Acadia Healthcare Intrinsic Value Calculator – ACADIA HEALTHCARE Reports Strong Earnings and Revenue Growth

April 27, 2023

Trending News ☀️

Acadia Healthcare ($NASDAQ:ACHC), a leading provider of behavioral health and addiction services, recently reported strong earnings and revenue growth for their latest quarter. Acadia Healthcare is a leading provider of mental health, behavioral health, and addiction services for children, adolescents, adults, and seniors. The company offers a wide range of behavioral health programs and services in its facilities, including inpatient psychiatric care and residential treatment centers. The company’s strong earnings and revenue growth is a testament to their commitment to providing high-quality, comprehensive behavioral health and addiction services.

Their success is also indicative of the growing need for these services throughout society as well as the growing recognition of the importance of mental health care. Going forward, Acadia Healthcare is expected to continue to benefit from increased demand for their services, and investors are looking forward to more positive news from the company in the future.

Market Price

ACADIA HEALTHCARE reported strong earnings and revenue growth on Wednesday, causing the stock to open at $74.0 and close at $74.1, a 0.4% increase from the prior closing price of $73.8. The strong earnings and revenue growth can be attributed to the company’s strategic decisions to expand operations and focus on customer service. Further, ACADIA HEALTHCARE’s cost-cutting initiatives have helped to improve overall financial performance. The results of their efforts have been promising, as the company has seen its stock price rise steadily over the past year.

Shareholders have reacted positively to the news, as they expect the trend to continue. Overall, the strong earnings and revenue growth reported by ACADIA HEALTHCARE is a positive sign for investors, as it suggests that the company is on the right path to long-term success. As the company continues to take strategic steps to improve operations and customer service, shareholders can look forward to continued growth in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Acadia Healthcare. More…

| Total Revenues | Net Income | Net Margin |

| 2.61k | 273.14 | 11.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Acadia Healthcare. More…

| Operations | Investing | Financing |

| 380.57 | -305.83 | -110.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Acadia Healthcare. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.99k | 2.09k | 31.28 |

Key Ratios Snapshot

Some of the financial key ratios for Acadia Healthcare are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.6% | 5.0% | 17.0% |

