Geodrill Limited Share Price Trades Up 0.9% During Mid-Day Trading Tuesday, Reaching High of $2.28

May 26, 2023

Trending News ☀️

Geodrill Limited ($TSX:GEO), a provider of mineral exploration and drilling services, saw its share price rise 0.9% during Tuesday’s mid-day trading session, reaching a high of $2.28 before closing. Geodrill is the largest independent exploration and development drilling services provider in Africa, and is well-known for its commitment to safety, quality, and cost-effectiveness. The company is also dedicated to environmental stewardship and sustainability.

The increase in Geodrill’s share price is the result of multiple factors, including increased demand for the company’s services in Africa, as well as investor confidence in its reputation for excellence and reliability. With Tuesday’s surge in share price, however, investors have reason to be optimistic about Geodrill’s future prospects.

Analysis

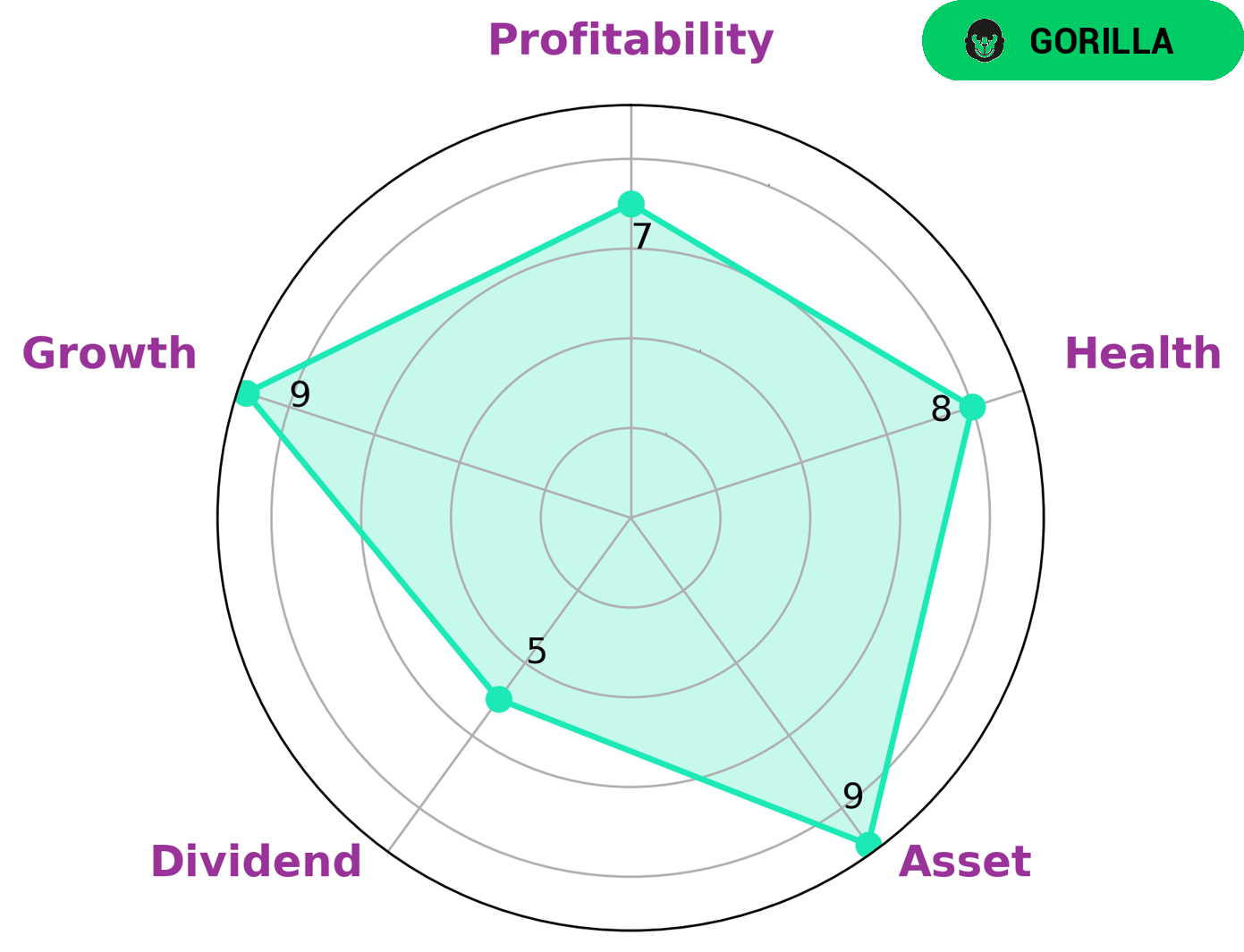

As GoodWhale, we have conducted an analysis of the fundamentals of GEODRILL LIMITED. According to our Star Chart, GEODRILL LIMITED is strong in asset, growth, profitability, and medium in dividend. We classify GEODRILL LIMITED as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for stocks for long-term growth and stability could be interested in such a company. Additionally, GEODRILL LIMITED has a high health score of 8/10 considering its cashflows and debt, which makes us conclude that it is capable to safely ride out any crisis without the risk of bankruptcy. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Geodrill Limited. More…

| Total Revenues | Net Income | Net Margin |

| 142.78 | 19.09 | 13.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Geodrill Limited. More…

| Operations | Investing | Financing |

| 20.35 | -15.76 | -2.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Geodrill Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 151.42 | 39.35 | 2.39 |

Key Ratios Snapshot

Some of the financial key ratios for Geodrill Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.7% | 47.9% | 20.0% |

| FCF Margin | ROE | ROA |

| 3.2% | 16.3% | 11.8% |

Peers

The company has a strong competitive advantage in the market due to its experienced management team, efficient operations, and strong financial position.

However, the company faces stiff competition from its competitors, Capital Ltd, Mitchell Services Ltd, and Perenti Ltd.

