Apollo Medical Stock Intrinsic Value – Apollo Medical Struggling to Convert Capital into Market Value

May 19, 2023

Trending News 🌧️

Apollo Medical ($NASDAQ:AMEH) is a healthcare technology company that has been attempting to convert its additional capital into market value. They have been investing heavily in research and development, and have managed to successfully develop solutions that are used by many healthcare providers around the world. Despite their success in developing innovative solutions, the company’s stock prices have remained largely stagnant since their inception. This stagnation has been attributed to a number of factors, such as a lack of visibility among investors, and the difficulty of predicting the long-term potential of the company’s solutions. In order to address these issues, Apollo Medical has begun to invest heavily in marketing and customer acquisition.

They are aiming to increase their visibility among investors by increasing the number of customers that use their services, and by creating partnerships with larger healthcare organizations. They are also actively engaging with investors to explain the long-term potential of their solutions, as well as the positive impact they can have on the industry. Ultimately, Apollo Medical is hoping that these efforts will help them convert their additional capital into market value and enable them to continue developing innovative solutions that will benefit the healthcare industry.

Price History

On Thursday, the stock of Apollo Medical Holdings, Inc. (AMEH) opened at $33.5 and closed at $33.8, up by 0.4% from its last closing price of $33.7. The organization is facing serious challenges to convert its capital into market value as investors are worried about its long-term prospects. Investors are concerned about the growing competition in the industry, as well as the potential impact of the coronavirus pandemic on the healthcare industry as a whole. Apollo Medical Holdings has taken steps to address these issues, such as implementing cost-cutting measures, expanding its technology platform, and expanding its presence in new markets.

However, it remains to be seen if these efforts will be enough to turn the company’s stock around and enable it to create long-term value for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Apollo Medical. More…

| Total Revenues | Net Income | Net Margin |

| 1.21k | 49.41 | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Apollo Medical. More…

| Operations | Investing | Financing |

| 82.13 | -7.11 | -20.09 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Apollo Medical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 992.63 | 414.7 | 12.05 |

Key Ratios Snapshot

Some of the financial key ratios for Apollo Medical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.7% | 33.6% | 8.1% |

