Integer Holdings’ Stock Rating Reaches 82 in 2023.

March 21, 2023

Trending News ☀️

Integer Holdings ($NYSE:ITGR) Corporation has established itself as one of the stocks to watch in 2023. The company’s RS Rating, a score based on its past performance, has increased to 82. This signifies that the stock is showing positive momentum and is well positioned for future growth. It’s no surprise that Integer Holdings Corporation’s stock rating has increased significantly in the past year. The company’s impressive product portfolio and consistent financial performance have contributed to the rise in its RS Rating.

Integer Holdings’ commitment to innovation and customer satisfaction has attracted investors who are eager to be part of the company’s success. The company’s ability to successfully navigate the changes in the global market and its willingness to invest in new technologies have enabled it to reach this impressive rating. With the support of its investors, Integer Holdings is well-positioned to continue its upward trend and reach even higher levels of success in the years to come.

Stock Price

Integer Holdings’ stock rating has seen a major boost in 2023 – reaching 82, despite the fact that media sentiment towards the company has mostly been negative till now. On Wednesday, INTEGER HOLDINGS stock opened at $73.6 and closed at $74.2, which was 1.6% lower than the previous closing price of 75.4. This slight drop in price may be attributed to the overall negative feeling in the market due to the lack of confidence in the company’s future prospects. Despite this, the stock has continued to rise over the past few months, with investors optimistic about its potential. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Integer Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.38k | 66.38 | 5.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Integer Holdings. More…

| Operations | Investing | Financing |

| 116.38 | -200.42 | 92.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Integer Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.79k | 1.38k | 42.73 |

Key Ratios Snapshot

Some of the financial key ratios for Integer Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.0% | -6.3% | 8.3% |

