SG Americas Securities LLC Decreases Stake in Cytek Biosciences,

February 6, 2023

Trending News ☀️

SG Americas Securities LLC recently decreased its stake in Cytek Biosciences ($NASDAQ:CTKB), Inc., a biotechnology company specializing in developing innovative tools for flow cytometry. The company develops, manufactures, and markets a portfolio of reagents, instruments, and software to enable single cell analysis. The company is focused on developing novel products to better enable researchers to rapidly and accurately analyze single-cell data. Cytek’s products allow researchers to explore cellular data at the single-cell level, providing insights into the biology of individual cells that are not available with traditional flow cytometry methods. Cytek Biosciences, Inc. has developed a comprehensive suite of products that provide a complete solution for single cell analysis. The company’s portfolio includes reagents and instruments for sample preparation and detection, as well as software for data analysis. Cytek’s products are designed to be easy to use and provide powerful and accurate results in a fraction of the time compared to traditional methods.

The company has also developed several proprietary technologies that enable researchers to better analyze single-cell data. These include a patented laser system that can identify rare cells and a patented signal processing technique that can accurately identify and measure features from the single-cell data. Cytek’s products have been used by researchers in a wide range of fields including cancer research, immunology, neuroscience, and infectious diseases. The company is committed to advancing the field of single-cell analysis and its products have been used in numerous research studies across the globe. Cytek Biosciences, Inc. is dedicated to providing researchers with the tools they need to explore the world at the single-cell level.

Share Price

On Wednesday, CYTEK BIOSCIENCES stock opened at $12.1 and closed at $12.3, up by 2.0% from the previous closing price of 12.0. This is the third consecutive day of stock appreciation, indicating that investors are interested in the company and its products. The company has been focusing on developing a new class of cellular assays that allow for the rapid, high-throughput characterization of cells in the Clinical Diagnostic setting. This technology is designed to enable clinicians to make more informed decisions in diagnosing and treating cancer and other diseases. Cytek’s products are currently being used in research laboratories worldwide and have been featured in publications such as The New England Journal of Medicine and Nature Communications. Cytek’s products are also being evaluated in clinical trials with the aim of helping clinicians in their diagnosis and treatment of various diseases, such as cancer, autoimmune diseases, and infectious diseases.

The company has also received regulatory approval in Europe for its next-generation flow cytometer. This approval allows the company to offer its products to the European market, increasing its market potential and providing it with a competitive edge. The recently reported stock appreciation further indicates that investors are confident in the company’s future potential. With new technologies and clinical trials underway, Cytek Biosciences appears to be well positioned for continued success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cytek Biosciences. More…

| Total Revenues | Net Income | Net Margin |

| 154.59 | -0.95 | -1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cytek Biosciences. More…

| Operations | Investing | Financing |

| -12.98 | -23.14 | 1.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cytek Biosciences. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 499.3 | 82.79 | 3.09 |

Key Ratios Snapshot

Some of the financial key ratios for Cytek Biosciences are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -0.0% |

