Align Technology Q2 Results Exceed Expectations with Record Revenue and Non-GAAP EPS

April 27, 2023

Trending News 🌥️

Align Technology ($NASDAQ:ALGN) reported a non-GAAP EPS of $1.82, which was an increase of 13% year-on-year, and which beat analysts’ expectations by $0.13.

In addition, the company reported revenue of $943.1 million, surpassing estimates by $39.9 million. Align Technology, Inc. is a medical device company that designs, manufactures, and markets a range of clear aligner products for orthodontic treatment. Its flagship product, Invisalign, is used by orthodontists and dentists worldwide to correct misaligned teeth and to improve smile aesthetics. The company also provides iTero Intraoral scanners and services, OrthoCAD digital services, and other products and services for orthodontic and restorative dentistry.

Earnings

In their report, they announced a total revenue of $901.52M USD and a net income of $41.78M USD for the period ending December 31, 2022. Compared to their results from the previous year, there was a 12.6% decrease in total revenue and a 78.1% decrease in net income. However, ALIGN TECHNOLOGY has made significant progress in the last three years, as their total revenue has increased from $834.52M USD to $901.52M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Align Technology. More…

| Total Revenues | Net Income | Net Margin |

| 3.73k | 361.57 | 9.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Align Technology. More…

| Operations | Investing | Financing |

| 568.73 | -213.32 | -501.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Align Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.95k | 2.35k | 46.61 |

Key Ratios Snapshot

Some of the financial key ratios for Align Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | 8.3% | 17.5% |

| FCF Margin | ROE | ROA |

| 7.4% | 11.2% | 6.9% |

Stock Price

The news sent ALIGN TECHNOLOGY stock up 0.9% from its prior closing price of $351.5 to open at $351.8 and close at $354.6. The company has also seen an uptick in digital marketing initiatives and consumer demand for orthodontic treatment, which has helped to boost its results. Live Quote…

