Opsens’s Stock Price Drops Below 50-Day Moving Average

May 25, 2023

Trending News 🌥️

Tuesday marked a concerning trend in Opsens Inc ($TSX:OPS).’s stock price, as it fell below the company’s fifty day moving average. Opsens Inc. is a healthcare technology company that specializes in diagnostic and therapeutic cardiovascular catheters. With operations in the United States and abroad, the Canadian-based company is a leader in this field, and its stock has been doing relatively well in the past several months.

However, the stock price drop below its fifty day moving average is a cause for concern. This decline could be indicative of a more serious trend, but only time will tell if the stock will be able to recover. Investors may be wary of investing in Opsens while its stock price is below the fifty day moving average, and analysts will be watching closely to see if the price rebounds. In the meantime, investors should take a wait and see approach before making any decisions on the company’s stock.

Stock Price

Overall, the stock has declined over the past year, as investors remain skeptical about its potential growth. It has been difficult for shareholders to find value in the stock due to its consistent underperformance in the market. As a result, it is essential for OPSENS INC to take decisive steps in order to turn things around and regain investor confidence. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Opsens Inc. More…

| Total Revenues | Net Income | Net Margin |

| 40.13 | -13.5 | -34.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Opsens Inc. More…

| Operations | Investing | Financing |

| -17.39 | -1.55 | 9.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Opsens Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 55.07 | 16.36 | 0.34 |

Key Ratios Snapshot

Some of the financial key ratios for Opsens Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.0% | – | -33.7% |

