Raymond James Analysts Increase Saia Price Target to $260.00

January 31, 2023

Trending News ☀️

Analysts at Raymond James have recently increased their price target for Saia ($NASDAQ:SAIA), Inc. (NASDAQ: SAIA) stock to $260.00. The stock has been steadily increasing in value over the past year, and with the new price target from Raymond James, analysts expect this trend to continue. This price jump is largely attributed to a number of positive developments at the company, such as a successful merger with USF Corporation and continued growth in the freight transportation industry. The analysts at Raymond James also noted that Saia’s strong balance sheet and solid financial performance make it an attractive option for investors. The company has been making a number of positive changes in recent months, including expanding its reach into new markets and investing in advanced technologies.

These investments are expected to continue to drive growth and profitability in the coming years. Overall, Saia is well-positioned to capitalize on the current market conditions and continue to drive growth in the long-term. With the new price target from Raymond James, investors have even more reason to take a closer look at this stock. With an impressive portfolio of services, strong financials, and a long history of success, Saia is an attractive option for long-term investors.

Share Price

This news sentiment was mostly positive, as investors began to buy the stock. When the markets opened on Monday, SAIA stock opened at $250.8 and closed at $261.0, up by 4.9% from its prior closing price of 248.9. Clearly, investors were pleased with the analysts’ decision to raise the target price, as the stock outperformed its peers. The analysts’ opinion of SAIA was cited as one of the primary reasons for the successful day in trading. Their price target increase was based on their research into the company’s prospects and potential growth opportunities. They noted that SAIA will continue to benefit from its strong customer base and competitive advantages in the freight transport industry.

The positive sentiment surrounding SAIA is also reflected in its financial results. This indicates that the company is well-positioned to continue its successful run in the coming quarters. The stock has responded positively to this news and has seen a 4.9% increase since its prior closing price of 248.9. This could be a sign of further momentum in the stock and investors should consider taking advantage of this opportunity. saia“>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Saia. saia“>More…

| Total Revenues | Net Income | Net Margin |

| 2.75k | 360.32 | 13.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Saia. saia“>More…

| Operations | Investing | Financing |

| 458.98 | -406.92 | -27.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Saia. saia“>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.14k | 633.84 | 56.93 |

Key Ratios Snapshot

Some of the financial key ratios for Saia are shown below. saia“>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.3% | 44.5% | 17.2% |

