STERIS PLC Reports Strong Earnings and Revenue Surpassing Expectations

May 11, 2023

Trending News ☀️

STERIS PLC ($NYSE:STE), a leading provider of infection prevention and procedural products and services, recently reported strong earnings and revenue surpassing expectations. According to the company’s financial report, Steris’ Non-GAAP earnings per share (EPS) of $2.30 exceeded estimates by $0.15, and revenue of $1.38B beat expectations by $110M. This is great news for the company, which has been working hard to improve its financial performance. As one of the world’s leading providers of infection prevention and procedural products, STERIS PLC has an impressive portfolio of products and services which are used in hospitals and other health care settings across the globe. The company has developed a strong reputation for its quality products and services, as well as its commitment to providing superior customer service.

Steris PLC has also implemented cost-saving measures and other initiatives to improve its financial performance, which have resulted in the reported stronger-than-expected earnings and revenue. This news of strong earnings and revenue is sure to be welcomed by investors, who have long been awaiting improved financial results from the company. With this positive news, STERIS PLC is showing that it is well positioned for continued success in the near future.

Price History

This news drove their stock to open at $188.5 and close at $189.4, an increase of 1.2% from their prior closing price of $187.1. This marks a notable milestone for the company as they continue to exceed their projected financial performance. The strong quarterly performance was attributed to their medical business, specifically their infection prevention, patient care and healthcare facility management products. The company’s Life Sciences division also delivered strong results with higher sales and margin contributions.

Overall, investors seem to be pleased with the progress and potential of STERIS PLC. The company is confident in its future prospects and remains committed to driving growth and shareholder value. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Steris Plc. More…

| Total Revenues | Net Income | Net Margin |

| 4.78k | -27.93 | 5.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Steris Plc. More…

| Operations | Investing | Financing |

| 712.88 | -212.18 | -581.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Steris Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.8k | 4.75k | 60.75 |

Key Ratios Snapshot

Some of the financial key ratios for Steris Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.1% | 6.0% | 2.8% |

