SandRidge Energy Volatility Reaches 4.03%, Prices Fall -0.58% on Friday, May 19th

June 4, 2023

☀️Trending News

SANDRIDGE ($NYSE:SD): SandRidge Energy Inc. is a leading oil and gas company that operates in the United States. On Friday, May 19, SandRidge Energy Inc. experienced a significant increase in volatility as the stock’s price fell by 0.58% from the previous day’s close, bringing the volatility to an alarming 4.03%. This drop in price can be attributed to an overall bearish sentiment in the markets. Investors should be on alert and be prepared for a bumpy road ahead. Although this news may seem bearish, there is still opportunity for investors to make a profit. SandRidge Energy Inc. has been performing well due to increased demand for its services and products in recent times.

With the right strategy, investors can capitalize on this volatile moment and make a profit. The recent drop in price could also bring a renewed focus on SandRidge’s operations and future prospects. Investors are advised to pay close attention to its long-term strategy and any upcoming announcements that could affect its stock price. With careful analysis and a sound investment strategy, SandRidge Energy Inc. could still prove to be a profitable investment.

Analysis

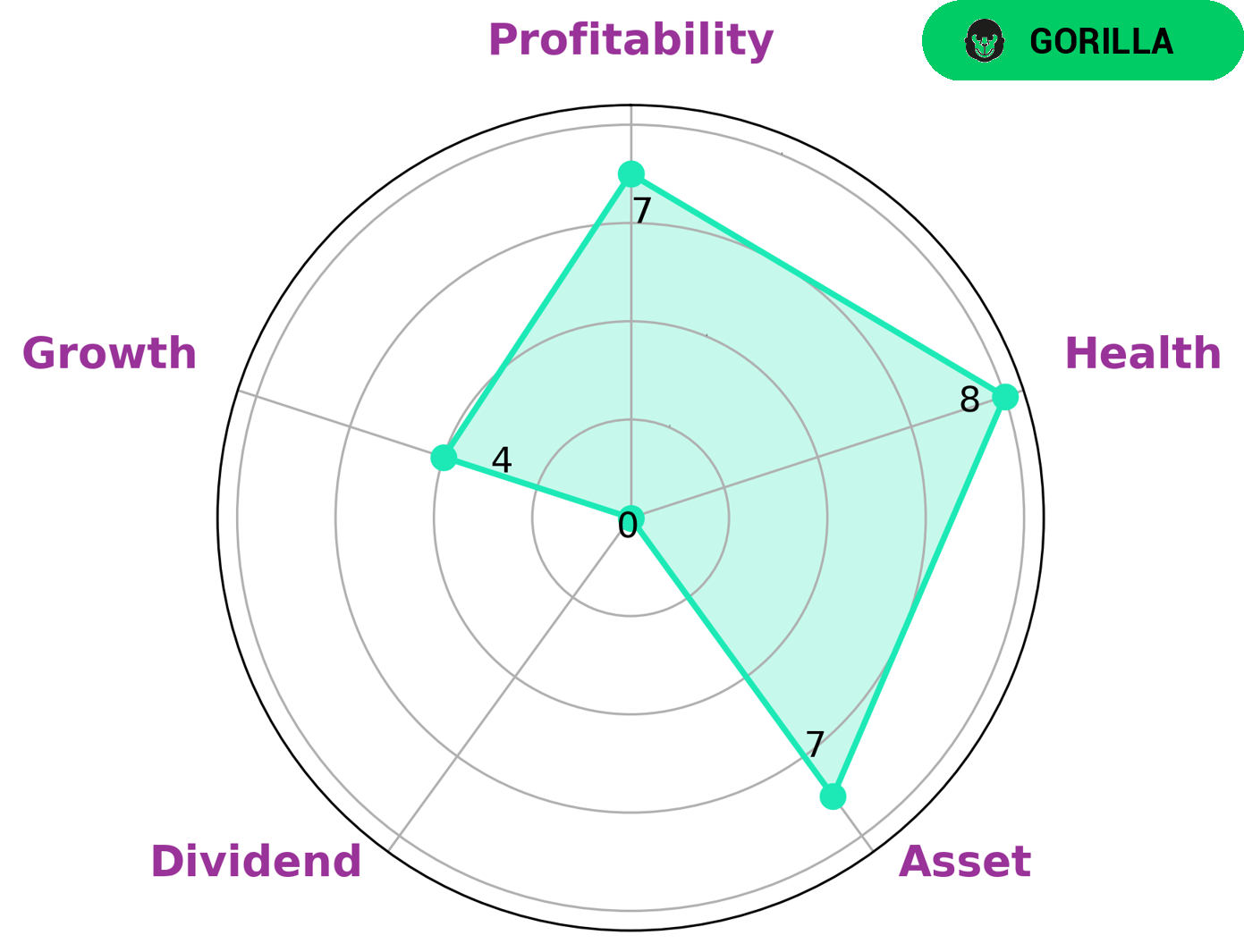

After analyzing SANDRIDGE ENERGY‘s fundamentals, GoodWhale has come to the conclusion that the company is strong in assets and profitability, and medium in growth. The Star Chart shows that the company has a weak dividend. SANDRIDGE ENERGY also possesses a high health score of 8/10 with regard to its cashflows and debt, which demonstrates that the company is capable of sustaining future operations even in times of crisis. We have classified the company as a ‘Gorilla’, which is our term for companies that have achieved stable and high revenue or earnings growth due to their strong competitive advantage. This makes the company an attractive investment opportunity for those investors looking for long-term stability and healthy returns. Furthermore, those investors with higher risk appetite may also find interest in such a company due to its potential upside growth. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sandridge Energy. More…

| Total Revenues | Net Income | Net Margin |

| 239.92 | 231.2 | 94.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sandridge Energy. More…

| Operations | Investing | Financing |

| 172.35 | -48.91 | -1.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sandridge Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 628.18 | 116.31 | 13.88 |

Key Ratios Snapshot

Some of the financial key ratios for Sandridge Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.8% | 31.1% | 67.9% |

| FCF Margin | ROE | ROA |

| 51.9% | 20.4% | 16.2% |

Peers

SandRidge Energy Inc is an American oil and natural gas company headquartered in Oklahoma City, Oklahoma. As of December 31, 2015, the company had 1,206.6 million barrels of oil equivalent of estimated proved reserves, of which 55% was petroleum, 41% was natural gas and 4% was natural gas liquids. The company also had estimated proved reserves of 2,473.5 Mboe in Canada. The company’s estimated proved reserves were primarily located in the Mid-Continent, Mississippi, Gulf Coast and Permian Basin regions.

– Traverse Energy Ltd ($TSX:PNE)

Pine Cliff Energy is a Canadian oil and gas company with a market cap of $589.7 million as of 2022. The company has a return on equity of 77.26%. Pine Cliff Energy is engaged in the exploration, development, production and marketing of natural gas and crude oil in Alberta and British Columbia, Canada.

– Pine Cliff Energy Ltd ($TSXV:SCD)

The company’s market cap is $1.37 million and its ROE is 11.39%. The company is involved in the exploration and production of oil and gas.

Summary

SandRidge Energy Inc. is a leading oil and natural gas exploration and production company based in Oklahoma. On Friday, May 19, the stock experienced a 0.58% drop in its share price, bringing the current volatility for the company’s shares to 4.03%. Investors should be aware of the potential for further downside risk in the stock, and may want to proceed with caution before investing in this energy company. Analysts suggest that investors watch the stock closely in order to take advantage of any potential opportunities that may arise from the current volatility.

Recent Posts