National Fuel Gas Co. Stock Rises 0.47%, Receives Bullish Rating from InvestorsObserver Sentiment Indicator – Is it Time to Buy?

May 4, 2023

Trending News 🌥️

National Fuel Gas ($NYSE:NFG) Co. (NFG) stock has seen a 0.47% increase over the past week, and has now been given a Bullish rating from InvestorsObserver Sentiment Indicator. With this in mind, many investors are wondering if it is time to buy NFG on Monday. National Fuel Gas is an energy-based holding company engaged in the production, gathering, transmission, and distribution of natural gas, as well as other energy-related businesses. It owns and operates natural gas pipelines, storage and other assets in New York, Pennsylvania, and Ohio. NFG also owns and operates oil and gas production and exploration in California, Texas, and other states. Given its Bullish rating, NFG stock is currently seen to have potential for investors.

However, there is no guarantee that the stock will hold up in the coming weeks. As such, investors should conduct their own research and consult a financial advisor before making any decisions to buy or sell shares of National Fuel Gas Co. However, investors should remember to do their due diligence before investing in the stock so that they can make an informed decision.

Analysis

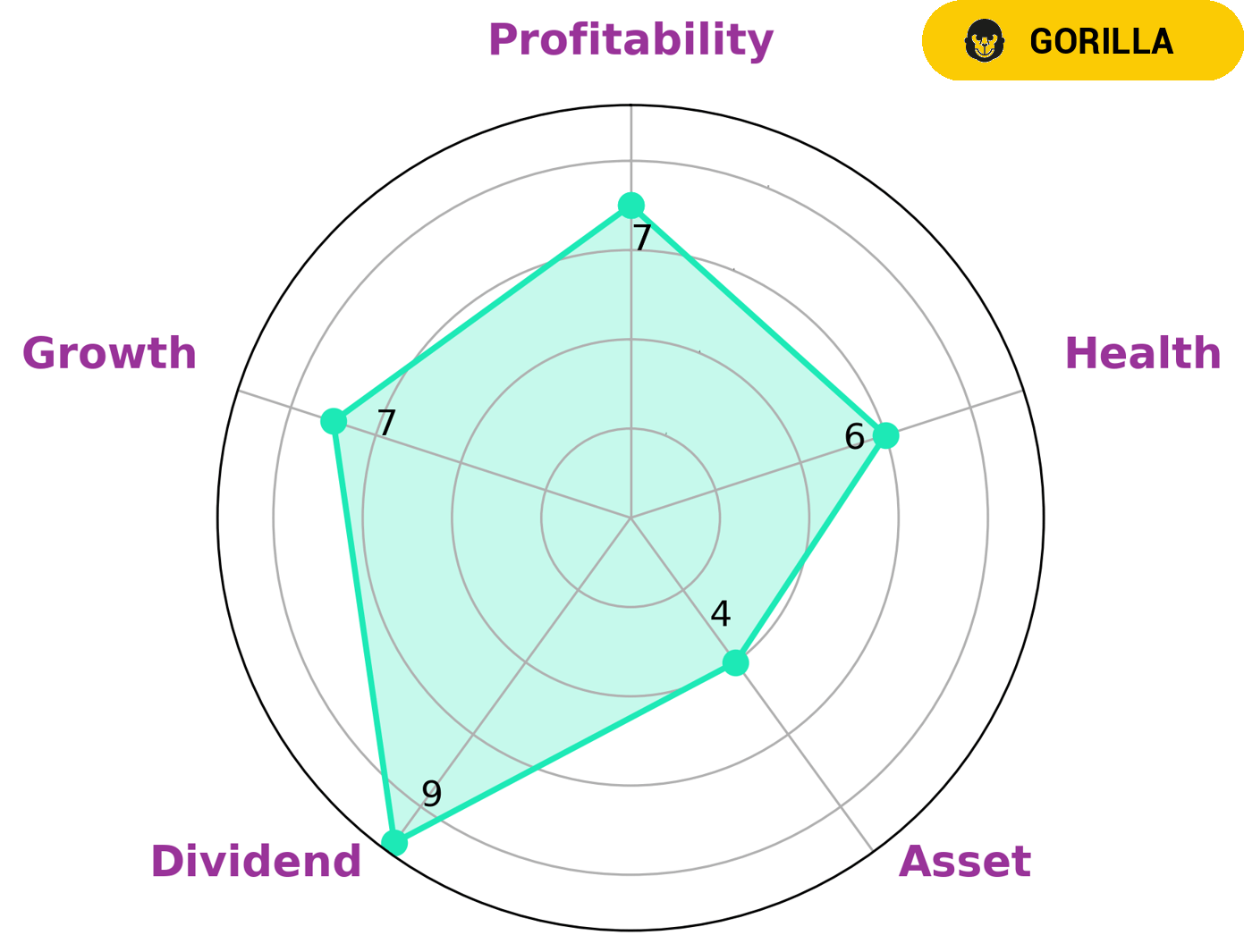

At GoodWhale, our analysis of NATIONAL FUEL GAS’s financials has classified the company as a ‘gorilla’, indicating that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes the company an attractive investment for a range of investors, from those looking for strong dividend returns to those searching for long-term growth opportunities. In terms of financial health, our score of 6/10 suggests that NATIONAL FUEL GAS is well-positioned to ride out any crisis, with cashflows and debt levels indicating that bankruptcy risks are low. The company is considered strong in dividend, growth, and profitability, with an intermediate rating in asset. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NFG. More…

| Total Revenues | Net Income | Net Margin |

| 2.3k | 603.32 | 25.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NFG. More…

| Operations | Investing | Financing |

| 968.38 | -557.83 | -243.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NFG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.13k | 5.6k | 27.64 |

Key Ratios Snapshot

Some of the financial key ratios for NFG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 19.3% | 37.6% |

