AIG Reduces Stake in West Pharmaceutical Services,

June 12, 2023

🌥️Trending News

West Pharmaceutical Services ($NYSE:WST), Inc. is a global leader in the design and manufacture of high-quality, safe and innovative drug delivery systems. West Pharmaceutical Services has a clear mission: to provide healthcare providers and patients with the most safe and effective products possible. The company puts great emphasis on innovation and research to ensure that their products are up-to-date with the latest technology and comply with all safety regulations. They also provide specialized services to customers such as packaging, engineering, and global sourcing. West Pharmaceutical Services has a strong focus on quality control and has earned many certifications to meet high standards of health and safety. Their products are used in a wide range of applications, from diabetes and cancer treatments to antibiotic delivery systems. The company provides customers with the highest quality of products and services, ensuring that they receive the best care available. AIG’s reduction of its stake in West Pharmaceutical Services could have a significant impact on the company’s future performance. It is likely that other investors will be wary of investing in West Pharmaceutical Services due to AIG’s recent decision.

However, the company remains committed to delivering the best products and services to its customers and is confident that it can continue to be a leader in the industry despite the recent changes in ownership.

Share Price

Monday marked a notable day for WEST PHARMACEUTICAL SERVICES as American International Group (AIG) reduced its stake in the company. The sale did not appear to have a major effect on WEST PHARMACEUTICAL SERVICES’ stock price, as it remained relatively steady throughout the trading period. This news comes at a time when the company is facing increased competition in the market, as well as a changing regulatory environment. It remains to be seen how this news will impact WEST PHARMACEUTICAL SERVICES going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WST. More…

| Total Revenues | Net Income | Net Margin |

| 2.88k | 552.1 | 19.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WST. More…

| Operations | Investing | Financing |

| 710.9 | -288.2 | -293.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WST. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.62k | 931.9 | 36.15 |

Key Ratios Snapshot

Some of the financial key ratios for WST are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.2% | 32.3% | 22.6% |

