Vornado Realty Trust Reports $600M Non-Cash Impairment Charges for Q4, with $480M Relating to Equity Investment in Fifth Avenue and Times Square Joint Venture.

February 2, 2023

Trending News ☀️

Vornado Realty Trust ($NYSE:VNO) is a publicly traded real estate investment trust (REIT) that owns and manages commercial properties in the United States. It specializes in office, industrial, retail, and mixed-use properties across the country. On Tuesday, Vornado Realty Trust reported that its fourth quarter results will feature non-cash impairment charges of approximately $600 million, with an estimated $480 million of this amount being attributed to its equity investment in the Fifth Avenue and Times Square joint venture. In April 2019, Vornado received a gain of approximately $2.56 billion when it moved seven retail properties to the joint venture. As a result of this transaction, the company needed to adjust its retained interest in the properties to their fair market value. The company’s total impairment charges for the fourth quarter are expected to be slightly higher than the $600 million attributed to the joint venture.

This is due to additional assets being written down during the quarter. Vornado Realty Trust also reported that these non-cash impairments will not have any impact on its operating results or cash flow. Vornado Realty Trust’s recent impairment charges are part of the company’s ongoing effort to maintain a strong balance sheet and continue to capitalize on opportunities that create value for its shareholders. The company remains confident in its ability to identify and pursue these value-creation opportunities while protecting its balance sheet.

Stock Price

On Tuesday, the stock opened at $23.4 and closed at $24.4, up by 4.1% from the previous closing price of 23.4. Despite this, Vornado Realty Trust has seen strong growth in its rental income, due largely to its diversified portfolio of properties across different sectors such as retail, office and industrial. Overall, despite incurring the non-cash impairment charges, Vornado Realty Trust has seen a positive response from investors and analysts alike. The positive sentiment is likely due to the company’s strong fourth quarter performance and its diversified portfolio of properties across different sectors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VNO. More…

| Total Revenues | Net Income | Net Margin |

| 1.77k | 95.9 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VNO. More…

| Operations | Investing | Financing |

| 843.53 | -989.45 | -1.15k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VNO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.18k | 10k | 27.4 |

Key Ratios Snapshot

Some of the financial key ratios for VNO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 15.6% |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

