New Hope Corp Ltd Share Price Plunges 9% as Coal Stocks Suffer on ASX 200.

February 12, 2023

Trending News ☀️

New Hope ($ASX:NHC) Corp Ltd, an Australian company listed on the ASX 200, recently saw its share price plunge 9% lower as coal stocks got hammered on the ASX 200. The company’s portfolio of projects spans across two coal basins in Queensland, namely the Surat and Bowen Basins. As a result of current market conditions, New Hope Corp Ltd’s share price took a nosedive on Tuesday, with the stock closing 9% lower than its opening price. The fall in share price has been attributed to the lack of investor confidence in the coal sector, with many investors concerned about the impact of new environmental regulations on the industry. It is also believed that market sentiment towards the sector has been further weakened by increasingly volatile oil prices.

Despite this, New Hope Corp Ltd still remains committed to investing in and developing its coal resources and is currently focusing on two major projects – the Wilkie Creek and Acland mine expansions. The company is also looking at ways to diversify into other resource industries such as renewable energy, lithium and cobalt. Overall, while New Hope Corp Ltd’s share price has taken a hit in recent weeks, the company is still confident in its long-term strategy of developing its coal resources and exploring new opportunities. With strong management, a robust balance sheet and a good track record of successful projects, the company is well positioned to weather the current storm and emerge stronger on the other side.

Price History

The news sentiment surrounding New Hope Corp Ltd (NEW HOPE) has been mostly positive so far; however, their share price took a nose-dive this Friday when the ASX 200 suffered. On Friday, NEW HOPE opened at AU$5.5 and closed at AU$5.3, dropping by 8.6% from the last closing price of 5.8. The main culprit behind this drop was mainly attributed to the falling coal prices, which resulted in a weak performance for the company on the ASX 200. The drop in share price for New Hope Corp Ltd was particularly alarming given that their share price had been steadily climbing over the past few weeks. This sudden plunge has caused investors to question whether the recent gains were simply a naïve over-estimation of the company’s stock potential.

The coal sector has been under pressure for a while now, with no end in sight to its woes. Despite the fact that New Hope Corp Ltd have so far managed to remain profitable, there is still a lot of uncertainty surrounding future profits due to the industry’s current state. The drop in share prices could be a sign of further losses on the horizon, or it could be an opportunity to buy into the company at a lower price and reap the potential rewards later. Whatever the case may be, investors are advised to tread carefully in the coming days. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for New Hope. More…

| Total Revenues | Net Income | Net Margin |

| 2.54k | 983.01 | 38.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for New Hope. More…

| Operations | Investing | Financing |

| 1.14k | -222.52 | -628.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for New Hope. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.43k | 1.11k | 2.78 |

Key Ratios Snapshot

Some of the financial key ratios for New Hope are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.2% | 69.1% | 56.0% |

