InvestorsObserver Rates Option Care Health Inc a Smart Choice in Medical Care Facilities.

February 5, 2023

Trending News ☀️

Option Care Health ($NASDAQ:OPCH) Inc is a leading provider of home and alternate site infusion services in the United States. The company has a solid balance sheet and consistently generates solid cash flow from its operations.

Additionally, Option Care Health Inc has a diversified revenue stream that includes both home infusion services and specialty pharmacy services, providing a stable platform for long-term growth. Option Care Health Inc also has an experienced management team that has extensive experience in the industry and a strong focus on customer service. The company is committed to providing quality care to its patients and is constantly looking for ways to improve its offerings. This commitment to quality has helped Option Care Health Inc build a strong reputation among its peers in the industry. In addition to its financial stability, Option Care Health Inc has an impressive track record of delivering value to investors. This makes it an attractive investment opportunity for investors looking for a high-quality medical care facility with a great track record of delivering long-term value. The company’s solid balance sheet, diversified revenue streams, and commitment to quality customer service make it an excellent choice for investors looking for long-term value.

Share Price

Option Care Health Inc has been receiving a lot of positive attention from the media lately, and it appears that investors have taken note. On Tuesday, the stock opened at $28.3 and closed at $28.9, up by 2.1% from last closing price of 28.3. Their wide range of services includes infusion therapies, home health care, specialty pharmacy services, and medical equipment rental.

In addition, they also offer managed care solutions and payment services to their customers. The company is committed to providing exceptional customer service and quality care to their patients. They take pride in their commitment to patient safety and satisfaction, and their focus on innovation and quality of care. Option Care Health Inc is dedicated to providing a comprehensive suite of services to meet the needs of their patients, while also offering cost-effective solutions to help them manage their health care costs. It seems that investors are taking note of Option Care Health Inc’s commitment to quality care and customer service, which is why they have rated the company a smart choice in medical care facilities. With their strong commitment to quality care and innovation, it’s no surprise that Option Care Health Inc is becoming a popular choice for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for OPCH. More…

| Total Revenues | Net Income | Net Margin |

| 3.84k | 178.49 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for OPCH. More…

| Operations | Investing | Financing |

| 289.4 | -185.37 | -49.42 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for OPCH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.07k | 1.74k | 7.35 |

Key Ratios Snapshot

Some of the financial key ratios for OPCH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.4% | 70.8% | 6.3% |