| FCF Margin | ROE | ROA |

| -48.5% | -24.2% | -15.3% |

Analysis

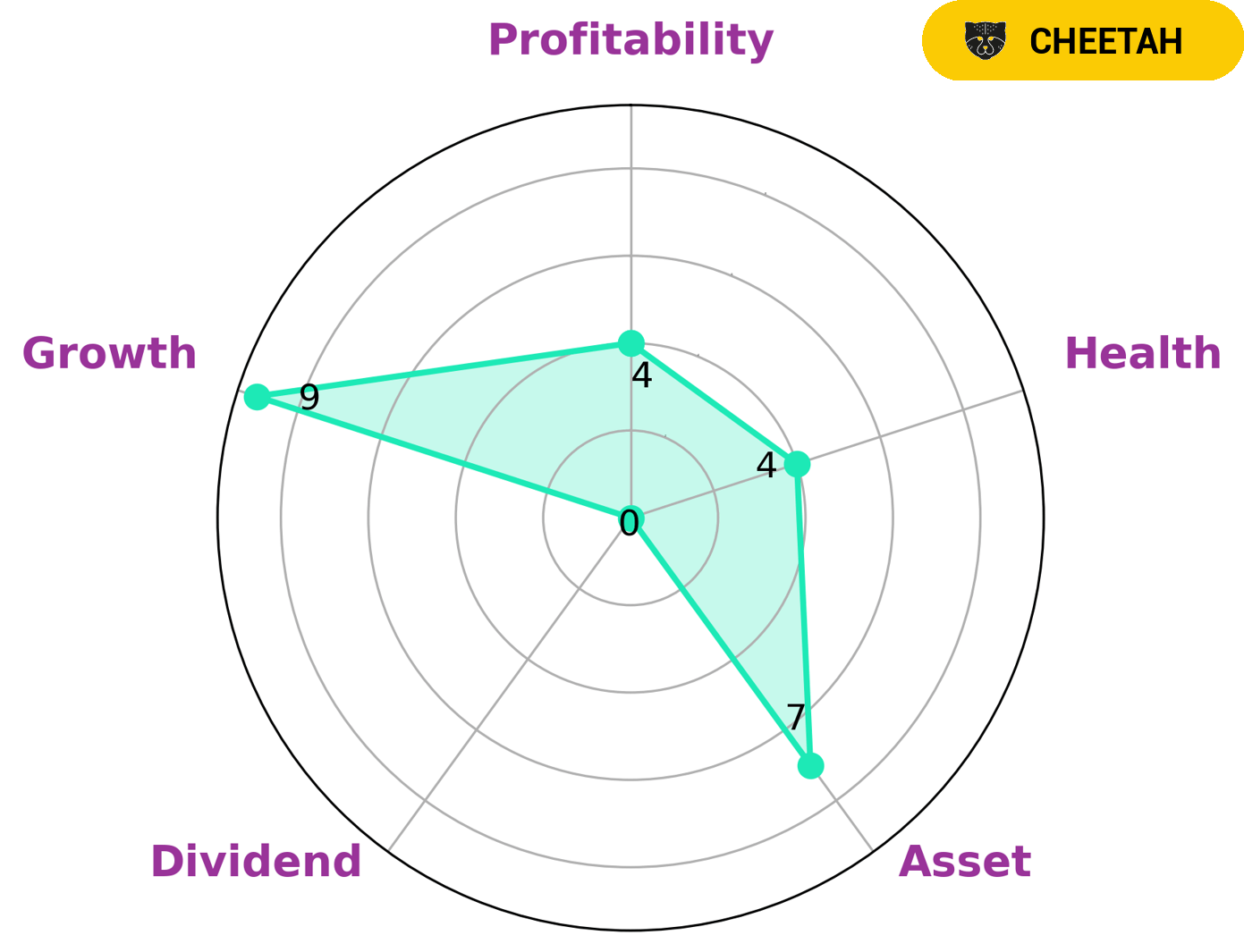

Analyzing OPSENS INC’s financials, GoodWhale classifies them as a ‘cheetah’. This means they have achieved high revenue or earnings growth, but are not as stable due to lower profitability. As such, investors that are looking for higher risk investments and are able to tolerate increased volatility may be interested in OPSENS INC. GoodWhale’s Star Chart has also evaluated OPSENS INC’s strengths and weaknesses. They are strong in asset, growth, and medium in profitability and weak in dividend. They also have an intermediate health score of 4/10 with regard to their cashflows and debt, which indicates they are likely to remain safe from bankruptcy during any economic downturn. More…

Peers

The competition in the market for optogenetics treatment is heating up. Opsens Inc, NovoCure Ltd, Avinger Inc, and REMSleep Holdings Inc are all vying for a piece of the pie. Opsens Inc has the most experience in the field, but the other companies are quickly catching up.

– NovoCure Ltd ($NASDAQ:NVCR)

NovoCure Ltd is a commercial-stage oncology company developing a proprietary therapy called Tumor Treating Fields, or TTFields, for the treatment of solid tumor cancers. The company’s FDA-cleared and CE-marked NovoTTF-100A System is currently being used in the United States and Europe to treat patients with glioblastoma (GBM), mesothelioma and non-small cell lung cancer (NSCLC). TTFields are low-intensity, alternating electric fields that are shown to disrupt cell division, preventing cancer cells from replicating and spreading.

NovoCure’s market cap as of 2022 is 7.73B. The company has a Return on Equity of -8.29%. NovoCure Ltd is a commercial-stage oncology company that develops a proprietary therapy called Tumor Treating Fields, or TTFields, for the treatment of solid tumor cancers. The company’s FDA-cleared and CE-marked NovoTTF-100A System is currently being used in the United States and Europe to treat patients with glioblastoma (GBM), mesothelioma and non-small cell lung cancer (NSCLC). TTFields are low-intensity, alternating electric fields that are shown to disrupt cell division, preventing cancer cells from replicating and spreading.

– Avinger Inc ($NASDAQ:AVGR)

Avinger Inc is a company that manufactures medical devices. Its market cap is 7.67M as of 2022 and its ROE is -121.86%. The company’s products include catheters, guidewires, and sheaths. It also offers services such as product design and development, prototyping, and manufacturing.

– REMSleep Holdings Inc ($OTCPK:RMSL)

REM Sleep Holdings Inc. is a publicly traded holding company focused on identifying and investing in businesses that operate in the sleep health industry. The company was founded in 2019 and is headquartered in Vancouver, Canada.

REM Sleep Holdings Inc. has a market cap of 21.63M as of 2022. The company’s return on equity is -17.66%.

REM Sleep Holdings Inc. operates in the sleep health industry. The company focuses on investing in businesses that operate in this industry.

Summary

Opsens Inc. (TSX:OPS) is a publicly traded company whose stock has recently seen some movement in the market. On Tuesday, the stock price crossed below its fifty day moving average, causing some concern amongst investors.

However, the same day, the stock price moved up, indicating a possible recovery. Investing analysts suggest that investors take a look at the company’s fundamentals to gain a better understanding of the situation. These fundamentals include financial performance, metrics such as debt and liquidity, and management changes.

Additionally, investors should consider tracking the stock’s movements in the short-term as well as longer-term performance. By doing this, investors can get a better understanding of potential risks and rewards when investing in Opsens Inc.

Recent Posts