Select Medical Intrinsic Value Calculator – Select Medical Reports $0.37 GAAP EPS, Misses Estimate by $0.05 and Revenue of $1.6B by $50M

May 5, 2023

Trending News 🌧️

Select Medical ($NYSE:SEM) Holdings Corporation is a healthcare company specializing in providing inpatient and outpatient rehabilitation services. The company recently reported its financial results for the quarter ending March 31st.

Additionally, revenues of $1.6B were lower than anticipated by $50M. The company’s lack of meeting estimates may have been due to the fact that the healthcare industry has seen a dramatic shift in recent months due to the pandemic. Many hospitals and healthcare facilities have had to shift their operations in order to accommodate for the virus, leading to financial strain for many companies in the industry. Despite this, Select Medical is still in a relatively strong position compared to its peers in the industry.

Earnings

Compared to the same quarter last year, SELECT MEDICAL reported a 1.4% increase in total revenue and a 44.8% decrease in net income. Despite the increase in revenue, net income has seen a decline over the same time period.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Select Medical. More…

| Total Revenues | Net Income | Net Margin |

| 6.33k | 153.38 | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Select Medical. More…

| Operations | Investing | Financing |

| 284.82 | -226.34 | -34.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Select Medical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.67k | 6.27k | 8.82 |

Key Ratios Snapshot

Some of the financial key ratios for Select Medical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.1% | -5.1% | 6.8% |

| FCF Margin | ROE | ROA |

| 1.5% | 24.1% | 3.5% |

Market Price

The stock opened at $29.0, and closed at the same price, down by 1.1% from its last closing price of 29.3. Investors were not pleased with the results, as evidenced by the stock performance. Live Quote…

