Stephens Sets $78.00 Price Target for Encompass Health Stock

July 5, 2023

🌥️Trending News

Encompass Health ($NYSE:EHC) Corp (NYSE: EHC), a leading provider of post-acute healthcare services, has seen Stephens, a financial services firm, set a new price target for Encompass Health’s stock of $78.00. This price target suggests that Stephens is confident in Encompass Health’s future performance. Encompass Health is the leading provider of post-acute care services in the United States. The company offers a variety of services including inpatient rehabilitation, home health and hospice services, and long-term acute care.

Encompass Health is also the nation’s largest provider of rehabilitation services. The new price target from Stephens is evidence of the company’s strength and potential for growth. With its comprehensive portfolio of post-acute care services, Encompass Health could be a good investment for those looking to add healthcare stocks to their portfolios.

Stock Price

On Monday, ENCOMPASS HEALTH stock opened at $67.1 and closed at $67.2, down by 0.8% from its previous closing price of 67.7. Taylor believes that the company has strong fundamentals and could deliver good returns for investors in the future. He is also positive on the company’s prospects as it seeks to capitalize on opportunities in the healthcare sector. With the new price target, ENCOMPASS HEALTH stock could be a good buy for investors looking to diversify their portfolios or to benefit from the potential upside. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Encompass Health. More…

| Total Revenues | Net Income | Net Margin |

| 4.18k | 270.4 | 6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Encompass Health. More…

| Operations | Investing | Financing |

| 714.8 | -607.9 | -142.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Encompass Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.75k | 3.78k | 13.87 |

Key Ratios Snapshot

Some of the financial key ratios for Encompass Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.6% | -3.2% | 15.0% |

