Wells Fargo & Company Raises Price Objective for Synaptics to $115.00.

February 1, 2023

Trending News ☀️

Wells Fargo & Company recently raised its price objective for Synaptics Incorporated ($NASDAQ:SYNA) to $115.00 in a research note distributed to clients on Friday. Synaptics Incorporated is a Nasdaq-listed global leader in human interface solutions, including touch, display, and biometrics technology. The company is a pioneer in the development of Human Interface solutions that enable people to interact more intuitively and naturally with the digital world around them. Synaptics designs, develops, markets, and sells a wide range of human interface solutions, including custom integrated solutions and touchpads, capacitive touchscreens, display drivers, fingerprint sensors, and biometric security solutions. Its products are used in mobile devices, computing platforms, and other electronic systems that require human interface solutions. Synaptics also provides software solutions for touchpads, fingerprint sensors, and other human interface solutions.

Synaptics has a broad portfolio of solutions for automotive, industrial, medical, and consumer applications. Its products are well-known for their high performance and quality. Synaptics’ technology is used by some of the world’s leading companies such as Apple, Samsung, Microsoft, and many others. The company has a strong presence in the automotive market, with its products being used by some of the leading automotive brands in the world. The company’s strong performance has been reflected in its stock price performance.

Stock Price

At the time of writing, media sentiment was largely positive. On Tuesday, Synaptics Inc. stock opened at $120.8 and closed at $125.0, up by a significant 2.9% from its prior closing price of 121.5. The company’s products are used in consumer electronics, such as mobile phones, tablets, gaming consoles, and personal computers. Synaptics Inc. also provides a wide range of software solutions for its customers. It is expected that the stock will continue to perform well in the days and weeks ahead.

Investors should keep an eye on Synaptics Inc. as the company is likely to benefit from the increased demand for human interface solutions in various consumer electronics products. It is expected that the stock will continue to perform well in the days and weeks ahead. Investors should keep an eye on Synaptics Inc. as the company is likely to benefit from the increased demand for human interface solutions in various consumer electronics products. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Synaptics Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 1.82k | 281.9 | 16.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Synaptics Incorporated. More…

| Operations | Investing | Financing |

| 482.9 | -475.7 | 521.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Synaptics Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.82k | 1.5k | 33.14 |

Key Ratios Snapshot

Some of the financial key ratios for Synaptics Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 289.2% | 22.6% |