| FCF Margin | ROE | ROA |

| 5.9% | 23.4% | 6.6% |

Peers

The company’s main business is natural gas and crude oil production, transportation and sale. The company operates in the United States, Canada and Argentina. National Fuel Gas Co’s main competitors are Transportadora de Gas del Sur SA, Oasis Petroleum Inc, YPF SA.

– Transportadora de Gas del Sur SA ($NYSE:TGS)

Transportadora de Gas del Sur SA is a gas transportation and distribution company operating in Argentina. The company’s market cap as of 2022 is 1.35B and its ROE is 10.03%. The company is engaged in the transportation and distribution of natural gas to industrial, commercial and residential customers in Argentina.

– Oasis Petroleum Inc ($NASDAQ:OAS)

Petróleos de Venezuela, S.A. (PDVSA) is a Venezuelan state-owned oil and natural gas company. It was created in 1976 from the nationalization of the Venezuelan oil industry. It is headquartered in Caracas and its operations are primarily focused on Venezuela’s Orinoco Belt region. The company has the largest proven reserves of crude oil in the world and is the largest producer of oil in South America.

PDVSA is a vertically integrated company that engages in all aspects of the oil and gas industry, including exploration and production, refining, marketing, and transportation. The company also has significant stakes in a number of joint ventures, most notably with Chevron, ExxonMobil, and Total.

PDVSA has a market cap of $2.94 billion as of 2022 and a return on equity of 22.79%. The company is the largest producer of oil in South America and has the largest proven reserves of crude oil in the world.

Summary

National Fuel Gas Co. (NFG) is a large energy company involved in production, transmission, distribution and storage of natural gas. Recently, analysts have been giving the stock a bullish sentiment with its stock price increasing by 0.47%, however on Monday the stock price moved down. Investors should consider carefully the risks and rewards of investing in NFG as the energy sector can be volatile. Factors to consider include the company’s financial performance, competitive advantages, and competitive landscape.

Additionally, investors should be aware of economic changes that could affect the energy industry, such as regulatory policies, technological advancements, and geopolitical developments. With these considerations in mind, investors should be able to make an informed decision on whether NFG is a good fit for their portfolio.

Recent Posts