Diodes Incorporated Receives Unexpected Attention in 2023, But What is the Stock Price Doing?

March 10, 2023

Trending News 🌥️

In 2023, Diodes Incorporated ($NASDAQ:DIOD) received unexpected attention from investors, despite not being a large cap stock. As it turns out, Diodes Incorporated has seen strong gains in recent months. Analysts attribute the surge in share price to a successful product launch in May and an uptick in demand for their products. Furthermore, the company has been able to capitalize on their strengths in the areas of power management, signal processing, and RF technology.

All of these factors, combined with a strong management team and a solid financial standing, have helped drive the stock price higher. Overall, investors appear to be optimistic about Diodes Incorporated’s prospects in the short to mid-term. The company has proven that it is capable of succeeding in a relatively unknown space and its performance is only likely to improve in the future.

Stock Price

So far, coverage has been overwhelmingly positive, with a variety of industry analysts and publications highlighting the company. On Friday, DIODES INCORPORATED stock opened at $92.6 and closed at $93.6, up by 1.0% from its prior closing price of 92.7. This increase in stock price is a promising sign for potential investors looking to get involved with the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Diodes Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 2k | 331.28 | 17.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Diodes Incorporated. More…

| Operations | Investing | Financing |

| 392.5 | -265.26 | -125.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Diodes Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.29k | 705.39 | 33.29 |

Key Ratios Snapshot

Some of the financial key ratios for Diodes Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.0% | 31.9% | 20.2% |