| FCF Margin | ROE | ROA |

| 17.1% | 15.2% | 11.3% |

Analysis

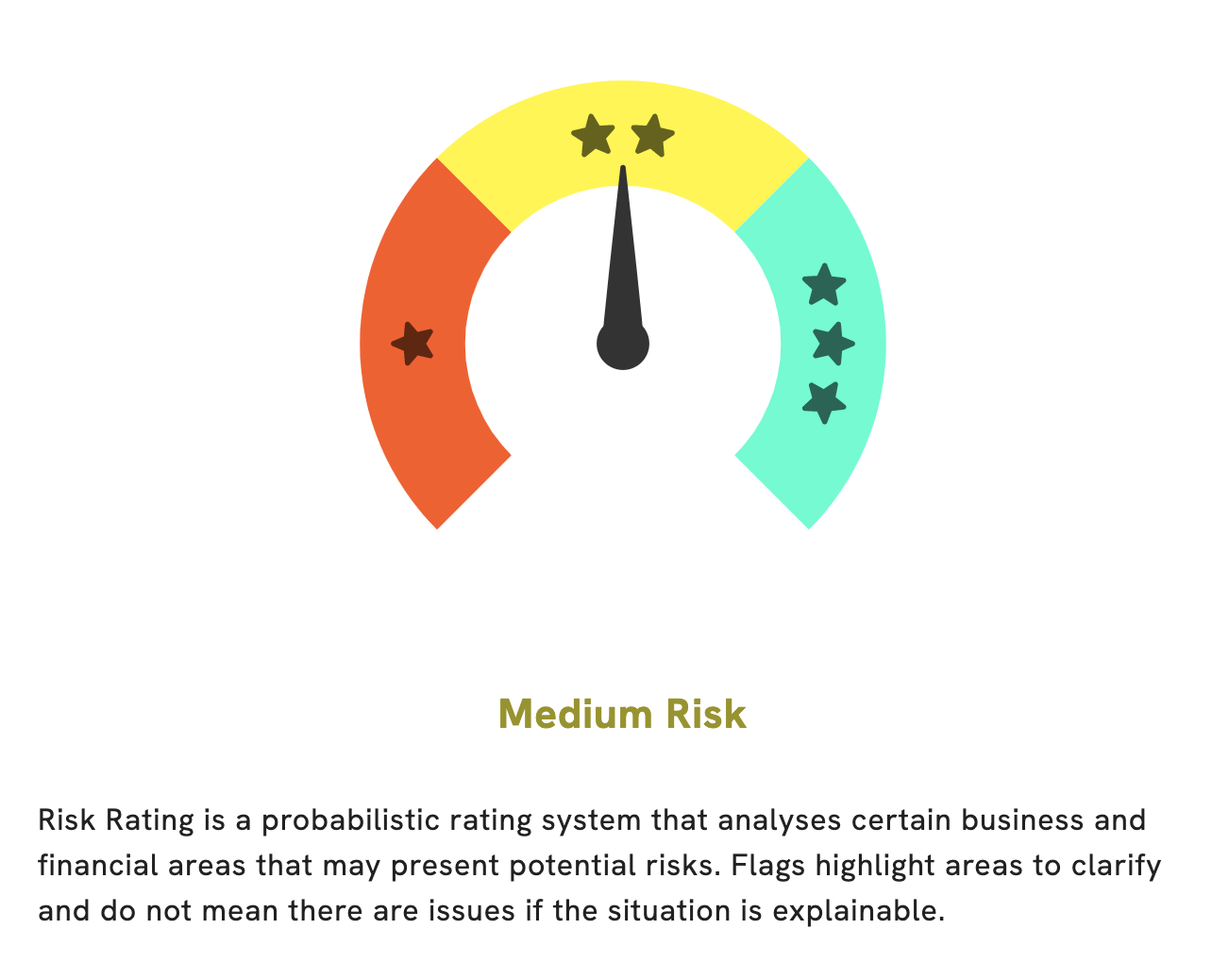

At GoodWhale, we help you analyze WEST PHARMACEUTICAL SERVICES’s fundamentals so that you can make informed investment decisions. Based on our Risk Rating, WEST PHARMACEUTICAL SERVICES is considered to be a medium risk investment in terms of financial and business aspects. Furthermore, our analysis has picked up two risk warnings that can be found in the balance sheet, which are non-financial in nature. To get more insight on our findings, simply register an account with us on goodwhale.com. More…

Peers

The company operates in North America, Europe, Asia, and South America. Seikagaku Corp, Shenyang Xingqi Pharmaceutical Co Ltd, and Shenzhen Salubris Pharmaceuticals Co Ltd are all competitors of West Pharmaceutical Services Inc.

– Seikagaku Corp ($TSE:4548)

Seikagaku Corp is a Japanese company that specializes in the research and development of pharmaceuticals. The company has a market cap of 53.35B as of 2022 and a return on equity of 2.38%. Seikagaku Corp’s products include treatments for osteoarthritis, inflammatory diseases, and cancer.

– Shenyang Xingqi Pharmaceutical Co Ltd ($SZSE:300573)

Shenyang Xingqi Pharmaceutical Co Ltd is a pharmaceutical company with a market cap of 10.63B as of 2022. The company has a return on equity of 12.24%. The company’s main products are traditional Chinese medicines and western medicines. The company also has a research and development center which is responsible for the development of new products and the improvement of existing products. The company has a strong marketing network and a good reputation in the industry.

– Shenzhen Salubris Pharmaceuticals Co Ltd ($SZSE:002294)

Shenzhen Salubris Pharmaceuticals Co Ltd is a Chinese pharmaceutical company with a market cap of 37.86B as of 2022. The company’s ROE is 6.05%. Shenzhen Salubris Pharmaceuticals Co Ltd is engaged in the research, development, manufacture and sale of pharmaceutical products. The company’s products include drugs for the treatment of cardiovascular and cerebrovascular diseases, cancer, infections, digestive diseases and other diseases.

Summary

American International Group Inc. (AIG) recently sold a portion of its holding in West Pharmaceutical Services, Inc. (WEST). This move signals a bearish sentiment towards the stock and could indicate that AIG believes that West Pharmaceuticals’ stock price is at its peak or perhaps headed for a decline. Investors should take note and look at other potential investments that may offer better potential returns. It is important to conduct a thorough analysis of the company’s financial performance, its competitive landscape, and key future drivers for the stock before investing in WEST.

Additionally, investors should keep up to date with the latest news and developments related to the company, as they may impact the stock’s performance.

Recent Posts