| FCF Margin | ROE | ROA |

| 4.9% | 11.0% | 6.2% |

Analysis – Apollo Medical Stock Intrinsic Value

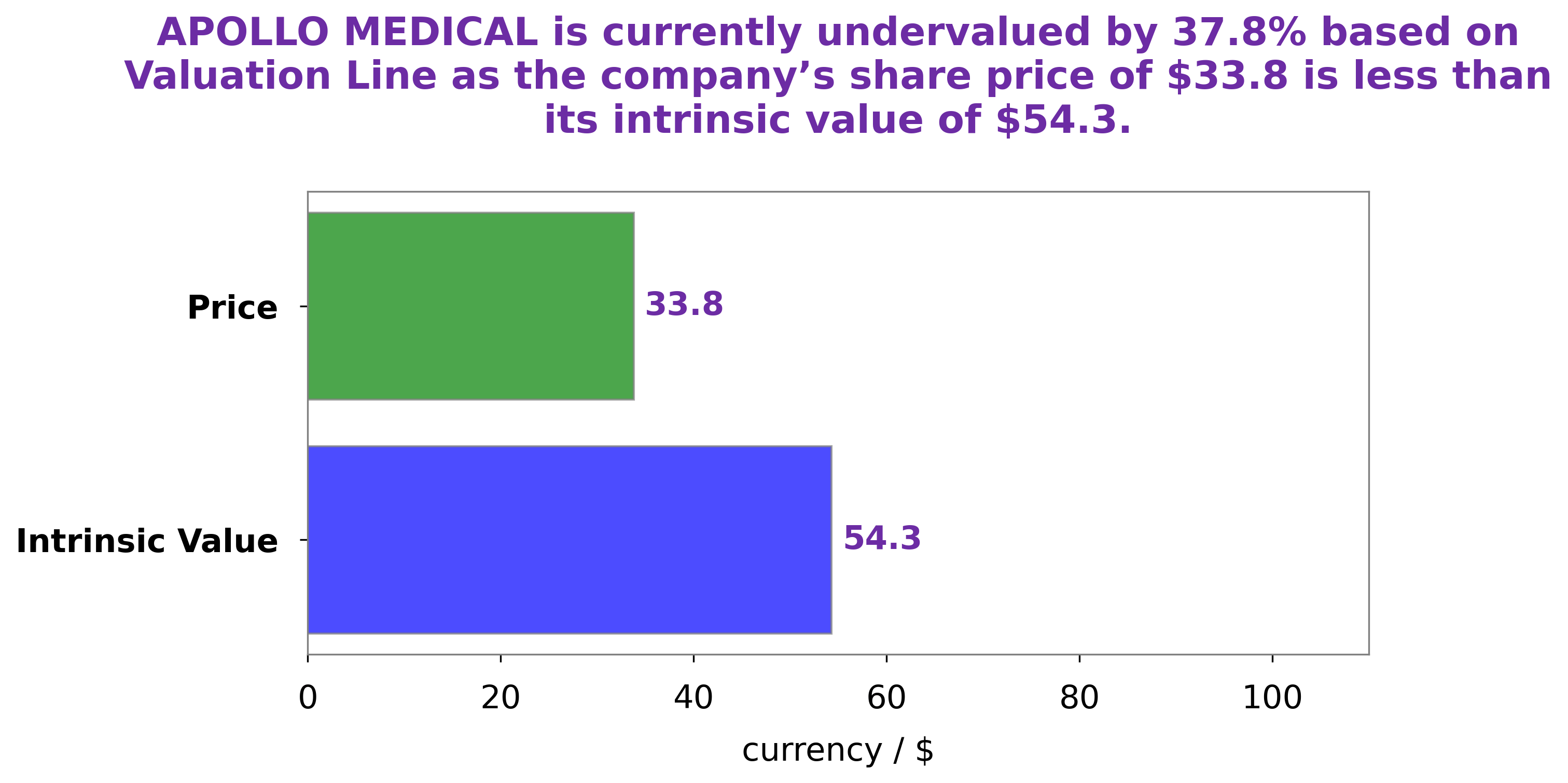

At GoodWhale, we have taken an in-depth analysis of APOLLO MEDICAL‘s financials. Our proprietary Valuation Line has calculated the intrinsic value of APOLLO MEDICAL shares to be around $54.3. However, it is currently trading at $33.8, representing a 37.7% discount from its intrinsic value. This indicates that there may be an opportunity to purchase APOLLO MEDICAL shares at a bargain at the moment. More…

Peers

The healthcare industry is highly competitive, with Apollo Medical Holdings Inc competing against some of the largest companies in the world.

However, Apollo has been able to maintain a strong position in the industry through its innovative products and services. The company has a strong focus on research and development, which has allowed it to bring new and innovative products to market. Additionally, Apollo has a strong marketing and sales force that has helped it to gain market share.

– HealthCare Global Enterprises Ltd ($BSE:539787)

HealthCare Global Enterprises Ltd has a market cap of 41.71B as of 2022, a Return on Equity of 13.62%. The company is a leading provider of healthcare services in India with a network of over 30 hospitals across the country. The company offers a comprehensive range of services including medical and surgical care, diagnostics, and preventive healthcare.

– Cano Health Inc ($NYSE:CANO)

Cano Health Inc is a healthcare services company that operates primary care and specialty care clinics in the United States. The company has a market cap of 828.58M as of 2022 and a Return on Equity of -2.88%. Cano Health Inc provides healthcare services to patients through its network of primary care and specialty care clinics. The company offers a range of services including primary care, specialty care, and behavioral health services. Cano Health Inc also provides pharmacy services and operates a laboratory.

– Dhanvantri Jeevan Rekha Ltd ($BSE:531043)

Dhanvantri Jeevan Rekha Ltd is a publicly traded company with a market cap of 64.14M as of 2022. The company’s Return on Equity is 3.31%. Dhanvantri Jeevan Rekha Ltd is engaged in the business of providing healthcare services in India. The company offers a wide range of services including medical consultation, diagnostics, surgery, and other treatments.

Summary

Apollo Medical (APO) is a healthcare company that has seen significant capital investment in recent years, yet struggles to turn it into market value. Analysts suggest that investors must pay attention to the company’s fundamentals, such as revenue growth, EPS, and cash flow, to determine its true potential. APO’s stock price has been relatively stagnant despite the influx of capital, a sign that investors may not have confidence in the company’s ability to deliver returns.

In addition to financial performance, investors should also consider risk factors such as competitive landscape and regulatory landscape in order to gain insight into the company’s future. While the stock price may not currently reflect the company’s potential, investors should assess Apollo Medical thoroughly and see if it is a good fit for their portfolios.

Recent Posts