Boston Trust Walden Corp Reports Decrease in UnitedHealth Group Holdings, But Healthcare Conglomerate Sees Continued Growth in 2023.

March 30, 2023

Trending News ☀️

HEALTHCARE ($NASDAQ:HCSG): The Boston Trust Walden Corp recently reported a decrease in UnitedHealth Group Holdings, the healthcare conglomerate. Despite this decrease, the conglomerate still shows signs of growth this year, with potential to continue that growth into 2023.

Additionally, many healthcare providers have seen their expenses increase, leading to a decrease in the conglomerate’s profits. Despite this decrease, UnitedHealth Group Holdings is still growing. The conglomerate has been expanding its services and offerings to better serve its customers and provide more reliable healthcare services. This expansion will provide additional benefits to those enrolled in the program, such as lower premiums, more personal care and increased access to specialty care. Additionally, UnitedHealth Group Holdings is investing heavily in technology and is focusing on developing innovative solutions to improve the quality of healthcare services. This includes developing software to improve patient experience, as well as improving communication between patients and providers. The conglomerate is investing in technology and expanding its services to better serve its customers and provide reliable healthcare services.

Market Price

Despite the decrease, the healthcare conglomerate is predicted to experience continued growth for the foreseeable future. HEALTHCARE SERVICES stock opened at $13.6 and closed at $13.6, up by 0.8% from the day before. This positive performance suggests there may be renewed confidence in the company’s ability to continue its steady growth. Analysts are predicting that the company will continue to grow significantly throughout 2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Healthcare Services. More…

| Total Revenues | Net Income | Net Margin |

| 1.69k | 34.63 | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Healthcare Services. More…

| Operations | Investing | Financing |

| -8.17 | 2.58 | -38.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Healthcare Services. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 718.33 | 292.16 | 5.75 |

Key Ratios Snapshot

Some of the financial key ratios for Healthcare Services are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.8% | -19.6% | 2.8% |