| FCF Margin | ROE | ROA |

| -11.3% | -0.0% | -0.0% |

Analysis

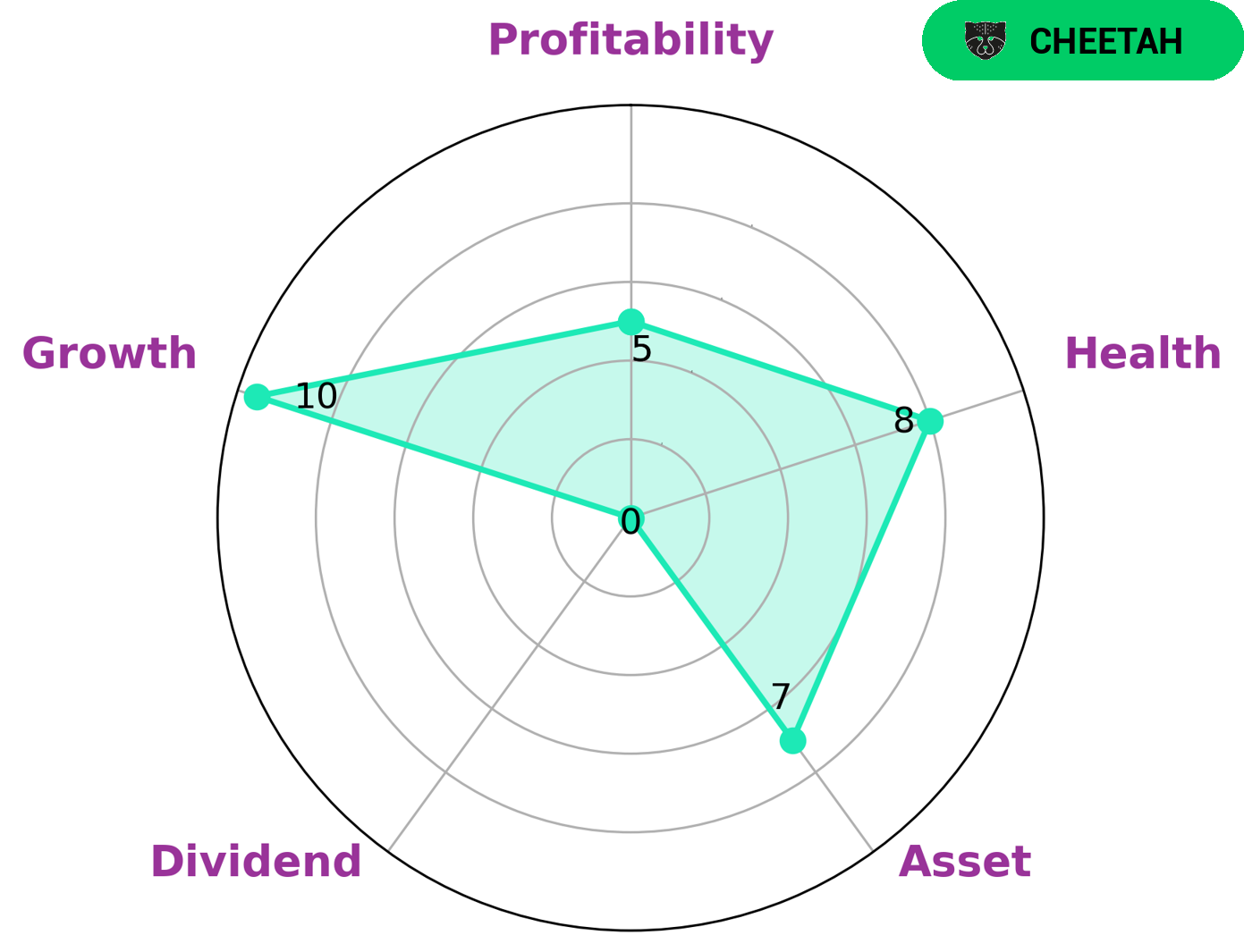

GoodWhale has conducted an analysis of CYTEK BIOSCIENCES‘ wellbeing, which revealed that the company has a high health score of 8/10 with regard to its cashflows and debt, allowing it to safely ride out any crisis without the risk of bankruptcy. According to the Star Chart, CYTEK BIOSCIENCES is strong in asset and growth, medium in profitability, and weak in dividend. The company is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who may be interested in such a company could include those who are looking for short-term gains with a higher level of risk, as well as those who are looking for long-term growth potential. These types of investors may be willing to accept a lower return on investment due to the higher risk associated with such companies. Additionally, these investors may be willing to take the gamble of investing in a cheetah stock due to its potential for rapid growth. In general, investors should be aware of the risks associated with investing in such companies and should also consider the potential for both short-term and long-term gains when making their investment decisions. With the right research and due diligence, investors can find companies with high health scores and strong growth potentials which can provide opportunities for both short-term and long-term gains. More…

Peers

Its competitors are Pressure BioSciences Inc, Delcath Systems Inc, Longport Inc.

– Pressure BioSciences Inc ($OTCPK:PBIO)

Pressure BioSciences Inc is a biotechnology company that develops, manufactures, and markets systems and consumables for sample preparation and analytical techniques used in the life sciences industry. The company’s products are based on the pressure cycling technology, which is a method of applying alternating cycles of hydrostatic pressure between ambient and ultra-high levels to biological samples in order to open or lyse cells and archives, release their contents for further analysis.

– Delcath Systems Inc ($NASDAQ:DCTH)

Delcath Systems Inc. is a commercial-stage pharmaceutical company focused on the treatment of primary and metastatic liver cancers. The Company’s product, Melphalan Hydrochloride for Injection for use with the Delcath Hepatic Delivery System (Melphalan/HDS), is an investigational drug delivery system that is designed to administer very high-dose melphalan, a chemotherapeutic agent, to the liver while minimizing exposure of other normal tissues.

Summary

The recent investment analysis from SG Americas Securities LLC showed a decrease in the stake in Cytek Biosciences, Inc. Despite this, the media coverage for the company has remained mostly positive. Cytek Biosciences is a biotechnology company focused on creating innovative products and services to help improve the diagnosis and treatment of disease. The company is committed to developing and delivering high-quality products to meet the needs of its customers. The company’s core technology platforms include flow cytometry, mass cytometry, data analysis, and cell sorting. Cytek Biosciences has made significant investments in research and development to develop advanced technologies.

The company also focuses on providing customer service and technical support to ensure customer satisfaction. Cytek Biosciences is well-positioned to benefit from advances in medical research and technology. It is expected that the company will continue to expand its customer base and product offerings in the future.

Recent Posts