CNX Resources: Shielded from Natural Gas Price Volatility with Attractive Valuation

April 11, 2023

Trending News ☀️

CNX ($NYSE:CNX) Resources is a publicly traded company based in the United States that specializes in natural gas and oil exploration and production. The company is mainly focused on Appalachian region and is one of the largest independent producers of natural gas in the region. CNX Resources is well-positioned to benefit from the current natural gas market as it is largely shielded from price volatility due to its hedging activities.

In addition, the company has an attractive valuation, making it an attractive investment opportunity. The company’s hedging activities have minimised the risks associated with fluctuating natural gas prices. Through their hedging activities, they are able to lock in prices over a period of time, thus providing stability in terms of revenues and cash flows.

Additionally, CNX Resources has a strong balance sheet and has a portfolio of high-quality assets that provide steady cash flows. Furthermore, CNX Resources has a valuation that is attractive to investors. The company’s share price is relatively low compared to its peers, and it offers a dividend yield that is well above average. Additionally, its price-earnings ratio is below the industry average, making it an attractive investment opportunity relative to its peers. Its hedging activities provide it with stability in terms of revenues and cash flows, and it has an attractive valuation that makes it an attractive investment opportunity.

Stock Price

On Monday, CNX RESOURCES stock opened at $16.2 and closed at $16.5, up by 3.3% from its last closing price of 16.0. This increase in stock price speaks to the strong fundamentals of the company, making it attractive for investors who are looking for value in the energy sector. The main advantage of investing in CNX RESOURCES is that their operations are largely shielded from natural gas price volatility. This is because the company has a large, diversified portfolio of assets and extensive hedging contracts which allow them to lock-in prices for their natural gas production. This allows them to maintain stable cash flows, even during periods of extreme price volatility in the energy markets.

This is significantly lower than its peers, making it an attractive buy for those looking for value investments in the natural gas industry. In conclusion, CNX RESOURCES is an attractive option for investors looking to invest in the energy sector. Its operations are largely shielded from natural gas price volatility, and it trades at an attractive valuation making it a great entry point for those looking for value investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cnx Resources. More…

| Total Revenues | Net Income | Net Margin |

| 3.92k | -142.08 | 42.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cnx Resources. More…

| Operations | Investing | Financing |

| 1.24k | -528.29 | -688.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cnx Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.52k | 5.57k | 17.34 |

Key Ratios Snapshot

Some of the financial key ratios for Cnx Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 36.4% | 116.5% | -2.1% |