| FCF Margin | ROE | ROA |

| -0.8% | 7.1% | 4.2% |

Analysis

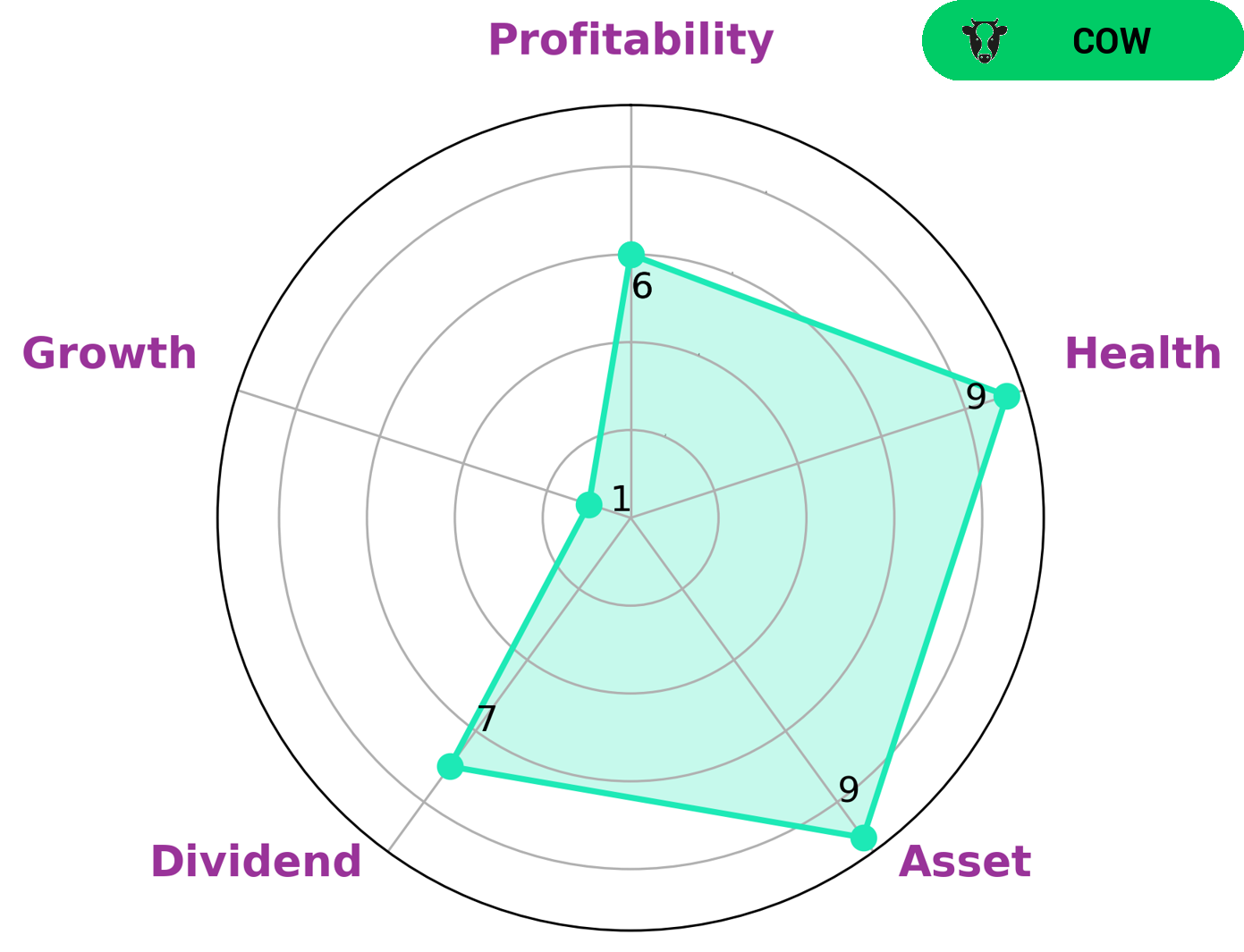

GoodWhale recently conducted an analysis of HEALTHCARE SERVICES‘s fundamentals. We found that the company scored highly in our Star Chart, with strong asset, dividend, and medium profitability scores and a weaker growth score. Moreover, HEALTHCARE SERVICES achieved a health score of 9/10, which indicates the company is well-positioned to continue operating even in times of unexpected crisis. Based on this information, we concluded that HEALTHCARE SERVICES is a ‘cow’ – a type of company that has been consistently and sustainably paying out dividends. Investors looking for consistent and reliable income streams should consider investing in HEALTHCARE SERVICES, especially those with a long-term investment strategy. More…

Peers

Companies such as Cross Country Healthcare Inc, Nexteligent Holdings Inc, and AMN Healthcare Services Inc all present stiff competition in the market, making it a highly competitive environment. Although each company has its own unique strategy, they all share a common goal of providing the best healthcare services possible to their customers.

– Cross Country Healthcare Inc ($NASDAQ:CCRN)

Cross Country Healthcare Inc is a leading provider of healthcare staffing and workforce solutions for healthcare organizations in the United States. With a market cap of 990.94M as of 2023, it is one of the most influential players in the healthcare staffing industry. The company also has a strong return on equity (ROE) of 44.54%, indicating that it has been able to generate a healthy return on its investments. Cross Country Healthcare Inc provides a range of services to healthcare organizations, including temporary and permanent placement of nurses and allied professionals, travel nurse and allied staffing, managed services programs, and recruitment process outsourcing.

– Nexteligent Holdings Inc ($OTCPK:NXGT)

AMN Healthcare Services Inc is a healthcare staffing and workforce solutions company based in San Diego, California. It provides healthcare staffing, recruitment process outsourcing, and consulting services to healthcare organizations and healthcare providers. The company has a market capitalization of 4.46 billion dollars as of 2023 and a return on equity of 40.08%. This indicates that the company is performing well financially and has been able to generate significant returns for its shareholders. Furthermore, the market capitalization implies that the stock is highly valued by investors, making it attractive for potential investors.

Summary

UnitedHealth Group, one of the largest healthcare conglomerates in the world, has seen a decrease in holdings reported by the Boston Trust Walden Corp. Despite this, the company expects to continue to grow throughout 2023. Healthcare services represent an increasingly attractive option for investors looking for a stable return. With an aging population and increasing global demand for health services, healthcare stocks and related investements offer a good opportunity to capitalize on long-term growth.

Investing in healthcare services is a smart choice given the sector’s diverse and expanding range of products, services and technologies. The sector is also resilient to economic downturns, making it attractive to investors.

Recent Posts