| FCF Margin | ROE | ROA |

| 7.3% | 1.4% | 0.8% |

Analysis

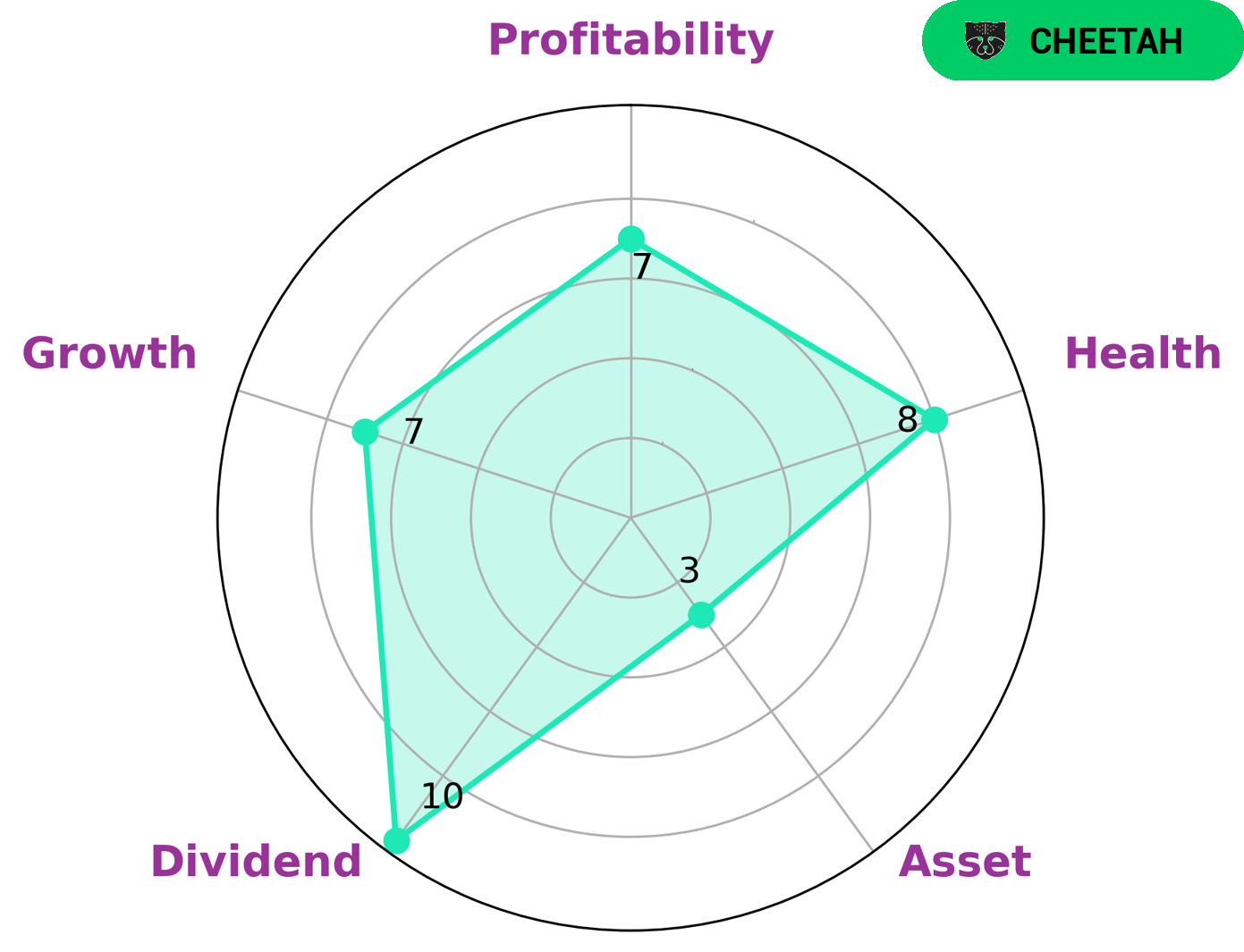

As part of our analysis of the well-being of STERIS PLC, we have used the Star Chart to assess the company. The results show that STERIS PLC is strong in dividend, growth, and profitability, but weak when it comes to asset. With a health score of 8/10, the company is in a strong position with regard to its cashflows and debt, enabling it to pay off debt and fund future operations. Based on this analysis, we have classified STERIS PLC as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. We believe that this type of company would be attractive to investors who are looking for the potential of high returns in the short term, but with an understanding of the inherent risks associated with such investments. More…

Peers

The company’s main competitors are Fonar Corp, Stryker Corp, and Dynatronics Corp.

– Fonar Corp ($NASDAQ:FONR)

Fonar Corporation is a holding company, which engages in the design, manufacture, sale, and service of magnetic resonance imaging (MRI) scanners. It operates through the following segments: Upright Multi-Position MRI; Stand-Up MRI; and Recurring Revenue. The Upright Multi-Position MRI segment designs, manufactures, and sells Upright Multi-Position MRI scanners. The Stand-Up MRI segment designs, manufactures, sells, and services Stand-Up MRI scanners. The Recurring Revenue segment provides service contracts, technical support, and parts sales. The company was founded by Stanley C. Krulick in 1978 and is headquartered in Melville, NY.

– Stryker Corp ($NYSE:SYK)

Stryker Corporation is one of the world’s leading medical technology companies. It offers a wide range of medical devices and services, including orthopedics, neurotechnology, and medical imaging. It has more than 87,000 employees worldwide.

– Dynatronics Corp ($NASDAQ:DYNT)

Dynatronics Corp is a medical device company that manufactures and markets physical therapy products and solutions. The company’s products are used by physical therapists, occupational therapists, athletic trainers, and other healthcare professionals. Dynatronics Corp has a market cap of 8.73M as of 2022, a Return on Equity of -10.7%. The company’s products are sold in the United States and internationally.

Summary

Revenue of $1.38B also beat estimates by $110M. According to market analysis, the stock performed well, with investors responding positively to the news. Relative to its competitors, STERIS PLC fared well, with analysts citing strong revenue growth and a robust balance sheet as key points of strength. Going forward, STERIS PLC is expected to remain profitable and continue delivering robust returns for shareholders.

Recent Posts