| FCF Margin | ROE | ROA |

| 17.1% | -2.1% | -0.6% |

Analysis

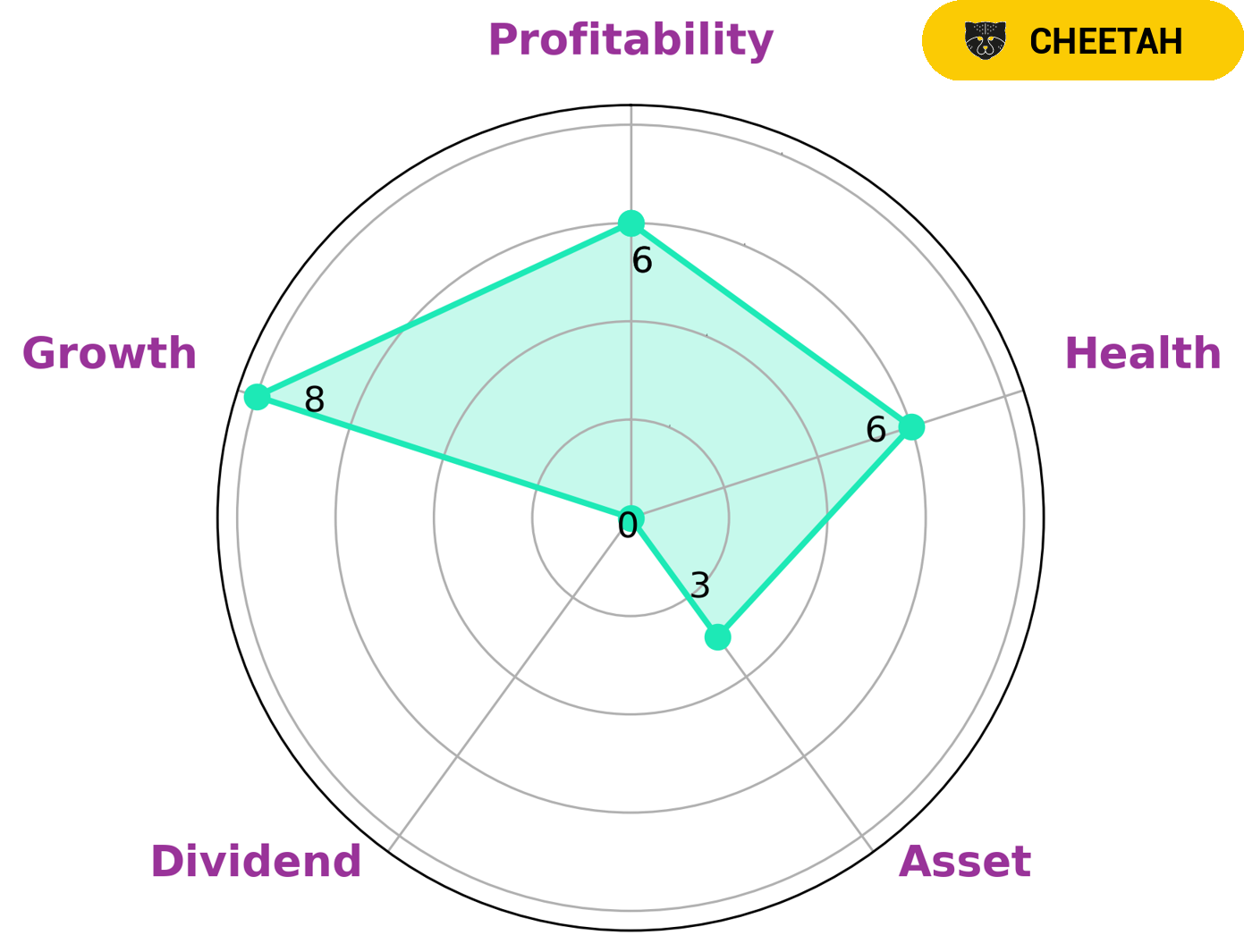

At GoodWhale, we recently performed an analysis of CNX RESOURCES‘s fundamentals. After assessing their performance on our proprietary Star Chart, we classified CNX RESOURCES as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. What type of investors may be interested in such a company? Well, based on CNX RESOURCES’s intermediate health score of 6/10 considering its cashflows and debt, we can conclude that the company is likely to safely ride out any crisis without the risk of bankruptcy. Furthermore, we found that CNX RESOURCES is strong in growth, medium in profitability and weak in asset, dividend. These factors make it a good choice for long-term investors who are looking for fast growth with some risk. More…

Peers

The competition between CNX Resources Corp and its competitors is fierce. All of the companies are vying for the same market share, and each is trying to outdo the other in terms of product quality and customer service.

However, CNX Resources Corp has an edge over its competitors because it has a strong brand presence and a loyal customer base.

– HighPeak Energy Inc ($NASDAQ:HPK)

HighPeak Energy Inc is a Canadian oil and gas company with a market cap of 2.44B as of 2022. The company has a Return on Equity of 14.7%. HighPeak Energy is engaged in the exploration, development and production of oil and natural gas in the Western Canadian Sedimentary Basin.

– Earthstone Energy Inc ($NYSE:ESTE)

Stone Energy is an oil and gas exploration and production company with operations primarily in the Gulf of Mexico. The company was founded in 1993 and is headquartered in Lafayette, Louisiana.

As of 2022, Stone Energy has a market capitalization of 1.6 billion dollars and a return on equity of 18.64%. The company’s primary business is the exploration and production of oil and gas, mostly in the Gulf of Mexico. Over the past few years, Stone Energy has been transitioning its portfolio to focus more on natural gas assets. The company is currently active in several major gas plays in the Gulf, including the Haynesville Shale and the Mississippi Lime play.

– Carbon Energy Corp ($OTCPK:CRBO)

Carbon Energy Corp is a Canadian oil and gas company with a market cap of 20.76k as of 2022. The company has a Return on Equity of -36.04%. Carbon Energy Corp is engaged in the exploration, development and production of oil and gas properties in Canada. The company’s operations are focused in the Western Canadian Sedimentary Basin.

Summary

CNX Resources is a natural gas producer, making it susceptible to market fluctuations in gas prices. Despite this, the company is an attractive stock due to its discounted valuation. Recently, the stock price has risen, showing that investors are confident that the company can adjust to volatile natural gas prices.

A further analysis of CNX Resources reveals that their reserves and potential for further growth is strong and steady. With a strong foundation and discounted price, investors can rest assured that they are making a wise investment in CNX Resources.

Recent Posts