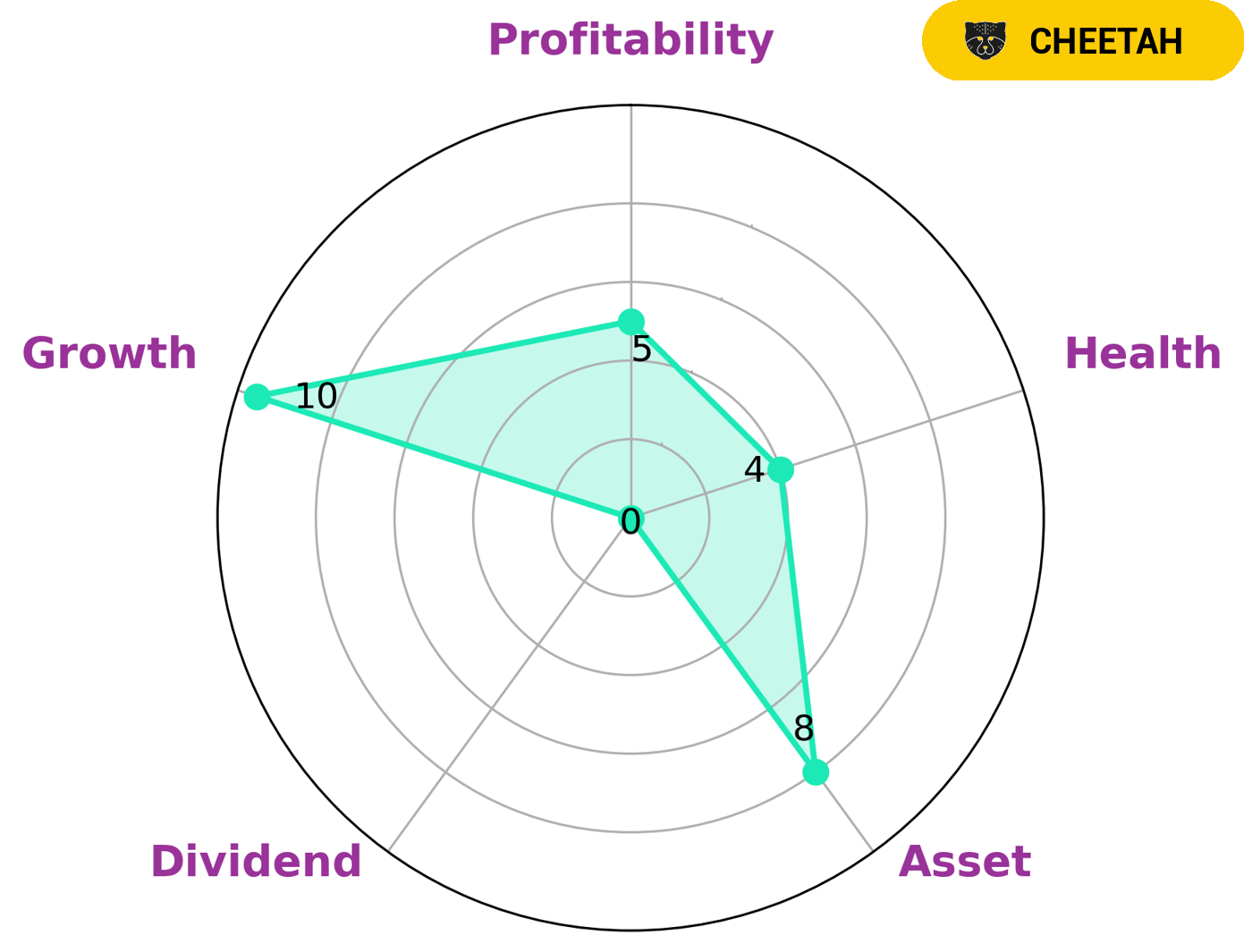

At GoodWhale, we have taken a close look at ATRICURE‘s financials and have classified them as ‘cheetah’ according to our Star Chart. This indicates that the company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking to invest in such companies should be aware of this fact. On further examination, GoodWhale has found that ATRICURE is strong in assets, growth and medium in profitability and weak in dividend. Furthermore, its intermediate health score of 4/10 considering its cashflows and debt indicate that it might be able to sustain future operations in times of crisis. Overall, ATRICURE is an interesting option for potential investors who are more risk-tolerant and target companies with high-growth opportunities. However, these investors should understand that the company is less stable due to its low profitability and should ensure that they have adequate diversification in their portfolio to manage their risk exposure. More…

Peers

The company was founded in 2000 and is headquartered in Mason, Ohio. AtriCure‘s competitors include Abiomed Inc, LeMaitre Vascular Inc, and Nevro Corp. These companies also provide medical devices and services for the treatment of Afib and other cardiovascular conditions.

– Abiomed Inc ($NASDAQ:ABMD)

Abiomed Inc. is a medical device company that develops and manufactures products to treat congestive heart failure and acute cardiac conditions. The company’s product portfolio includes implantable cardioverter defibrillators, left ventricular assist devices, and heart pumps. Abiomed’s products are used by hospitals and clinics around the world. The company has a market capitalization of $16.86 billion and a return on equity of 10.55%. Abiomed is headquartered in Danvers, Massachusetts.

– LeMaitre Vascular Inc ($NASDAQ:LMAT)

LeMaitre Vascular Inc is a medical device company that specializes in the manufacturing of devices and implants for the treatment of peripheral vascular diseases. The company has a market capitalization of 984.38 million as of 2022 and a return on equity of 6.77%. The company’s products are used by surgeons to treat a variety of vascular conditions, including arterial and venous diseases.

– Nevro Corp ($NYSE:NVRO)

As of 2022, Nevro Corp has a market cap of 1.44B and a Return on Equity of -34.12%. The company is a medical device company that develops and commercializes proprietary neuromodulation solutions for the treatment of chronic pain.

Summary

.

Recent Posts