| FCF Margin | ROE | ROA |

| 6.7% | 11.5% | 4.9% |

Analysis

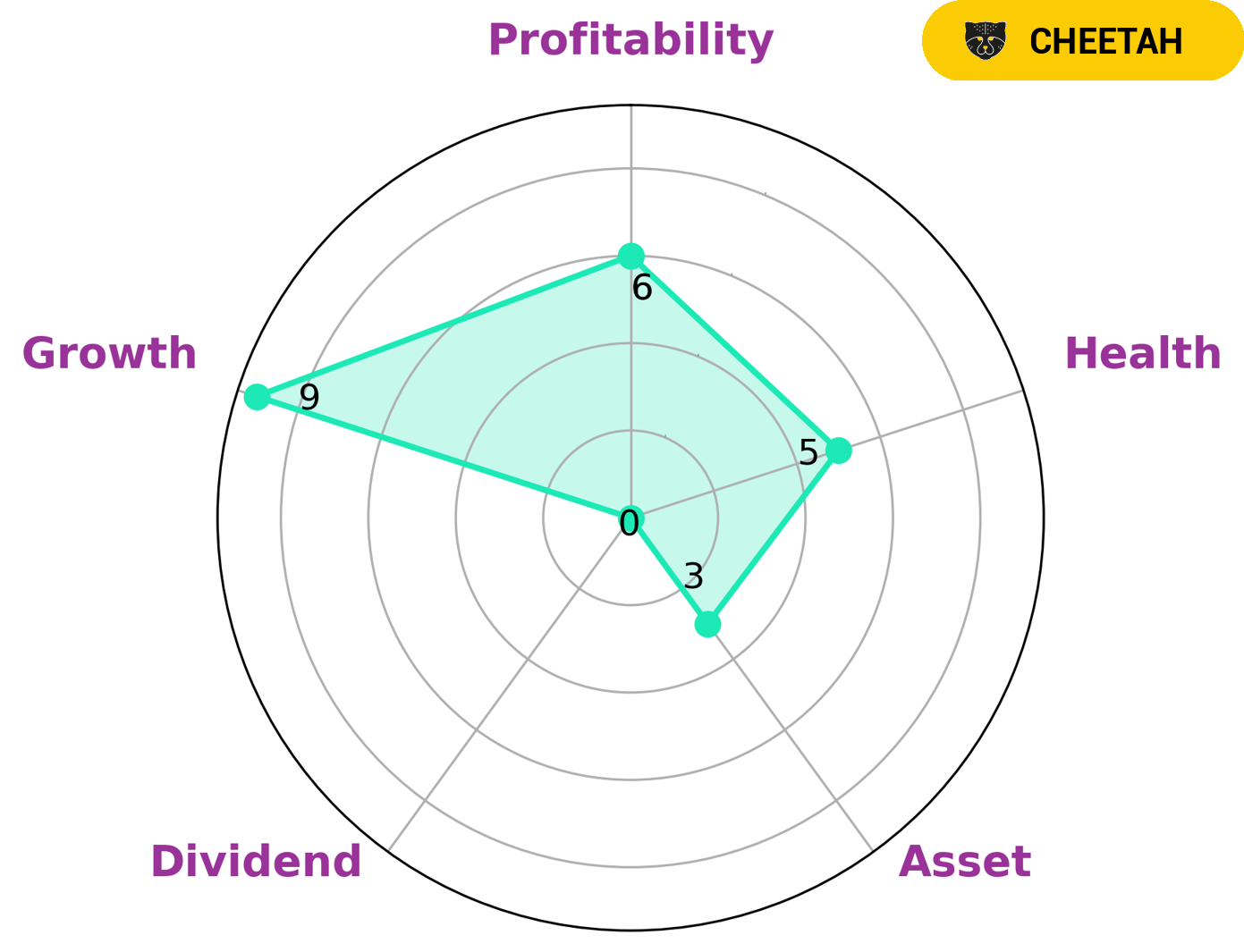

Option Care Health is a company that has been analyzed through GoodWhale’s Star Chart, which assesses the financial performance of a company in terms of growth, profitability, asset, and dividend. The analysis revealed that Option Care Health is strong in growth, moderately profitable, and weak in asset and dividend. It has an intermediate health score of 5/10 with regard to its cashflows and debt, suggesting that it is likely to pay off debt and fund future operations. Based on this analysis, Option Care Health is classified as a ‘cheetah’, which is a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who may be interested in such companies are those who are looking for higher growth without sacrificing too much stability. These investors may be willing to take on some risk in order to potentially achieve higher returns. They should conduct further research into the company’s financials before investing. More…

Peers

The company’s competitors include LHC Group Inc, Singapore Paincare Holdings Ltd, and New York Health Care Inc.

– LHC Group Inc ($NASDAQ:LHCG)

LHC Group Inc is a healthcare provider that offers a wide range of services to its patients. Its services include home health, hospice, community care, and other services. The company has a market cap of 5.14B as of 2022 and a return on equity of 5.37%. The company’s main focus is on providing quality care to its patients and their families.

– Singapore Paincare Holdings Ltd ($SGX:FRQ)

Singapore Paincare Holdings Ltd has a market cap of 36.82M as of 2022. The company’s Return on Equity for the same year is 13.23%.

Singapore Paincare Holdings Ltd is a healthcare company that focuses on the provision of pain management solutions. The company offers a wide range of services including pain consultation, pain relief treatments, and rehabilitation programs. Singapore Paincare Holdings Ltd also provides education and training on pain management for both healthcare professionals and the general public.

– New York Health Care Inc ($OTCPK:BBAL)

New York Health Care Inc is a healthcare company with a market cap of 335.37k as of 2022. It has a Return on Equity of 21.67%. The company provides healthcare services to patients in the New York area.

Summary

Option Care Health Inc. is a medical care facility that has been receiving positive media attention. The company has a strong financial outlook, with a robust balance sheet and good cash flow. Additionally, its competitive advantages include a low cost structure and a diversified customer base. Option Care Health Inc. is well positioned to capitalize on growth opportunities in the healthcare sector and is an attractive option for investors looking to add healthcare exposure to their portfolios.

Recent Posts