RPC Share Price Drops 10.91% YTD Despite 1.54 Million Shares Traded and Beta of 1.82 in 2023.

March 29, 2023

Trending News ☀️

Despite the 1.54 million shares traded and the beta of 1.82, the RPC ($NYSE:RES) Inc. share price has dropped by 10.91% year to date. This decrease has pushed the company into the limelight of investors and analysts, who are now closely monitoring RPC Inc. to gauge its value. With a high beta of 1.82, it suggests that RPC Inc. is a higher risk investment than other stocks and could be more volatile, making it a less desirable option for those seeking steady returns.

Yet, with the large number of shares traded in the latest session, there is still a lot of interest in this company and the potential for long-term gains may be enough to counter any short-term losses. Ultimately, it is up to investors to decide whether or not this stock is worth their money.

Market Price

So far, news surrounding the company has been mostly positive. On Tuesday, RPC stock opened at $7.8 and closed at $8.1, up by 2.1% from its prior closing price of 7.9. This indicates that investors remain hopeful about the future of the company, despite the general decline in share prices YTD. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rpc. More…

| Total Revenues | Net Income | Net Margin |

| 1.6k | 215.17 | 13.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rpc. More…

| Operations | Investing | Financing |

| 201.29 | -123.72 | -33.58 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rpc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.13k | 271.28 | 3.96 |

Key Ratios Snapshot

Some of the financial key ratios for Rpc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | -70.3% | 18.1% |

