Canacol Energy Ltd Stock Price Surges Above 50-Day Moving Average

May 11, 2023

Trending News ☀️

CANACOL ENERGY ($TSX:CNE) is a publicly traded oil and gas exploration and production company based in Canada. It is primarily focused on Colombia, with operations in the Caribbean, Central America and the United States. The company is dedicated to providing value to shareholders through exploration and production activities in key geographic areas.

Its focus is on developing and producing oil and gas resources that can be monetized efficiently. It has been successful in growing its reserves and production, as well as achieving significant increases in its share price over the past few years.

Stock Price

On Monday, CANACOL ENERGY (TSX:CNE) stock opened at CA$10.7 and closed at CA$10.4, representing a 1.2% decrease from last closing price of 10.5. The surge in the stock price is likely due to investor optimism over the company’s strong financial performance and growth prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Canacol Energy. More…

| Total Revenues | Net Income | Net Margin |

| 335.71 | 147.27 | 48.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Canacol Energy. More…

| Operations | Investing | Financing |

| 185.43 | -179.91 | -80.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Canacol Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.01k | 722.91 | 8.56 |

Key Ratios Snapshot

Some of the financial key ratios for Canacol Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.5% | 11.5% | 29.8% |

| FCF Margin | ROE | ROA |

| 27.9% | 27.4% | 6.2% |

Analysis

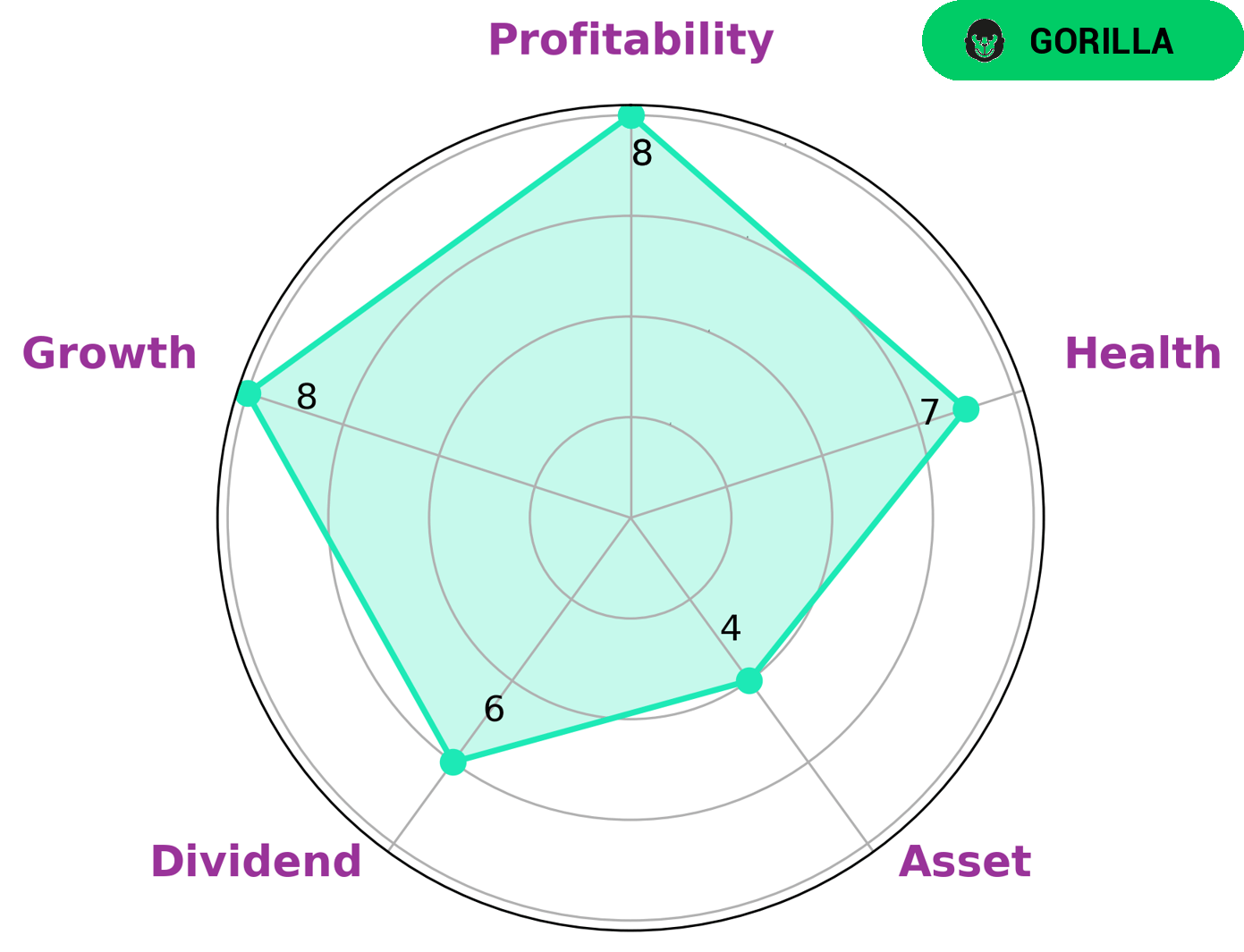

GoodWhale has conducted a thorough analysis of CANACOL ENERGY‘s financials. According to our Star Chart, CANACOL ENERGY has a high health score of 7 out of 10 with regards to its cashflows and debt. This score indicates that the company is in a strong financial standing and is capable of riding out any crisis without the risk of bankruptcy. Moreover, CANACOL ENERGY is very strong in growth, profitability and medium in asset, dividend. Based on these results, GoodWhale classifies CANACOL ENERGY as a ‘gorilla’ company, which we conclude is capable of achieving stable and high revenue and earnings growth due to its strong competitive advantage. Given this strong financial health and competitive advantage, it is likely that investors interested in long-term returns may be attracted to CANACOL ENERGY. Investors who are looking for stability, reliable cashflows and a strong growth potential may find the company particularly attractive. Additionally, those who appreciate CANACOL ENERGY’s industry exposure may also decide to invest in the company. More…

Peers

The company was founded in 2002 and is headquartered in Calgary, Alberta, Canada. Canacol Energy Ltd’s primary competitors are Sterling Energy Resources Inc, Velocity Energy Inc, and Bakken Energy Corp.

– Sterling Energy Resources Inc ($OTCPK:SGER)

Velocity Energy Inc. is a Canadian oil and gas company with a market capitalization of $2.29M as of 2022. The company is engaged in the exploration, development and production of oil and natural gas properties in Canada. Velocity Energy’s primary focus is on the development of its Montney natural gas assets in British Columbia. The company’s Montney assets are located in the Peace River Arch region, where it holds approximately 100,000 net acres of land. Velocity Energy is headquartered in Calgary, Alberta.

– Velocity Energy Inc ($OTCPK:VCYE)

Bakken Energy Corp is a publicly traded company with a market capitalization of 383.21k as of 2022. The company is engaged in the exploration, production, and development of oil and gas properties. Bakken Energy Corp has a return on equity of 1.81%.

Summary

Canacol Energy Ltd’s share price saw a positive trend on Friday, passing its fifty day moving average. This is an encouraging sign for investors as a stock’s price crossing its fifty day moving average indicates the current trend is upwards and hence the stock is likely to continue to rise in value. Investors should keep an eye on the company’s financial results, news reports, and analyst opinions as these will be key indicators of the company’s prospects.

Additionally, looking at the stock’s performance over time and its relative value compared to its peers can also offer insight into its future direction. With the stock’s positive momentum, Canacol Energy Ltd could be an opportunity for investors looking to benefit from favourable market conditions.

Recent Posts