Citigroup Lowers Stake in Tandem Diabetes Care, as Analysts Issue Mixed Ratings

June 9, 2023

☀️Trending News

Tandem Diabetes Care ($NASDAQ:TNDM), Inc. is a healthcare company that specializes in the production and distribution of innovative diabetes management products and services. Recently, financial analysts have been giving varied ratings on the company’s performance, which has led Citigroup Inc. to reduce its stake in the company. The analysts have had a wide range of opinions, from positive to negative. Some believe that Tandem Diabetes Care is set for a successful future, while others have predicted that their products and services may face greater competition in the market. Despite this, the company continues to remain popular among investors due to its strong leadership and industry-leading technology.

As analysts continue to issue their ratings on the company’s performance, Citigroup Inc. has taken a step back from its investment by reducing its stake in Tandem Diabetes Care. This decision may be seen as a sign of caution for the healthcare company, as the future of its products and services remains uncertain. Analysts have yet to come to a consensus on the company’s potential and outlook, and it remains to be seen how the company will fare in the coming years.

Share Price

The stock opened at $24.8 and closed at $24.2, down from its prior closing price of $24.8. Analysts have issued mixed ratings for the company, with some cautioning investors against buying the stock while others remain bullish on it. Despite the mixed outlook, TANDEM DIABETES CARE Inc. remains committed to improving care for people with diabetes and other related conditions.

The company has developed innovative products that allow individuals better access to care and better management of their disease. Through better monitoring and management, TANDEM DIABETES CARE Inc. is helping to lower the cost of care for people with diabetes and other related conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TNDM. More…

| Total Revenues | Net Income | Net Margin |

| 794.69 | -203.75 | -19.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TNDM. More…

| Operations | Investing | Financing |

| 50.46 | 33.17 | 16.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TNDM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 954.14 | 615.39 | 6.81 |

Key Ratios Snapshot

Some of the financial key ratios for TNDM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.3% | – | -15.4% |