| FCF Margin | ROE | ROA |

| 3.6% | 29.2% | 6.8% |

Analysis

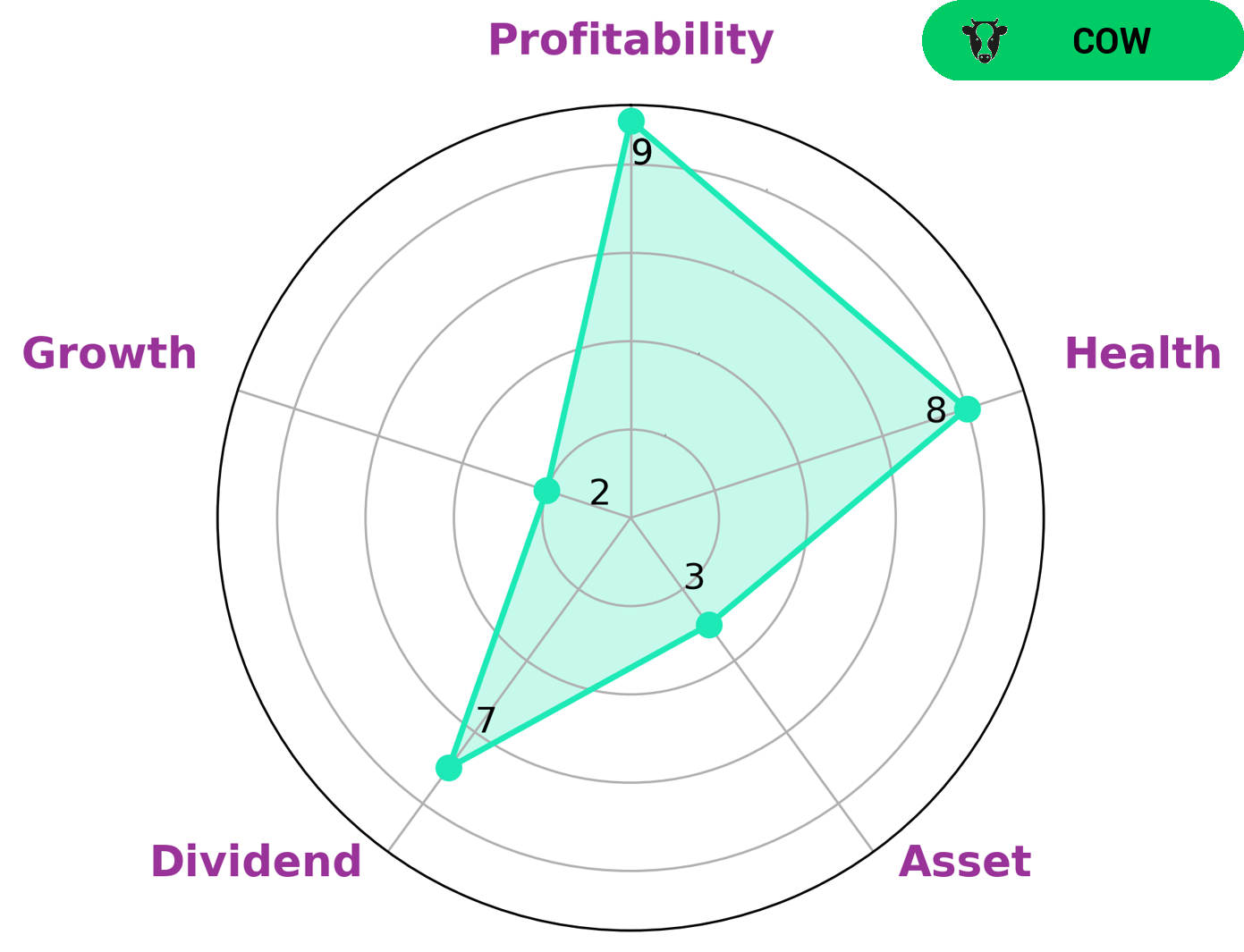

At GoodWhale, we have taken a look at the financials of ENCOMPASS HEALTH and conducted an analysis. The Star Chart shows that ENCOMPASS HEALTH has a high health score of 8/10, indicating that it is more than capable of sustaining future operations even in times of crisis. Moreover, due to its consistent and sustainable dividend payouts, ENCOMPASS HEALTH is classified as a ‘cow’ company. Investors who are interested in a company like ENCOMPASS HEALTH should take into account its strong dividend, profitability, and weak asset and growth. Companies with similar characteristics may be a good fit for investors who are looking for steady and reliable returns over time. More…

Peers

There is fierce competition between Encompass Health Corp and its competitors: Community Health Systems Inc, Pennant Group Inc, Greenbrook TMS Inc. All four companies are leaders in the healthcare industry and are constantly striving to be the best.

– Community Health Systems Inc ($NYSE:CYH)

The company’s market capitalization is 311.19 million as of 2022. The company’s return on equity is -48.01%. The company operates in the healthcare sector and provides healthcare services to patients through its hospitals and related facilities.

– Pennant Group Inc ($NASDAQ:PNTG)

Pennant Group, Inc. provides healthcare services in the United States. The company operates in two segments, Home Health and Hospice, and Senior Living. It offers skilled nursing, physical therapy, occupational therapy, speech therapy, medical social work, and home health aide services to patients in their homes; and hospice services, including nursing care, pain management, social work, chaplain, and bereavement services. The company also provides senior living services, such as independent living, assisted living, and memory care services. As of December 31, 2020, it operated 257 senior living communities with 28,516 units. The company was formerly known as Curo Health Services, Inc. and changed its name to Pennant Group, Inc. in July 2018. Pennant Group, Inc. was founded in 2006 and is headquartered in Carrollton, Texas.

– Greenbrook TMS Inc ($TSX:GTMS)

Greenbrook TMS Inc is a healthcare company that provides treatment for depression and other mental disorders. The company has a market capitalization of 123.09M and a return on equity of -213.16%. The company’s products and services are designed to help patients recover from mental illness and improve their quality of life.

Summary

ENCOMPASS HEALTH has recently been given a new price target of $78.00 from Stephens. Analysts at Stephens have noted that ENCOMPASS HEALTH is expected to have a strong performance in the near future, due to their growing presence in home health and hospice services. They believe that the company’s recent acquisition of HomeCare Homebase will help to increase their market share and improve profitability.

They also expect that the company will benefit from their strong relationships with providers and payers as well as their focus on innovation and technology. Overall, analysts remain positive on the long-term growth prospects of ENCOMPASS HEALTH.

Recent Posts