| FCF Margin | ROE | ROA |

| 3.9% | 22.2% | 16.1% |

Analysis

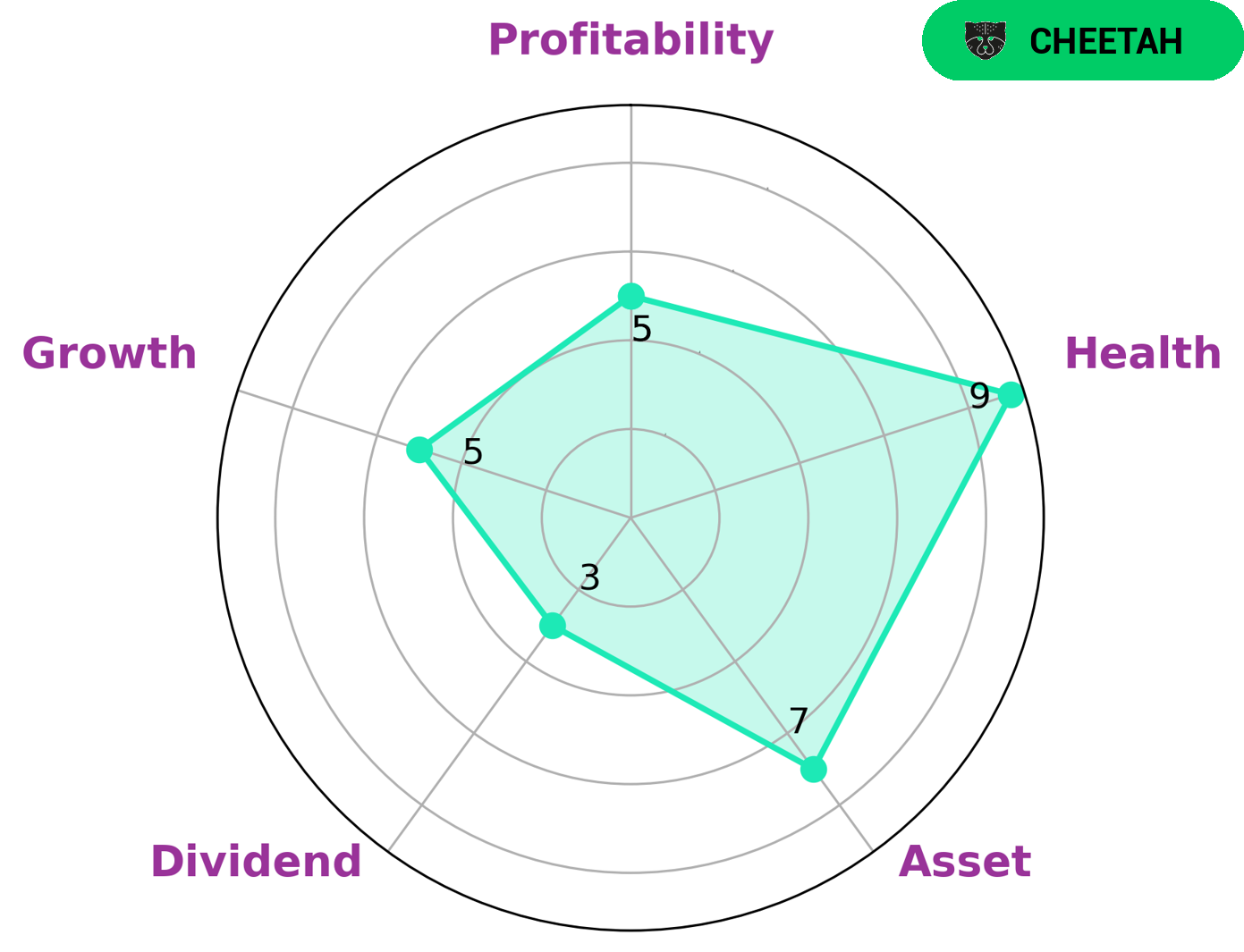

At GoodWhale, we performed an analysis of RPC‘s financials and found that the company had a high health score of 9/10 on our Star Chart. This reflects RPC’s ability to fund future operations and pay off debt through strong cashflows and debt. In terms of our four criteria – asset, growth, profitability and dividend – we found that RPC was strong in asset, medium in growth, profitability and weak in dividend. Based on this assessment, we classified RPC as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Such companies may be of interest to investors looking for short-term gains or those with a higher risk appetite. Investors who are looking for stable, longer-term investments may want to look elsewhere. More…

Peers

Despite the competition, RPC Inc remains confident that its expertise and commitment to quality will enable it to remain a leader in the sector.

– High Arctic Energy Services Inc ($TSX:HWO)

High Arctic Energy Services Inc is a Canadian-based oilfield services company that provides drilling, completion and workover services to customers involved in the exploration and production of oil and gas in western Canada. The company has a market capitalization of 73.56M as of 2023. This figure indicates the total value of the company’s stock and is an important indicator of its financial health. The company’s Return on Equity (ROE) is -11.23%, which indicates that the company is not generating any profits for its shareholders. This could be due to the company’s high cost structure, or the low price of oil.

– KLX Energy Services Holdings Inc ($NASDAQ:KLXE)

KLX Energy Services Holdings Inc is an energy services company that provides services and solutions to the energy industry. With a market cap of 180.08 million as of 2023, the company has established itself as a leader in the industry. The company’s Return on Equity (ROE) of 415.16% is a testament to its strong financial performance and is indicative of its ability to generate high returns on its investments. KLX Energy Services Holdings Inc offers a variety of services ranging from engineering, project management, and operational support to maintenance and repair services. It also provides specialty services such as well-site operations, inspection and testing, and clean-up services. The company’s commitment to providing top-notch services and solutions has enabled it to become one of the leading energy services companies in the industry.

– Coil Tubing Technology Inc ($OTCPK:CTBG)

Coil Tubing Technology Inc is an oilfield services company that specializes in providing services related to coiled tubing, such as drilling, completion, and production. The company has a market cap of 1.56M as of 2023, which is relatively small compared to other oilfield services companies in the same industry. Despite its small size, Coil Tubing Technology Inc has a negative Return on Equity of -33.21%. This suggests that the company is not currently generating a profit on its investments, and investors are not seeing a return on their investments.

Summary

RPC Inc. is a publicly-traded company that has seen its share price decline 10.91% year to date in 2023, despite trading of 1.54 million shares and a beta of 1.82. The overall sentiment from investors has been positive, although the stock has not been able to rally this year. Analysts believe that the company may pursue a strategy focusing on cost savings and improved efficiency.

Further, industry trends suggest that RPC Inc. may benefit from increased demand for their core products and services due to the continued growth of their industry. Investors should watch upcoming earnings and reports to get a better idea of the stock’s trajectory, as well as any potential gain or loss in value.

Recent Posts