Analysis

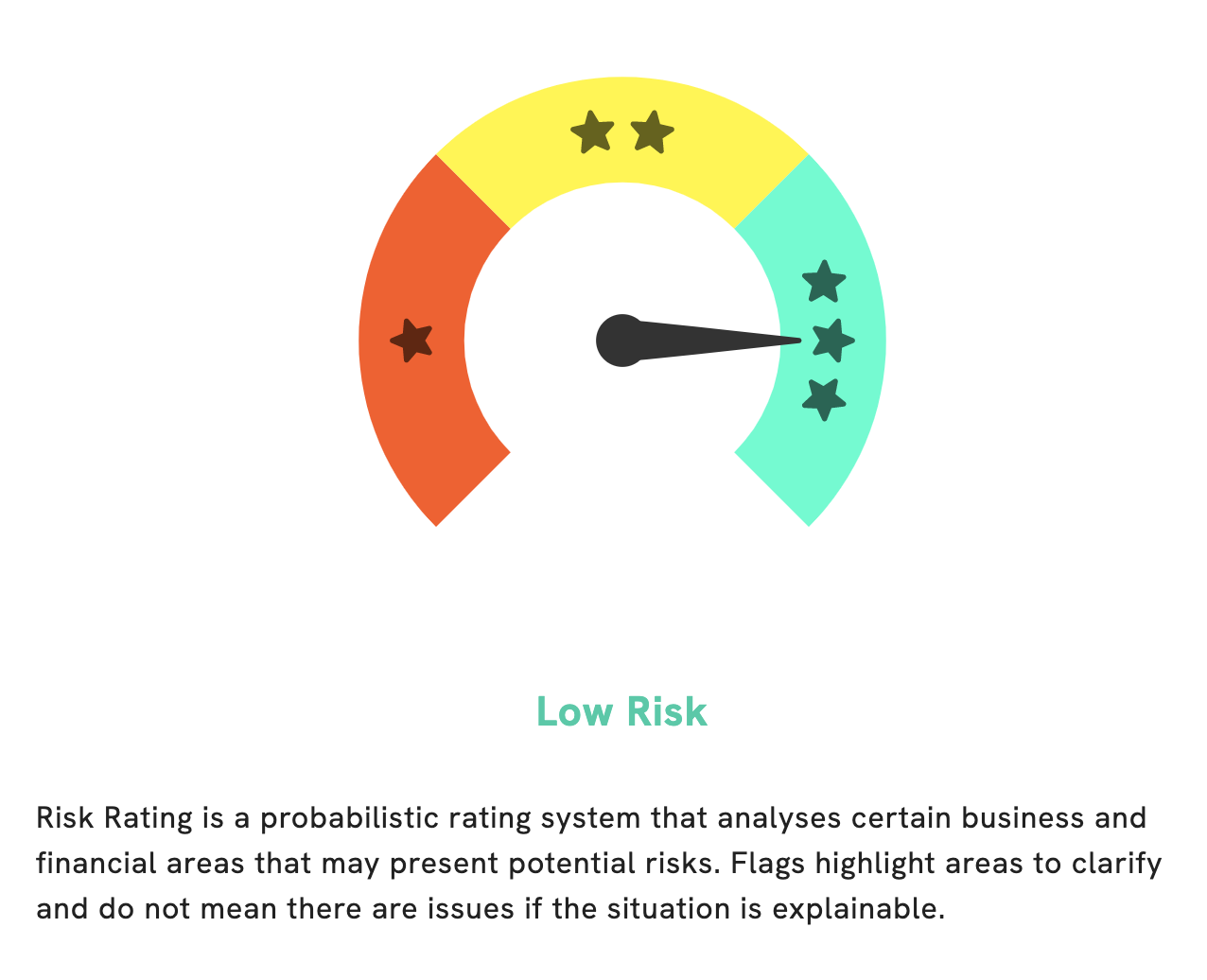

GoodWhale has conducted a thorough analysis of ALIGN TECHNOLOGY‘s financials and we have determined that ALIGN TECHNOLOGY is a low risk investment in terms of financial and business aspects. Our Risk Rating gives investors an idea of the long-term stability of a company and its ability to generate profits. However, our analysis also revealed two risk warnings within their income sheet and balance sheet. To see what these warnings are, you have to become a registered user on our platform. We believe that it’s important for investors to understand all aspects of a company before investing, so we encourage everyone to be informed before making any decisions. More…

Peers

Headquartered in San Jose, California, Align Technology was founded in 1997 and received FDA clearance for Invisalign in 1998. Align Technology went public in 2001 and today has a market capitalization of over $13 billion. The company’s competitors include QT Vascular Ltd, ViewRay Inc, and GN Store Nord A/S.

– QT Vascular Ltd ($SGX:5I0)

Ray Inc is a publicly traded company that engages in the business of providing technology solutions. Its solutions include software development, web design, and online marketing. The company’s primary focus is on small businesses. Ray Inc has a market cap of 704.13M as of 2022 and a Return on Equity of -75.17%. Ray Inc’s market cap is 704.13M, which means it has a market value of 704.13M. Ray Inc’s ROE of -75.17% means that it has a negative net income. This is likely due to the company’s expenses exceeding its revenue.

– ViewRay Inc ($NASDAQ:VRAY)

A.P. Moller – Maersk is an integrated logistics company. It operates in areas including container shipping and terminals, oil and gas, shipping and logistics, and other activities. The company has a market cap of 19.32B as of March 2021 and a return on equity of 13.56%. A.P. Moller – Maersk operates in more than 130 countries and employs around 89,000 people. The company was founded in 1904 and is headquartered in Copenhagen, Denmark.

Summary

Align Technology released its third quarter earnings report, showing non-GAAP earnings per share (EPS) of $1.82, exceeding analysts’ expectations by $0.13. Revenue for the quarter was also impressive, coming in at $943.1 million, beating estimates by $39.9 million. This marks the fourth consecutive quarter of year-over-year revenue growth for Align Technology, demonstrating the company’s strong performance and ability to successfully capitalize on market trends. Investors should continue to watch for further growth in the coming quarters.

Recent Posts