| FCF Margin | ROE | ROA |

| 23.2% | 19.8% | 9.1% |

VI Analysis

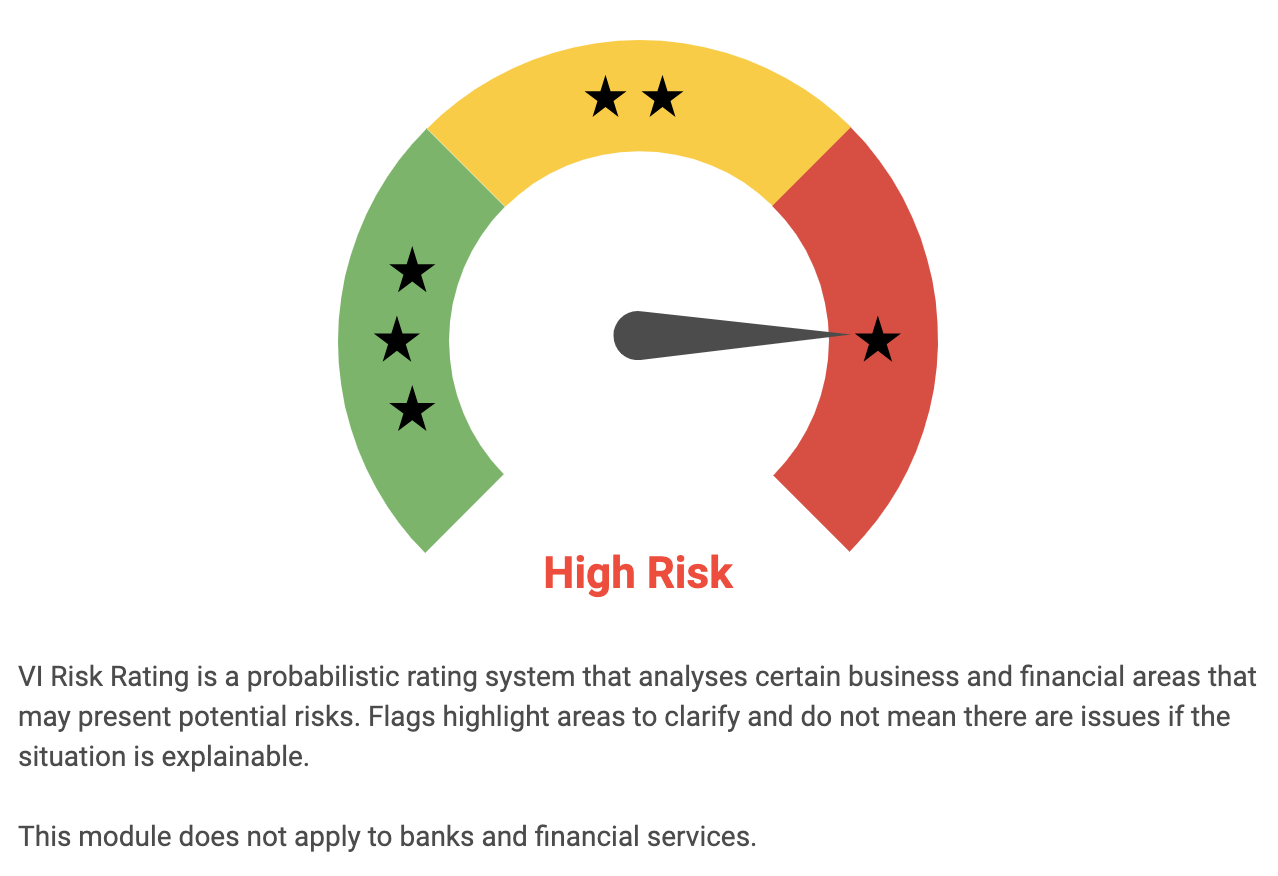

SYNAPTICS INCORPORATED‘s long-term potential can be easily analyzed with the help of the VI app. The app takes into account the company’s fundamentals and provides a VI Risk Rating. Based on the rating, SYNAPTICS INCORPORATED is considered a high risk investment from both a financial and business perspective. The VI App has detected three risk warnings in the company’s income sheet, balance sheet, and cashflow statement. These warnings are not visible to everyone, and one must become a registered user of the app to get access to this information. The main factors to consider when evaluating the company’s long-term potential are its financial health, competitive position, and management team. Financial health is important because it determines how much capital the company can use to reinvest in its business.

Moreover, it is important to understand the competitive position of the company as it will determine how well the company can compete in its industry. Finally, it is essential to assess the quality of the company’s management team as this will determine how well the company is managed and how effectively its strategies are implemented. All these factors should be taken into consideration when analyzing SYNAPTICS INCORPORATED’s long-term potential. The VI app makes this process easier by providing a comprehensive risk rating and highlighting any risk warnings that may exist. Registered users of the app can access this information to make an informed decision about investing in the company.

Peers

The company’s products are used in a variety of applications, including smartphones, tablets, notebook computers, automotive systems and industrial robotics. Synaptics’ competitors in the human interface solutions market include AP Memory Technology Corp, Giga Device Semiconductor (Beijing) Inc, Quantum eMotion Inc.

– AP Memory Technology Corp ($TWSE:6531)

Micron Technology, Inc. is an American producer of computer memory and computer data storage including dynamic random-access memory, flash memory, and USB flash drives. It is headquartered in Boise, Idaho. The company has manufacturing facilities in Asia, the United States, and Europe.

– Giga Device Semiconductor (Beijing) Inc ($SHSE:603986)

Giga Device Semiconductor (Beijing) Inc is a Chinese semiconductor company with a market cap of 57.27B as of 2022. The company has a Return on Equity of 14.43%. Giga Device Semiconductor (Beijing) Inc is a leading fabless semiconductor company that designs, develops, and markets high-performance integrated circuits (ICs). The company’s products are used in a wide range of applications, including mobile devices, computers, consumer electronics, and automotive electronics.

– Quantum eMotion Inc ($TSXV:QNC)

Quantum eMotion Inc is a publicly traded company with a market cap of 14.89M as of 2022. The company has a Return on Equity of -22.72%. Quantum eMotion Inc is a provider of digital motion capture solutions. The company’s products are used in the film, television, video game, and virtual reality industries.

Summary

Investors are encouraged to take a closer look at Synaptics Incorporated (SYNA) following the recent price objective upgrade by Wells Fargo & Company. Currently, analysts expect the stock to reach $115, a significant increase from the previous price target. In addition, media sentiment regarding the company is mostly positive, suggesting that the stock could be a good addition to any portfolio. Investors should do their own research and consider the financials and fundamentals of SYNA before making any investment decisions.

Recent Posts