| FCF Margin | ROE | ROA |

| 3.0% | 5.2% | 2.6% |

Analysis

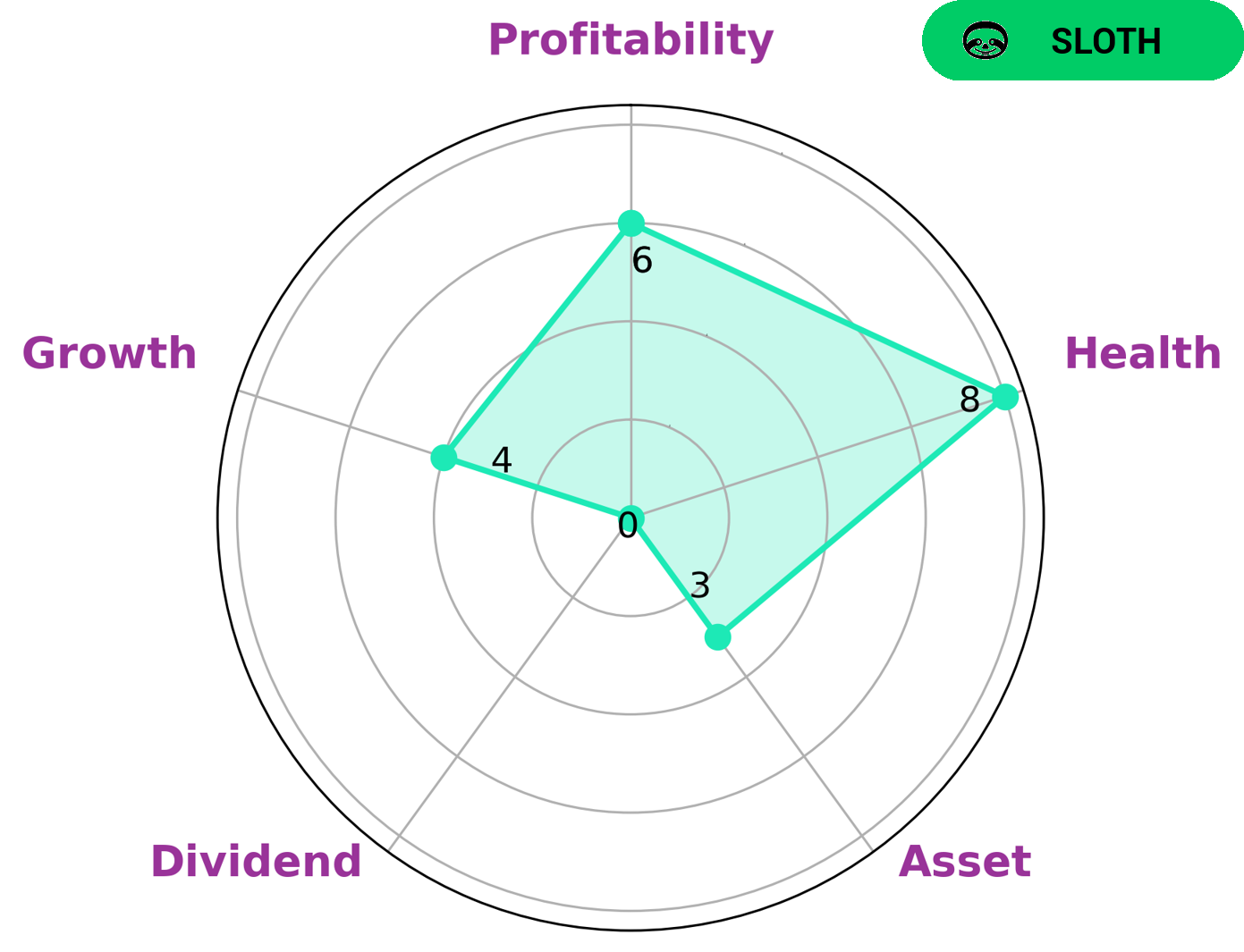

GoodWhale conducted an analysis of INTEGER HOLDINGS‘s wellbeing and the results were positive. The Star Chart showed that INTEGER HOLDINGS had a health score of 8/10, indicating that it was able to safely ride out any crisis without the risk of bankruptcy due to its healthy cashflows and debt. INTEGER HOLDINGS is classified as ‘sloth’, meaning that it has achieved revenue or earnings growth slower than the overall economy. Investors who are looking for a slow but steady return on their investments may find this company of interest, as the low-risk nature of the investment may appeal to those who seek minimal risk. INTEGER HOLDINGS is strong in liquidity, medium in growth, profitability and weak in asset, dividend. This indicates that while INTEGER HOLDINGS has good cashflow and is able to pay its debts, there is still room for improvement in terms of its asset and dividend growth. More…

Peers

The company designs, develops, manufactures, and markets medical devices and services worldwide. Integer’s competitors in the orthopedics industry include Polynovo Ltd, Globus Medical Inc, and Shenzhen Mindray Bio-Medical Electronics Co Ltd.

– Polynovo Ltd ($ASX:PNV)

Polynovo Ltd is a medical device company that designs, manufactures, and markets biodegradable scaffolds for use in tissue regeneration. The company has a market cap of 1.32B as of 2022 and a Return on Equity of -3.08%. Polynovo’s products are used in a variety of applications, including orthopedics, plastic surgery, and wound care. The company’s products are sold in over 30 countries worldwide.

– Globus Medical Inc ($NYSE:GMED)

Globus Medical Inc is a leading musculoskeletal solutions company. They design, develop, manufacture and market a comprehensive line of products for the orthopedic market. Their products are used in a wide variety of procedures, including spine, hip, and extremities. Globus Medical Inc has a market cap of 7.02B as of 2022, a Return on Equity of 7.24%. Globus Medical is committed to helping improve the quality of life for patients with musculoskeletal disorders. Their products are designed to provide solutions that enable patients to return to their active lifestyles.

– Shenzhen Mindray Bio-Medical Electronics Co Ltd ($SZSE:300760)

Shenzhen Mindray Bio-Medical Electronics Co Ltd is a medical device company that manufactures a range of medical devices and equipment. The company has a market capitalization of $366.53 billion as of 2022 and a return on equity of 23.24%. The company’s products are used in a variety of medical applications, including diagnostics, patient monitoring, and imaging.

Summary

Integer Holdings is a publicly-traded company that is currently receiving mixed ratings from investment analysts. Media sentiment towards the company has been generally negative. For investors contemplating a purchase of Integer Holdings stock, it is important to consider the potential risks and rewards associated with the investment. Analysts recommend performing thorough research and evaluating both short- and long-term trends before making a decision.

Potential investors should also be aware of any potential changes in the political or economic landscape that could affect Integer Holdings’ performance. Overall, Integer Holdings appears to be a company worth watching as its stock rating continues to improve.

Recent Posts