Analysis – Select Medical Intrinsic Value Calculator

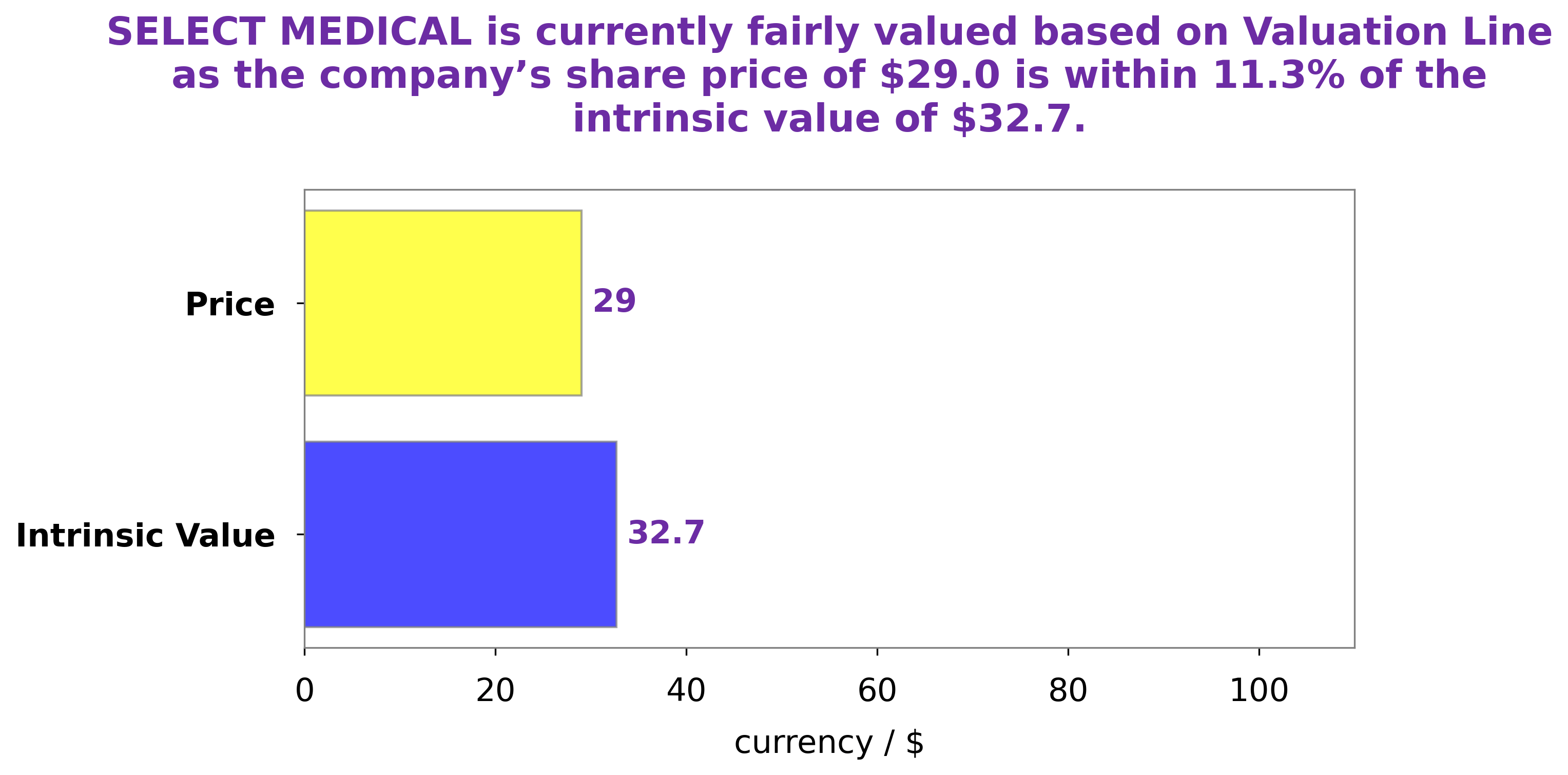

At GoodWhale, we have been carefully analyzing SELECT MEDICAL‘s fundamentals in order to provide our investors with the best possible assessment of the company’s intrinsic value. According to our proprietary Valuation Line, the intrinsic value of SELECT MEDICAL’s share is around $32.7. At present, the stock is being traded at $29.0 – a price that is undervalued by 11.3%. This presents an excellent opportunity for investors to purchase SELECT MEDICAL shares and benefit from their future appreciation. More…

Peers

The company’s competitors include Eukedos SpA, Med Life SA, Athens Medical Centre SA, and other similar companies.

– Eukedos SpA ($LTS:0Q8E)

Eukedos SpA is a pharmaceutical company that focuses on the development and commercialization of drugs for the treatment of rare diseases. The company has a market cap of 28.09M as of 2022 and a Return on Equity of 10.29%. Eukedos SpA is headquartered in Milan, Italy.

– Med Life SA ($LTS:0RO5)

MedLife SA is a publicly traded company with a market capitalization of 2B as of 2022. The company’s return on equity is 22.48%. MedLife SA is a leading provider of medical and healthcare services in South America. The company offers a full range of services including primary care, hospital care, specialty care, and behavioral health services. MedLife SA also has a strong presence in the insurance and managed care markets.

– Athens Medical Centre SA ($LTS:0ONM)

Athens Medical Centre SA is a medical company that operates in Greece. The company has a market cap of 117.53M as of 2022 and a return on equity of 18.02%. The company provides medical services and products to patients in Greece. Athens Medical Centre SA operates in the following segments: Medical Services, Medical Products, and Other. The Medical Services segment provides medical services to patients in Greece. The Medical Products segment provides medical products to patients in Greece. The Other segment includes activities such as real estate and investments.

Summary

Revenue was also slightly lower than expected, with the company reporting $1.6 billion in revenue – $50 million less than what analysts had anticipated. The stock price fell after the announcement and investors are now reassessing Select Medical‘s financial outlook. The company’s future earnings will likely be closely monitored, as investors seek to determine whether the company can return to its previous growth trajectory or if they will need to adjust their investment strategies.

Recent Posts