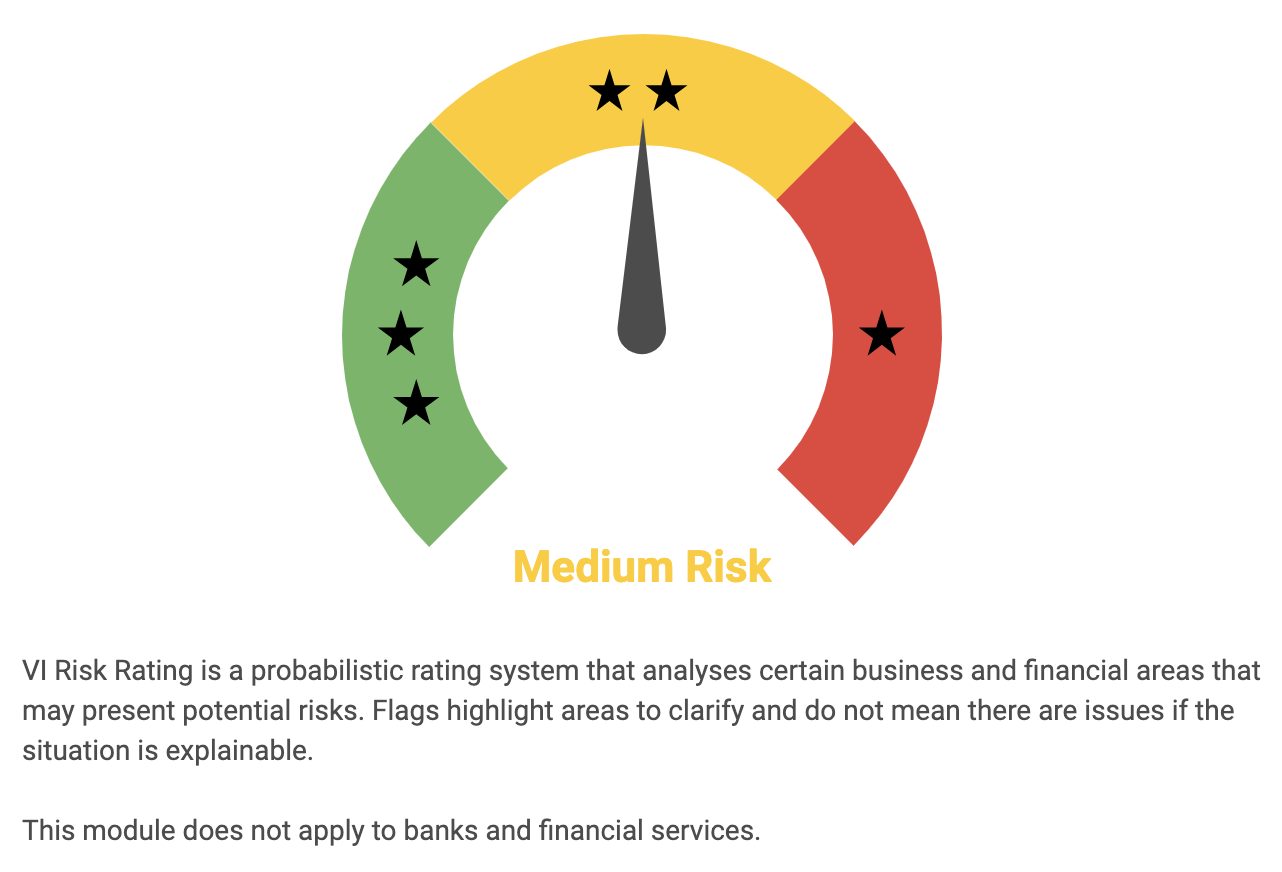

In order to assess its potential, the VI app makes it easier to take into account the company’s fundamentals. The VI App has identified one risk warning from the balance sheet. It is recommended to register on vi.app in order to check out the details of this warning. To further assess the company’s future potential, investors should analyze the company’s financial statements and other required documents. Investors should also be aware of the risks associated with investing in any company. These include market risk, currency risk, liquidity risk, and political risk.

Additionally, investors should always be aware of the possibility of changes in company management, which may affect the company’s potential in the long term. When investing in VORNADO REALTY TRUST, investors should also be aware of the competitive environment and any potential risks or opportunities that may arise from it. Additionally, investors should pay attention to macroeconomic factors such as economic growth and inflation, as these can have a significant impact on investors’ returns. Overall, VORNADO REALTY TRUST appears to be a good option for long-term investors, but it is important to consider all relevant factors before investing. The VI App can provide investors with a comprehensive assessment of the company’s risk profile and help them make an informed decision.

Peers

Vornado owns and operates office, retail, and hotel properties in the United States. The company was founded in 1959 and became a public company in 1971. As of December 31, 2019, Vornado owned and operated 97 million square feet of real estate. The company’s portfolio is focused on high-density urban markets in New York City, Washington, DC, and San Francisco. Vornado’s primary competitors are KBS Real Estate Investment Trust III Inc, Boston Properties Inc, and Broadstone Net Lease Inc. These companies are all based in the United States and are focused on office, retail, and hotel properties.

– KBS Real Estate Investment Trust III Inc ($OTCPK:KBSR)

KBS Real Estate Investment Trust III Inc is a real estate investment trust that owns and operates a portfolio of properties in the United States. The company’s portfolio includes office, retail, industrial, and hotel properties. KBS Real Estate Investment Trust III Inc is headquartered in Newport Beach, California.

– Boston Properties Inc ($NYSE:BXP)

Boston Properties Inc is a real estate investment trust that owns, manages, and develops properties in the United States. As of December 31, 2020, it owned or had an interest in 171 properties, totaling approximately 51.4 million square feet. The company was founded in 1970 and is headquartered in Boston, Massachusetts.

– Broadstone Net Lease Inc ($NYSE:BNL)

The company’s market cap is 2.79B as of 2022. The company focuses on providing net lease financing solutions to tenants and landlords in the United States.

Summary

Despite the large non-cash impairment charge, media sentiment has remained mostly positive and the stock price increased the same day. Investors seeking to analyze Vornado Realty Trust should consider factors such as the current market conditions, the company’s financial performance, and its portfolio of properties to determine if an investment would be a wise decision.

Recent Posts