| FCF Margin | ROE | ROA |

| 41.7% | 41.1% | 26.0% |

Analysis

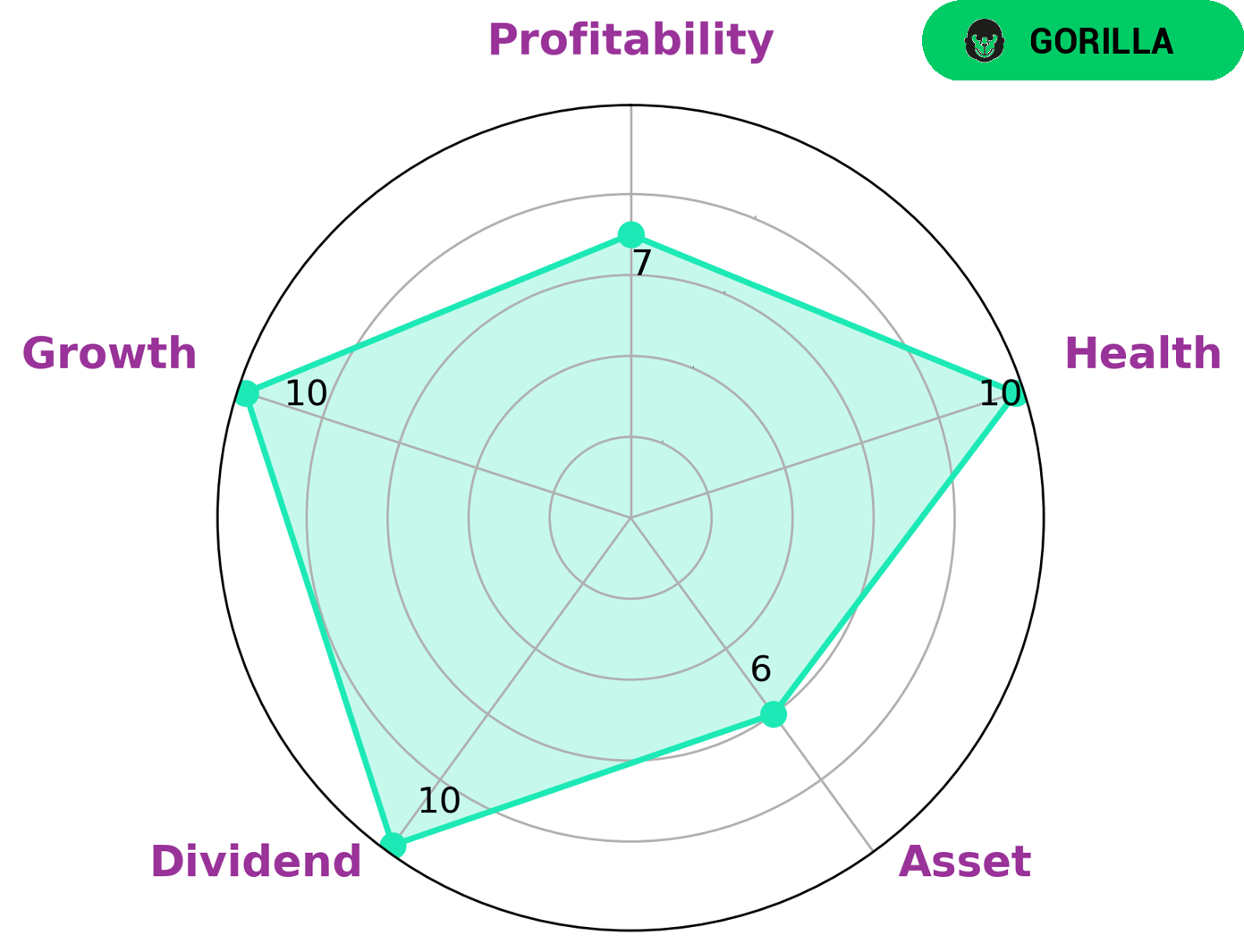

GoodWhale’s analysis of NEW HOPE reveals the company to be classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantages. Companies such as NEW HOPE are attractive to investors looking for both growth and upside potential. NEW HOPE’s health score of 10/10 indicates that the company is in a safe financial position with regard to cash flows and debt, making it less vulnerable to economic downturns. Furthermore, its strength in dividends, growth and profitability, as well as its medium level of asset make it a lucrative investment for those seeking a secure, long-term return. The company’s strong competitive advantage and relatively low level of risk make it attractive to investors looking for both capital gains and income through dividends. Its solid financial position also makes it attractive to conservative investors seeking to avoid the risks associated with more volatile investments. Investing in a company like NEW HOPE not only provides investors with a secure return, but also the opportunity to participate in the company’s growth as it expands its operations. This makes it an attractive option for investors looking for both growth and income. In addition, the potential for capital gains adds another layer of potential returns that investors may be able to benefit from. More…

Peers

New Hope Corporation Limited is an Australian coal mining company. It is one of Australia’s largest coal producers and exporters with annual production in excess of 30 million tonnes of coal. The company has operations in Queensland and New South Wales. New Hope’s main competitors are Whitehaven Coal Limited, Guizhou Panjiang Refined Coal Co. Ltd., and Shanxi Hua Yang Group New Energy Co. Ltd.

– Whitehaven Coal Ltd ($ASX:WHC)

In 2022, Whitehaven Coal Ltd had a market capitalization of 9.27 billion Australian dollars and a return on equity of 48.41%. Whitehaven is an Australian coal company that operates mines in the states of New South Wales and Queensland. The company’s flagship mine is the Maules Creek mine in New South Wales, which is one of the largest coal mines in Australia. Whitehaven also has a minority interest in the Boggabri mine in New South Wales.

– Guizhou Panjiang Refined Coal Co Ltd ($SHSE:600395)

As of 2022, Guizhou Panjiang Refined Coal Co Ltd has a market cap of 15.09B and a Return on Equity of 15.96%. The company produces and sells refined coal products in China.

– Shan Xi Hua Yang Group New Energy Co Ltd ($SHSE:600348)

Shan Xi Hua Yang Group New Energy Co Ltd has a market cap of 45.24B as of 2022, a Return on Equity of 27.17%. The company is engaged in the business of developing, manufacturing and selling solar photovoltaic products. The company’s products are used in a variety of applications, including power generation, solar street lighting, solar water pumping, solar water heating and solar lighting.

Summary

Investors in New Hope Corp. Ltd were met with a sharp decline in stock price on the ASX 200 market, with the company’s coal stocks suffering a 9% plunge. Despite mostly positive sentiment surrounding the company prior to this downturn, the market responded quickly to this news. For those considering investing in New Hope Corp. Ltd., it is important to take into account this sudden shift in stock price, and to consider both the short-term and long-term trends of the company’s coal stocks. Additionally, research into the company’s competitors and the coal industry in general may help investors make informed decisions when it comes to investing in New Hope Corp. Ltd.

Recent Posts