| FCF Margin | ROE | ROA |

| 3.2% | 10.0% | 5.6% |

Analysis – Acadia Healthcare Intrinsic Value Calculator

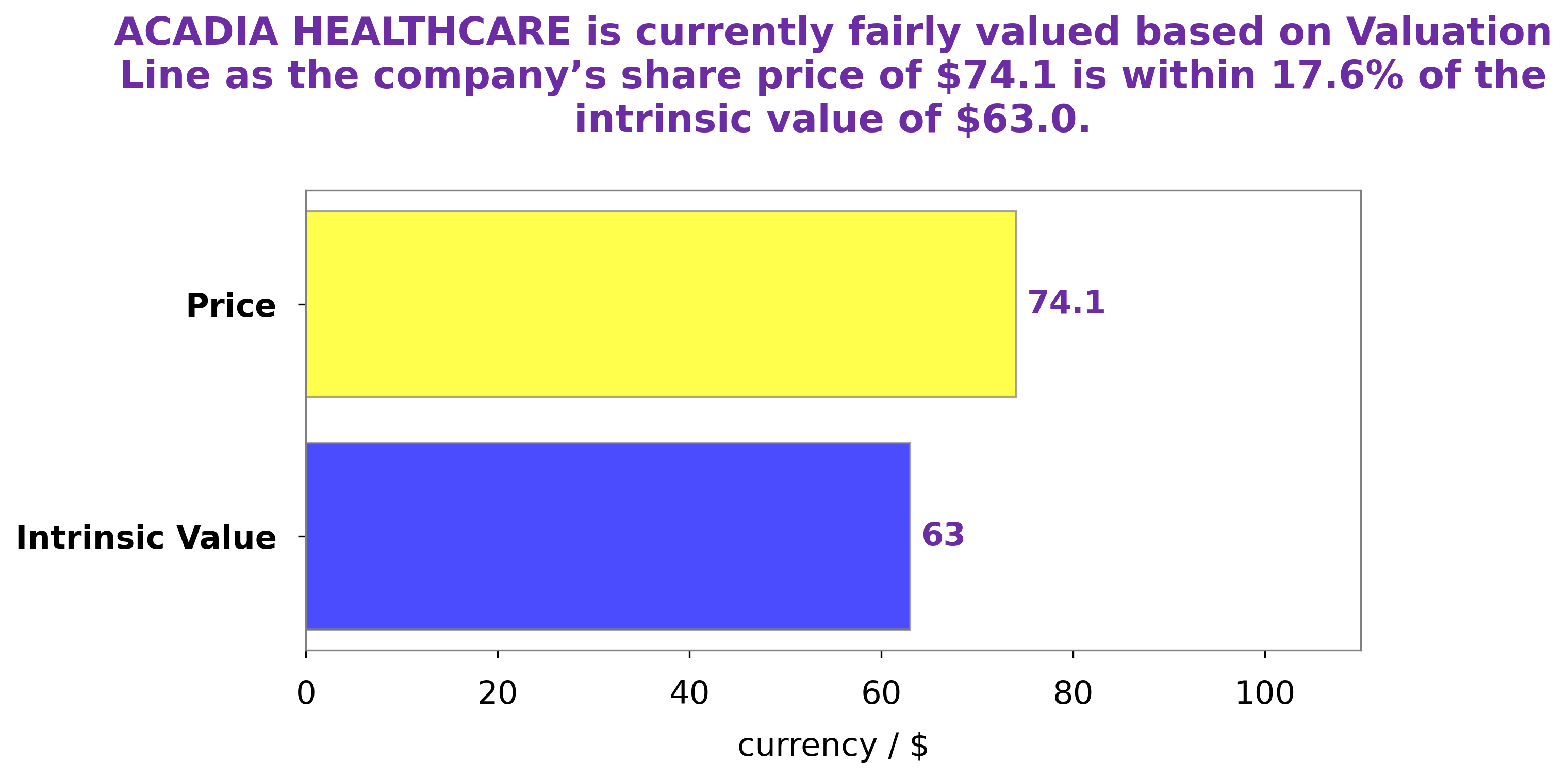

GoodWhale recently conducted an analysis of ACADIA HEALTHCARE‘s wellbeing. Through our proprietary Valuation Line, we determined that the intrinsic value of ACADIA HEALTHCARE share is around $63.0. Currently, ACADIA HEALTHCARE stock is traded at $74.1, meaning that the stock is fairly priced but slightly overvalued at 17.5%. It is important to continue to monitor the stock price of ACADIA HEALTHCARE as values may continue to fluctuate, and which will ultimately determine the return of investment. More…

Peers

The Company offers inpatient and outpatient behavioral healthcare services to children, adolescents, adults, and seniors through its facilities in the United States, United Kingdom, and Puerto Rico. Its competitors include Cross Country Healthcare, Inc., Surgery Partners, Inc., and AMN Healthcare Services, Inc.

– Cross Country Healthcare Inc ($NASDAQ:CCRN)

Cross Country Healthcare, Inc. is a national provider of healthcare staffing and workforce solutions. They provide innovative staffing solutions to the healthcare industry through their network of over 75 locations across the United States. Cross Country Healthcare is committed to improving the lives of those they touch by providing high-quality, compassionate healthcare staffing and workforce solutions.

– Surgery Partners Inc ($NASDAQ:SGRY)

Surgery Partners Inc is a healthcare services company that owns and operates surgical facilities and ancillary services in the United States. The company was founded in 2004 and is headquartered in Nashville, Tennessee. As of 2022, Surgery Partners had a market capitalization of $2.36 billion and a return on equity of 26.22%. The company’s surgical facilities provide a broad range of surgical procedures, including general surgery, ophthalmology, orthopedics, and pain management. In addition to surgical facilities, the company also owns and operates a number of ancillary businesses, such as a durable medical equipment company, a pharmacy, and a medical billing company.

– AMN Healthcare Services Inc ($NYSE:AMN)

The company’s market cap and ROE are impressive, and it is clear that the company is doing well. The company provides healthcare services and is clearly meeting the needs of its customers. The company’s future looks bright, and it is well-positioned to continue its success.

Summary

Non-GAAP EPS of $0.75 beat estimates by 4 cents, while revenue of $704.3M beat estimates by $14.31M. ACADIA Healthcare is well-positioned to continue delivering strong results, providing investors with an attractive investment opportunity.

Recent Posts