Mizuho Securities Adjusts Omega Healthcare Investors Price Target to $31, Maintaining Neutral Rating

June 1, 2023

☀️Trending News

Mizuho Securities recently adjusted the price target for Omega Healthcare Investors ($NYSE:OHI) from $30 to $31, while maintaining their neutral rating. Omega Healthcare Investors is a real estate investment trust (REIT) that specializes in healthcare facility investment. It is based in Hunt Valley, Maryland and it invests in the long-term healthcare industry, including skilled nursing and assisted living facilities, as well as medical office buildings. Mizuho Securities noted that despite the company’s history of strong performance, there are still some risks to consider. These include increases in healthcare costs, as well as potential decreases in occupancy rates due to changing demographics.

Analysts at Mizuho also noted that Omega Healthcare Investors may be negatively impacted by the competitive landscape, particularly from larger healthcare REITs. Despite these risks, analysts at Mizuho still remain confident in Omega Healthcare Investors’ ability to deliver strong returns in the future. They believe that the REIT’s portfolio diversification, strong management team, and focus on long-term healthcare facilities will continue to be beneficial for investors. As such, Mizuho has maintained their neutral rating on the stock, while raising the price target from $30 to $31.

Stock Price

On Wednesday, OMEGA HEALTHCARE INVESTORS saw an increase in stock price, opening the day at $28.8 and closing at $29.8, up by 4.3% from the prior closing price of $28.6. This change indicates Mizuho’s belief that the stock has a good potential for growth, and their hope that it will continue to increase in price. Despite the increasing stock price, Mizuho has not changed their stance on the company, maintaining their neutrality on OMEGA HEALTHCARE INVESTORS. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for OHI. More…

| Total Revenues | Net Income | Net Margin |

| 847.13 | 273.26 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for OHI. More…

| Operations | Investing | Financing |

| 604.88 | 268.17 | -1.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for OHI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.29k | 5.6k | 14.92 |

Key Ratios Snapshot

Some of the financial key ratios for OHI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 43.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

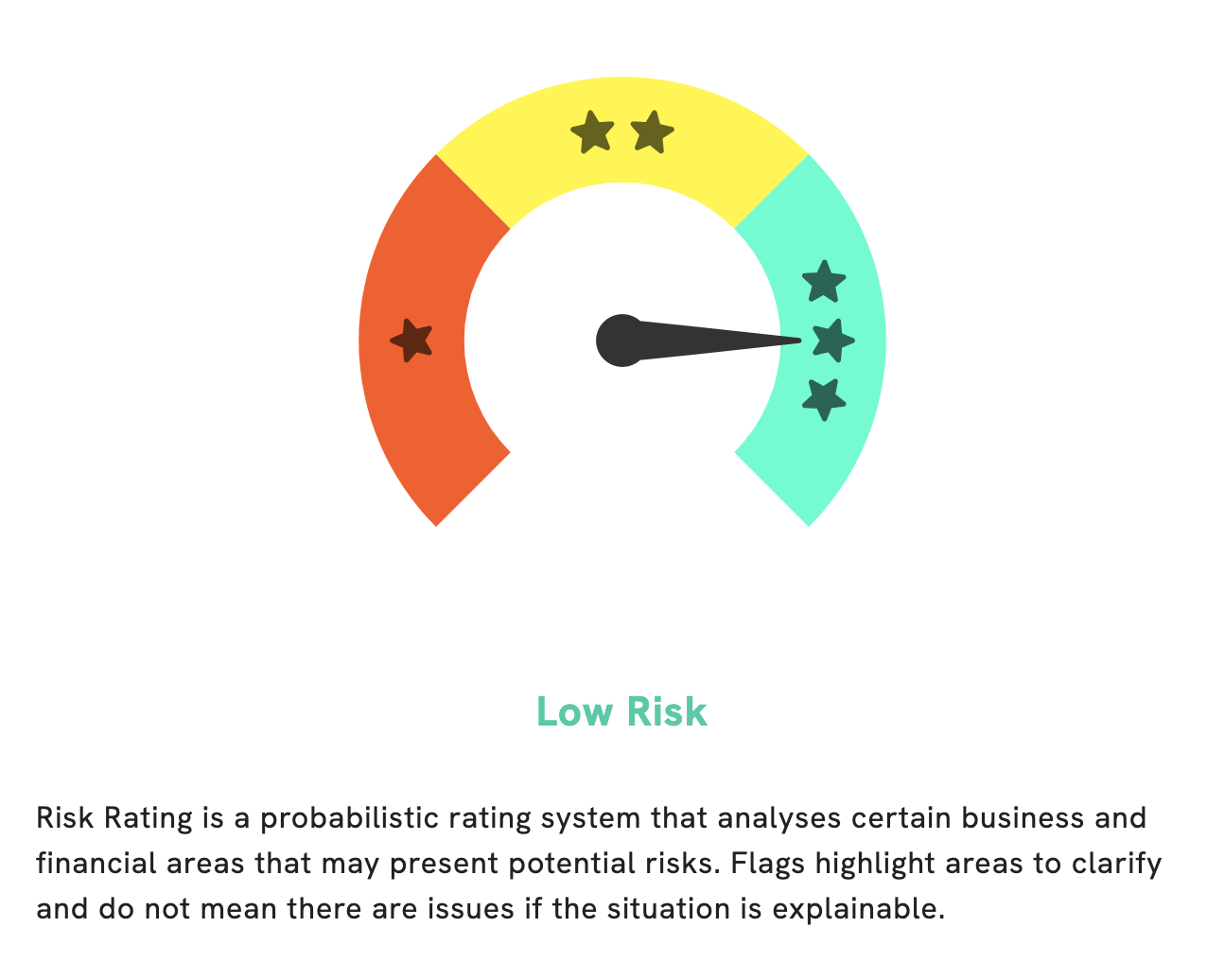

At GoodWhale, we conducted an analysis to evaluate the fundamentals of OMEGA HEALTHCARE INVESTORS. After a thorough assessment, we can confidently say that OMEGA HEALTHCARE INVESTORS is low risk investment from a financial and business perspective. There is, however, one risk warning in the balance sheet that we detected. If you are interested in learning more, please register with us to gain further access to this information. More…

Peers

As of December 31, 2019, the company owned 1,214 properties in 41 states and the United Kingdom, with a portfolio value of $9.4 billion. The company’s competitors include Medical Properties Trust, Inc., Healthcare Realty Trust, Inc., and Sabra Health Care REIT, Inc.

– Medical Properties Trust Inc ($NYSE:MPW)

As of 2022, Medical Properties Trust, Inc. has a market capitalization of $6.58 billion. The company is a healthcare real estate investment trust that invests in hospitals and other healthcare-related facilities.

– Healthcare Realty Trust Inc ($NYSE:HR)

Healthcare Realty Trust Inc is a publicly traded real estate investment trust that invests in healthcare-related properties. The company’s portfolio includes hospitals, medical office buildings, and other healthcare facilities. Healthcare Realty Trust is headquartered in Nashville, Tennessee.

– Sabra Health Care REIT Inc ($NASDAQ:SBRA)

The company’s market cap is $2.93 billion as of 2022. The company is a real estate investment trust that focuses on owning and operating skilled nursing and assisted living facilities in the United States.

Summary

This news caused the stock price to move up on the same day. Overall, OHI’s current fundamentals make it an attractive investment option.

Recent Posts