– Capital Ltd ($LSE:CAPD)

Pandora Media, Inc. operates as a music streaming company in the United States. It operates in two segments, Advertising and Subscription. The company offers a music streaming service that allows users to create stations and playlists based on various genres, artists, songs, and comedy. It also provides Pandora Premium, a music streaming service for $9.99 per month that allows users to create playlists, search for and play songs on-demand, and download music for offline listening. Additionally, the company offers various features for its listeners, such as the ability to rate songs and stations; discover new music; and create and share playlists. As of December 31, 2020, it had approximately 100 million monthly active users. Pandora Media, Inc. was founded in 2000 and is headquartered in Oakland, California.

– Mitchell Services Ltd ($ASX:MSV)

Mitchell Services Ltd is a publicly traded company with a market capitalization of 86.73 million as of 2022. The company has a return on equity of 1.36%. Mitchell Services Ltd is engaged in the provision of mining and energy services. The company operates in Australia, the United Kingdom, and the United States. Mitchell Services Ltd was founded in 1963 and is headquartered in Brisbane, Australia.

– Perenti Ltd ($ASX:PRN)

Perenti Ltd is an Australian mining services company with a market cap of 744.13M as of 2022. The company has a Return on Equity of 5.88%. Perenti Ltd is involved in the provision of mining services and equipment to the mining industry. The company has operations in Australia, Africa, and Asia.

Summary

Geodrill Limited is a company that operates in the drilling and exploration services for the mining industry. Its stock has shown positive performance in the market today, rising by 0.9% during midday trading up to $2.28. This could signal a positive outlook for the company in the near future, suggesting that investors may want to look into investing in Geodrill Limited. Analysts have noted that Geodrill’s low debt-to-equity ratio and strong operating cash flows could indicate potential for long-term growth and profitability.

Additionally, the company’s current operations combined with its experienced management team is expected to drive further developments in its services. Investors should consider Geodrill Limited as a potential investment due to its strong financials and promising outlook.

Recent Posts