| FCF Margin | ROE | ROA |

| 1.8% | 20.4% | 13.9% |

VI Analysis

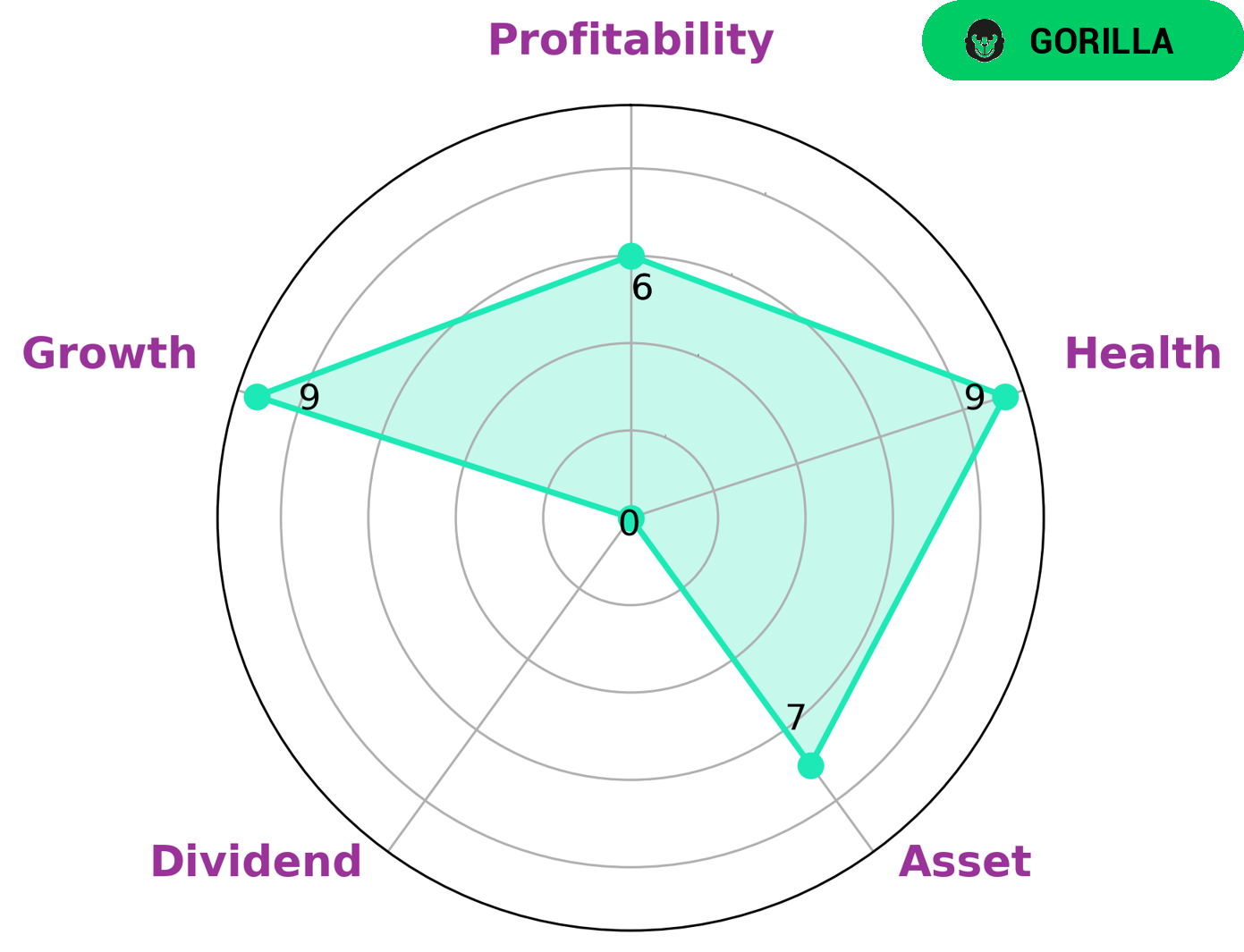

Investors looking for long-term potential may find SAIA appealing, as evidenced by its fundamentals. According to the VI Star Chart, SAIA has strong assets, growth, and medium profitability. Its dividend yield is weak, however. Its health score of 9/10 indicates that its cashflows and debt are strong, and it should have no difficulty paying off debt and funding future operations. SAIA is classified as a ‘gorilla’ company—one that has achieved stable and high revenue or earning growth due to its competitive advantage. These types of companies often attract investors due to their potential for long-term success. Investors who are familiar with SAIA’s industry may be particularly interested in the company due to its established competitive advantage. In addition, those investors who value sustainability may also be attracted to SAIA. The company’s strong cashflows and debt suggest that it has the financial resources to invest in long-term projects that can ensure its success over time. This can be attractive to investors who are looking for a company with a bright future. Overall, SAIA is an appealing investment choice for those looking for a company with long-term potential, a competitive advantage, and sustainable operations. With the help of the VI app, analyzing SAIA’s fundamentals is made easy, making it even easier for investors to assess the company’s potential for success. saia“>More…

VI Peers

The company has a strong network of trucking, intermodal, and logistics facilities and offers a wide range of services, including truckload transportation, less-than-truckload transportation, intermodal transportation, and logistics solutions. Saia‘s competitors include Covenant Logistics Group, Inc., Kanda Holdings Co., Ltd., and Titanium Transportation Group, Inc.

– Covenant Logistics Group Inc ($NASDAQ:CVLG)

Covenant Logistics Group Inc. is a provider of transportation and logistics services. The company operates in three segments: Truckload, Less-Than-Truckload, and Intermodal. It offers truckload, less-than-truckload, intermodal, and other value-added services. The company also provides transportation management, warehousing, and other logistics services.

– Kanda Holdings Co Ltd ($TSE:9059)

Kanda Holdings Co Ltd is a Japanese conglomerate with a market cap of 11.74B as of 2022. The company has a Return on Equity of 8.89%. Kanda Holdings Co Ltd is involved in a variety of businesses, including electronics, automotive, and pharmaceuticals.

Summary

Investing in Saia Inc. (NASDAQ: SAIA) is looking more attractive to analysts, as Raymond James has increased the company’s price target to $260.00. This positive news has been reflected in the stock price, which has moved up on the same day. Generally, sentiment towards the stock appears to be positive, with more analysts expecting the price to rise in the near term.

Investors interested in Saia should stay up-to-date on the latest news and analysis surrounding the company and its performance. With a strong track record and positive outlook, Saia is a good choice for investors looking to diversify their portfolios.

Recent Posts