| FCF Margin | ROE | ROA |

| 9.0% | 17.4% | 11.0% |

Analysis

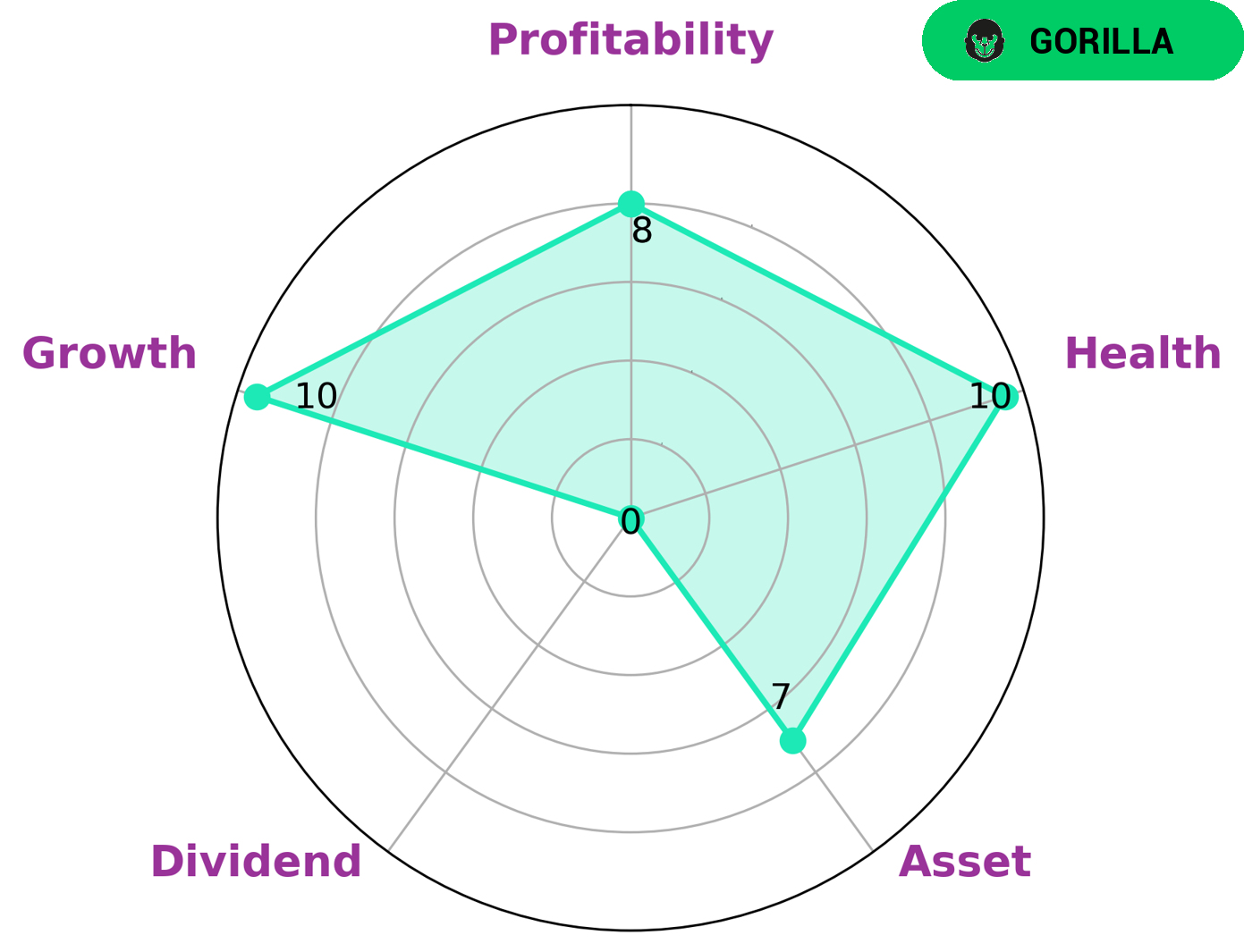

As a GoodWhale user, it is easy to analyze DIODES INCORPORATED‘s financials. Our Star Chart gives DIODES INCORPORATED a high health score of 10/10 with regard to its cashflows and debt, showing that the company is capable to pay off debt and fund future operations. DIODES INCORPORATED also has strong asset, growth, and profitability, though it is weak in dividend. Furthermore, DIODES INCORPORATED is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors looking for potential investments may be interested in this type of company. More…

Peers

Diodes Inc is in competition with Vishay Intertechnology Inc, Microchip Technology Inc, Aixtron SE. All of these companies are in the business of manufacturing semiconductor products.

– Vishay Intertechnology Inc ($NYSE:VSH)

Vishay Intertechnology is a leading manufacturer of discrete semiconductors and passive components. The company’s products include diodes, MOSFETs, thyristors, optoelectronic components, and power ICs. Vishay Intertechnology’s products are used in a wide range of end-markets, including automotive, computing, consumer electronics, industrial, and communications. The company has a strong market position in many of its product categories and is a leading supplier of power semiconductors, MOSFETs, and diodes. Vishay Intertechnology has a diversified customer base and a global footprint. The company’s products are sold to original equipment manufacturers, distributors, and contract manufacturers.

– Microchip Technology Inc ($NASDAQ:MCHP)

Microchip Technology Inc is a company that provides microcontroller, mixed-signal, analog and Flash-IP solutions. They have a market cap of 36.04B as of 2022 and a ROE of 25.66%. The company has over 8,000 employees and serves over 125,000 customers in more than 70 countries.

– Aixtron SE ($OTCPK:AIIXY)

Aixtron SE is a publicly traded German company that manufactures and sells deposition equipment used in the semiconductor industry. The company has a market capitalization of 2.86 billion euros as of 2022 and a return on equity of 10.97%. Aixtron is a leading provider of deposition equipment and services for the semiconductor industry, with a focus on new and emerging technologies. The company has a strong presence in Asia, Europe, and North America.

Summary

Diodes Incorporated has been receiving unexpected attention in the 2023 media, and the stock market has reacted accordingly. Analysts have observed that the stock price of DIODES INCORPORATED has been steadily rising since announcement of the unexpected media attention, a sign that investors are optimistic about the future of the company. Furthermore, P/E ratios, earnings per share, and other financial metrics all point to a healthy outlook for the future of DIODES INCORPORATED.

Furthermore, growth in sales and profitability indicate that the company is able to sustain its current level of growth in the long term. In short, DIODES INCORPORATED appears to be a promising investment for the foreseeable future.

Recent Posts