Barclays Lowers Price Objective of Liberty Energy to $22.00 from $25.00

June 11, 2023

☀️Trending News

Liberty Oilfield Services ($NYSE:LBRT) (LIBERTY) is an oil and gas services company providing hydraulic fracturing and other well stimulation services in the United States. On Thursday, Barclays released a research note that lowered the price objective of LIBERTY stock from $25.00 to $22.00. Analysts at Barclays noted that market volatility and macro uncertainties may have a negative impact on LIBERTY’s earnings, leading to the lowered price objective.

The lowered price objective did not come as a surprise, as LIBERTY’s stock has been negatively impacted by the overall decline in oil prices. Despite the lower price objective, Barclays maintains a “overweight” rating for LIBERTY stock, indicating that they believe the company’s long-term prospects remain positive.

Market Price

On Friday, LIBERTY OILFIELD SERVICES stock opened at $13.6 and closed at $13.7, down by 0.4% from last closing price of 13.7. This drop in the stock price was further compounded by the fact that the company had announced a 1 for 4 reverse split earlier this month. Despite this, the company remains optimistic about its position in the market and continues to endeavor to provide the best services to its clients. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LBRT. More…

| Total Revenues | Net Income | Net Margin |

| 4.62k | 567.63 | 12.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LBRT. More…

| Operations | Investing | Financing |

| 530.36 | -450.66 | -55.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LBRT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.76k | 1.17k | 9.06 |

Key Ratios Snapshot

Some of the financial key ratios for LBRT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 33.8% | 120.0% | 14.0% |