| FCF Margin | ROE | ROA |

| 0.9% | -17.4% | -8.0% |

Analysis

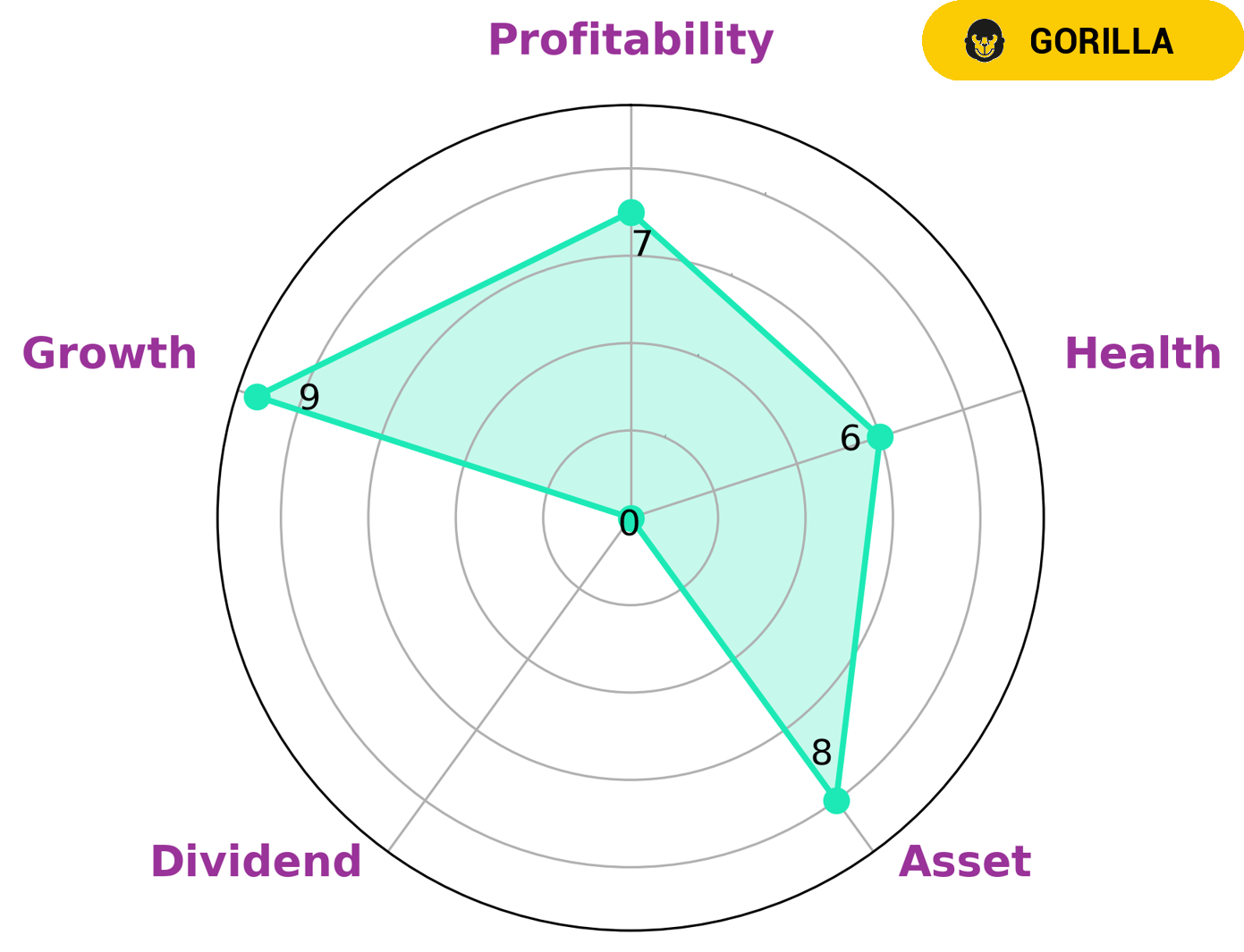

At GoodWhale, we took a closer look into TANDEM DIABETES CARE’s financials. After running our Star Chart analysis, we concluded that TANDEM DIABETES CARE has an intermediate health score of 6/10, considering its cashflows and debt. We believe that the company is likely to pay off debt and fund future operations in order to maintain its current financial state. We also classified TANDEM DIABETES CARE as a ‘gorilla’–a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are interested in such a company would benefit from keeping track of TANDEM DIABETES CARE’s asset, growth, profitability, and dividend. More…

Peers

The market for diabetes care products is highly competitive, with major players such as Tandem Diabetes Care Inc, NuVasive Inc, Avanos Medical Inc, and Penumbra Inc vying for market share. While each company has its own strengths and weaknesses, the competition between them is fierce, and it is often the case that one company’s success comes at the expense of its rivals.

– NuVasive Inc ($NASDAQ:NUVA)

NuVasive Inc is a medical device company that develops minimally-invasive surgical products and procedures for spine surgery. The company has a market cap of 2.17B as of 2022 and a Return on Equity of -1.33%. NuVasive’s products and procedures are designed to improve patient outcomes and minimize surgical invasiveness. The company’s products are used in a variety of spine surgeries, including lumbar, thoracic, and cervical procedures.

– Avanos Medical Inc ($NYSE:AVNS)

Avanos Medical Inc is a medical technology company that focuses on developing and commercializing minimally invasive medical devices. The company has a market cap of 957.63M as of 2022 and a Return on Equity of 2.85%. Avanos’ products are used in a variety of procedures, including pain management, gastrointestinal, urological, ENT, and vascular.

– Penumbra Inc ($NYSE:PEN)

As of 2022, Penumbra Inc has a market cap of 6.49B and a Return on Equity of -2.31%. The company is a medical device company that develops, manufactures and markets products for the treatment of neurovascular diseases.

Summary

Citigroup Inc. recently reduced its stake in Tandem Diabetes Care, Inc. Financial analysts have given the company varying ratings on its performance. Despite the mixed reviews, analysts agree that investing in Tandem Diabetes Care has potential and could provide attractive returns. The company’s stock is likely to remain volatile as it’s still in the early stages of business.

Investors should be prepared to do their own research to determine if this company is a good fit for their portfolio. Ultimately, Tandem Diabetes Care could be a valuable investment for those looking for long-term growth in the healthcare sector.

Recent Posts