| FCF Margin | ROE | ROA |

| 1.5% | 26.2% | 14.7% |

Analysis

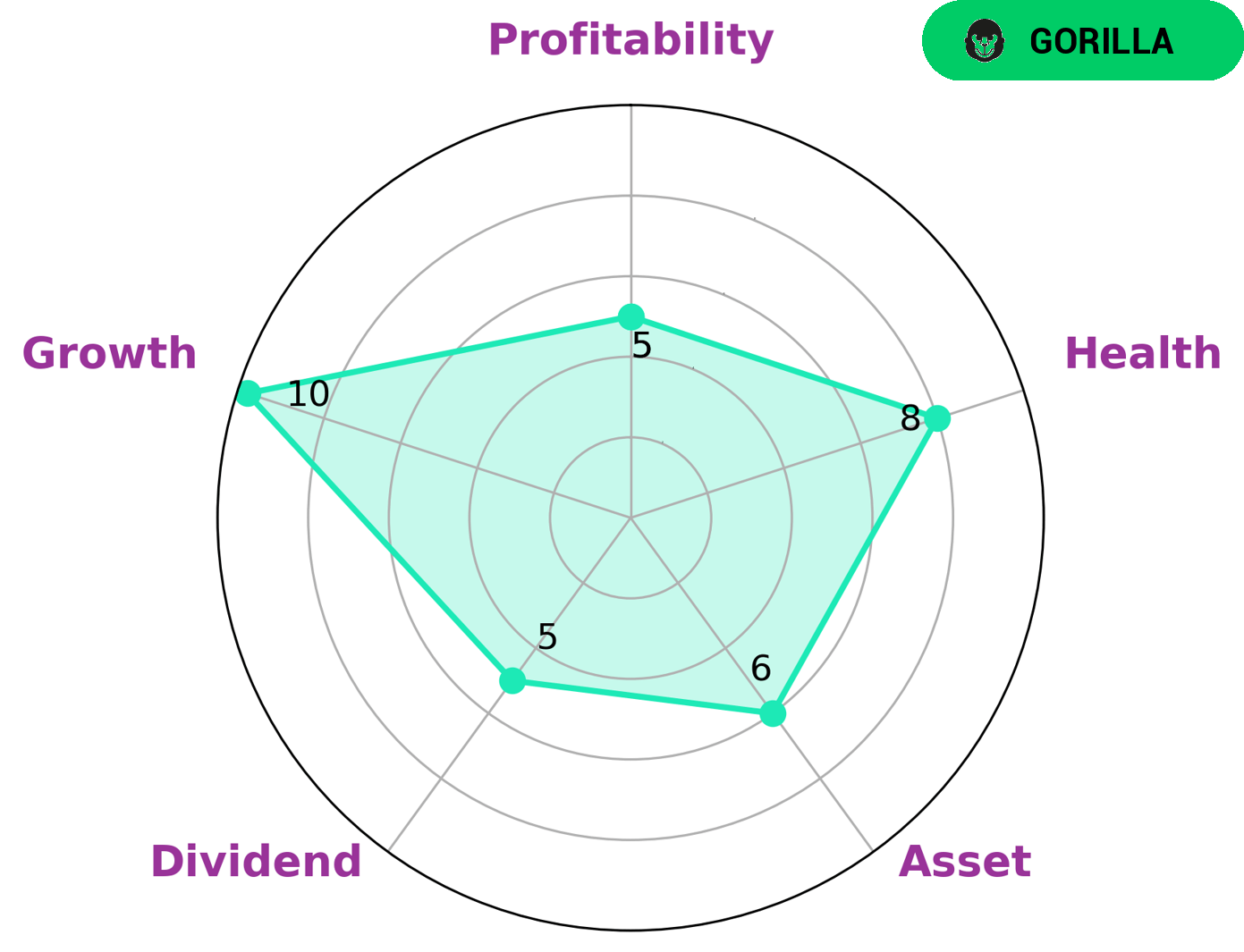

At GoodWhale, we have analyzed LIBERTY OILFIELD SERVICES’s financials and found that it is strong in growth, and medium in asset, dividend, and profitability. Additionally, this company has a high health score of 8/10 with regard to its cashflows and debt, which indicates that it is capable of sustaining operations in times of crisis. We have classified LIBERTY OILFIELD SERVICES as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. We believe investors interested in investing in companies such as LIBERTY OILFIELD SERVICES are likely to be long-term investors who are seeking stability and growth potential. These investors may be looking for a company with a strong competitive advantage that can continue to generate returns regardless of market conditions. Such investors may also be looking for a company with a strong balance sheet and cashflow to help it manage through difficult times. More…

Peers

The oil and gas industry is a highly competitive market. There are many large and small companies competing for market share. Liberty Energy Inc is a small company that is up against some big names in the industry. Sixty Six Oilfield Services Inc, Serica Energy PLC, and Helix Energy Solutions Group Inc are all large, well-established companies. Liberty Energy Inc is a relative newcomer to the industry, but it has been quickly gaining market share. The company has been aggressive in its pricing and marketing, and it has been able to capture a significant portion of the market.

– Sixty Six Oilfield Services Inc ($OTCPK:SSOF)

Sixty Six Oilfield Services Inc is a publicly traded company with a market cap of 1.63M as of 2022. The company has a strong ROE of 35.81% and is engaged in providing oilfield services to the upstream oil and gas industry. Some of the services offered by the company include drilling, completion, and production services. The company has a strong presence in the Bakken region of North America and is well-positioned to capitalize on the growing demand for oil and gas services in this region.

– Serica Energy PLC ($LSE:SQZ)

Serica Energy PLC is an oil and gas exploration and production company with a market cap of 871.59M as of 2022. The company has a Return on Equity of 64.14%. Serica Energy PLC is engaged in the exploration, development, production and sale of crude oil, natural gas and natural gas liquids. The company has a portfolio of assets in the UK, Indonesia, Vietnam and Trinidad & Tobago.

– Helix Energy Solutions Group Inc ($NYSE:HLX)

Helix Energy Solutions Group Inc is an international offshore energy services company that provides decommissioning and decommissioning services to the oil and gas industry. The company has a market cap of 673.68M as of 2022 and a Return on Equity of -3.94%. Helix Energy Solutions Group Inc is headquartered in Houston, Texas.

Summary

Liberty Oilfield Services recently had its price target lowered by Barclays from $25.00 to $22.00 in a research note. This noted a decrease in potential returns for investors, as the company may not have as much potential upside as initially estimated. Investors should be cautious when considering Liberty Oilfield Services as the lowered price target may indicate underwhelming performance going forward. Investors should also consider the macroeconomic environment when making decisions, as this can affect the performance of the company as well.

Evaluating the company’s financials, competitors, and market trends can also help investors determine if Liberty Oilfield Services is worth investing in. Ultimately, investors should make an informed decision before making any investments.

Recent Posts